Recent price decline action has seen Dogecoin rebounding at a recent multi-month low after the entire market started last week on a liquidation stretch. However, technical analysis from analyst Trader Tardigrade suggests that Dogecoin may have already established its cycle bottom before the next price surge.

Dogecoin Tests Key Weekly Support After 40% Drop

The cryptocurrency market faced a significant downturn last week, with widespread losses hitting various digital assets. Dogecoin was no exception to the sell-off, experiencing a sharp decline of nearly 40% before finding support around $0.22. This drop marked the lowest price Dogecoin has reached since the beginning of 2025, and the last time it traded at this level was in early November 2024.

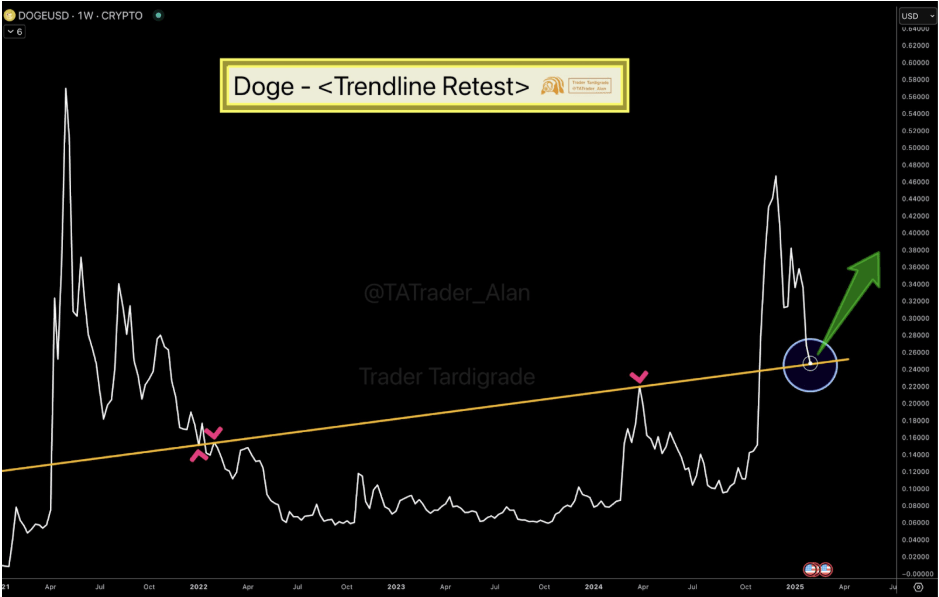

Despite the severity of the drop, technical analysis from crypto analyst Trader Tardigrade suggests that Dogecoin’s recent 2025 low may be more significant than it appears at first glance. In a social media post on platform X, the analyst shared a weekly timeframe chart highlighting that $0.22 is part of a key trendline that played a crucial role in Dogecoin’s price movements throughout 2024.

Now, with the price falling back to this level and bouncing off it, Trader Tardigrade noted that the trendline has seemingly flipped into a strong support zone.

As of now, Dogecoin has rebounded to $0.2561, reflecting a positive reaction of approximately 16% from its recent low. Notably, on-chain data from IntoTheBlock shows buyers stepped in just around this support level. However, Dogecoin’s ability to hold above this support level in the coming weeks will determine if the cryptocurrency has truly reached a bottom for the rest of this cycle.

Image From X: Trader Tardigrade

Historical Pullbacks Point To $2 Price Target

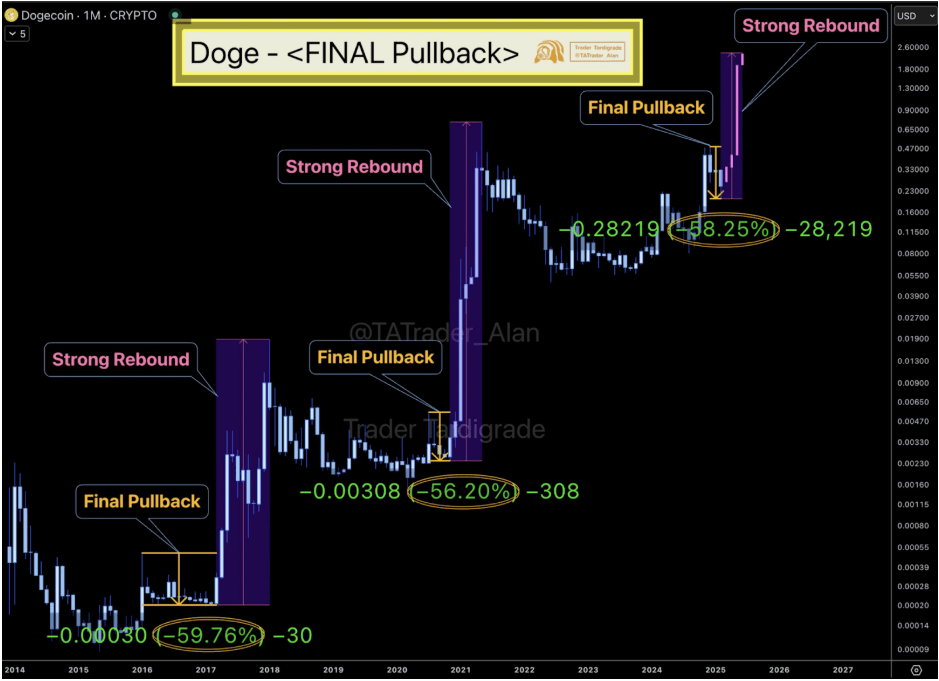

In another analysis, Trader Tardigrade highlighted a recurring pattern in which the Dogecoin price tends to experience significant pullbacks of more than 50% after a strong multi-month rally. However, these pullbacks have always been accompanied by another strong rebound rally, and Dogecoin eventually reached a new peak.

His analysis noted three major pullbacks: the first saw a decline of 59.76%, the second dropped by 56.2%, and the most recent pullback registered a 58.25% drop. Based on this historical behavior, Tardigrade noted that the recent correction might be accompanied by another strong rebound.

The last such a rebound happened, Dogecoin went on a 23,000% increase to reach its current all-time high of $0.73. From here, Trader Tardigrade predicted a similar playout to reach a price target of $2.

Image From X: Trader Tardigrade

The $2 price target has been a recurring prediction among crypto analysts for Dogecoin. One similar prediction came from crypto analyst Dima Potts, who predicted that Dogecoin is poised to target all-time highs between $1.50 and $2.10. For now, the first step for a bullish Dogecoin would be to break above $0.3.

Featured image from Mudrex, chart from TradingView