Dogecoin holders just surpassed 5 million addresses this week, a huge milestone for the meme cryptocurrency. According to data from on-chain analytics platform IntoTheBlock, Dogecoin addresses have been growing steadily since the beginning of the year. At the same time, DOGE is up by 43% from its October bottom of $0.056.

However, this growth is still small when compared to other popular cryptocurrencies, as DOGE is still yet to reach $0.1 this year. This major growth in addresses could be the catalyst needed for Dogecoin to reach its next price target to push it to $0.1.

New Milestone For Dogecoin

The Dogecoin community is one of the most active in the crypto industry, and the meme token is currently in the 8th spot in terms of market cap. According to IntoTheBlock’s Total Addresses metric, the total number of addresses with a balance crossed over 5 million this week to reach a high of 5.11 million on November 27th. At the time of writing, this metric still stands at over 5 million with 5.1 million addresses.

The surge of new Dogecoin addresses is largely due to growing growing interest and adoption of the cryptocurrency. On the price action end of things, DOGE has increased by 9.00% in a 7-day timeframe as most cryptocurrencies start to turn a profit again after a few weeks of consolidation.

At the same time, IntoTheBlock’s large transaction metric which measures transactions with a value larger than $100,000 has been increasing, reaching a total of $2.08 billion in the past seven days.

Balance Among Addresses

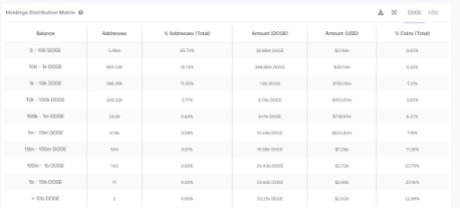

Despite the rise in addresses with a balance, the holding distribution shows that most of the tokens are concentrated in a few addresses. Around 4.48 million addresses representing 95.5% of the total addresses hold just 1.59% of the total circulating supply. On the other hand, just 700 addresses hold 81% of the total supply.

There’s also been a surge in the number of daily transactions, with a 102.09% increase in the number of new addresses and an 89.70% increase in the number of active addresses. Notably, there were 221,330 active DOGE addresses on November 27th. According to IntoTheBlock, this is most likely driven by Dogecoin Doginals.

DOGE’s ascent to $0.1 this year seems bleak at the moment, as the crypto will have to go on another 25% increase from its current price in December. DOGE is currently trading around a prior resistance at the $0.081 level and has formed support just around the $0.071 level.

A continued inflow into addresses could see DOGE break above the resistance, and continue its price surge. The next hurdle would be to break above $0.087 before getting to $0.1 for the first time this year.