Over the last 24 hours, Dogecoin (DOGE) has been on a wild ride, proving to be one of the best performers in the crypto market. This motion is here to stay, as there has been a massive swell in addresses turning profits.

Although a forecast by CoinCodex suggests DOGE may see a dip of roughly 14% by the end of September, that has done nothing to dull investor enthusiasm. This, in fact, for many tells yet another twist in Dogecoin’s rather unpredictable journey.

At the time of writing, DOGE was trading at $0.1083, down 3.6% in the last 24 hours, but sustained a 9% rally in the last week, data from Coingecko shows.

More Addresses Turn Profitable

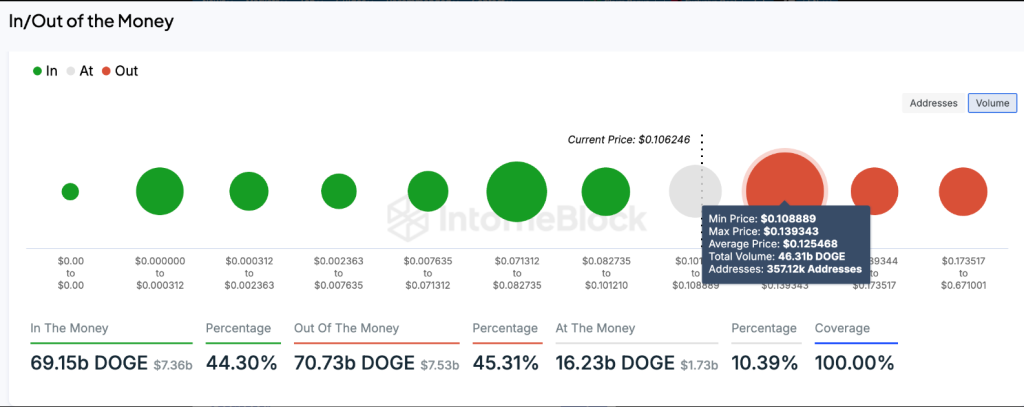

In its entirety, this latest price rally has seen 73% of Dogecoin addresses turn “in-the-money.” That amounts to 4.72 million addresses currently realizing gains.

On the opposite side, there are 1.61 million addresses, which accounts for 25.04%, which is still in the red. There’s also a small percentageᅳ1.34%ᅳthat are breaking even.

But here’s the really interesting part: many analysts argue that just in case DOGE conquers the resistance at $0.139, the number of profitable addresses will surge to 80%. That is significant because it would trigger confidence among investors, leading to more buy-ins and, arguably, higher prices.

Whales Aren’t Worried

With talks of a potential price drop at play, whalesᅳthe big players in the Dogecoin marketᅳare not too far away to get bothered.

What the data from Santiment further revealed is that such large holders are, in fact, piling on to their positions in DOGE. Those holding between 100,000 to 1 million DOGE represent 6.14% of the total supply.

Those holding between 10 million to 100 million DOGE have also been locking in their stash and now represent 12.92% of the supply at press time.

This accumulation in a fixed manner reveals a whale community poised to play the long game, ignoring short-term fluctuations while betting on Dogecoin in their portfolio.

Importance Of $0.139

Dogecoin needs to gain strength above $0.139 in order to make an important step in the direction of a notable change. The level is coming from a long-term moving average, and what is rather interesting, it is quite tricky: as a matter of fact, it had statistically played as tough long-term resistance for DOGE.

Indeed, if that level is surpassed, a big rise is present in profitable addresses. This, in turn, could fuel further buying pressure, pushing the price even higher.

If, conversely, DOGE fails to rise above this critical level, the expected dip could materialize, leading to a period of consolidation.

Mixed Sentiments Ahead

So, what’s next for Dogecoin? The sentiment is a bit of a mixed bag. The Fear & Greed Index currently stands at 54- neutral, which shows that the market does not incubate extreme fear or overwhelming greed.

Over the last 30 days, DOGE has had 33% green days, which means there is activity in the marketᅳnot hot, but at least it’s not stagnant. Enough movement is happening to keep things interesting.

All in all, Dogecoin probably will remain as unpredictable as always. The whales believe in the long-term potential and the rise in profitable addresses. But with a potential dip on the horizon, caution remains the name of the game.

If long-term holders and short-term traders share anything in common, it’s going to be that evidently Dogecoin will be a coin that over the weeks to come you cannot afford not to watch very carefully.

Featured image from Screen Rant, chart from TradingView