The post Dogecoin Price Prediction: What’s Next After 150% Surge? appeared first on Coinpedia Fintech News

Over the last week, Dogecoin has surprised the market by soaring over 150%. Its price went from $0.16824 to as high as $0.42275, and while it’s still below its all-time high of $0.7376, excitement is in the air. So, could this upward trend continue and push Dogecoin to the magic $1 mark? Here’s the price analysis and dogecoin price prediction for upcoming days.

Why is Doge Rising Now?

Dogecoin’s recent surge isn’t happening in isolation. It’s partly due to Bitcoin’s impressive climb to a new record high of $89,500, which has boosted the entire crypto market’s confidence. When Bitcoin rises, people often feel good about other cryptos too, and this time, Dogecoin is one of the biggest winners. Dogecoin currently has a market cap of $59.57 billion with $3.76 billion of trading volume in the last 24 hours.

There’s also talk of Elon Musk potentially joining a future administration and promoting pro-crypto ideas. Rumors suggest he might even help create a so-called “Department of Governmental Efficiency (D.O.G.E.),” though it’s just speculation for now. Still, Musk’s support for Dogecoin has been known to push prices up in the past, and this recent buzz could be adding fuel to the fire.

Can Dogecoin Actually Reach $1?

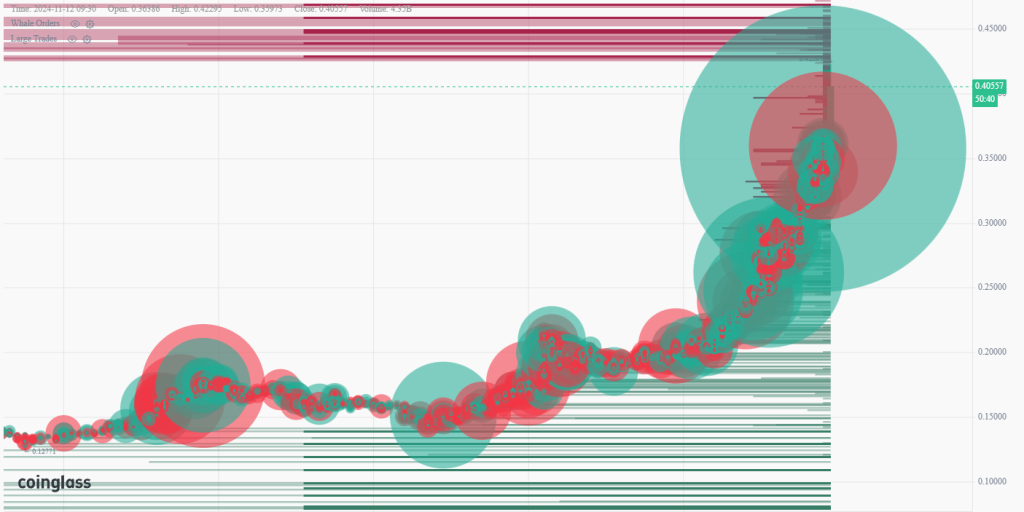

Analysts think it’s possible, but it won’t be easy. Right now, Dogecoin’s next big test is at $0.76. That was the level it hit back in 2021, so if it breaks past that, $1 could become a reality. Many traders are betting big on Dogecoin’s rise. Large trade and whale order data shows huge long trades as compared to the shorts showing most investors believe Dogecoin will keep climbing.

Even more, around 96% of DOGE holders are in profit, which is encouraging for those watching from the sidelines. Dogecoin price prediction by some experts shows it reaching $2 if it keeps following the BTC rally. While that’s a high target, the current wave of optimism is making people hopeful for now.

What’s Next for Dogecoin?

The coming weeks will be critical. If Dogecoin keeps this momentum and more positive news surfaces, that $1 goal might not be far off. But as with any crypto, there’s a mix of hope and risk. For now, the Dogecoin community is holding on tight, hoping this is their moment.