On-chain data from Santiment shows the Dogecoin whales have added another 1.47 billion DOGE to their holdings in the year 2023 so far.

Dogecoin Whales Been Accumulating In 2023 So Far

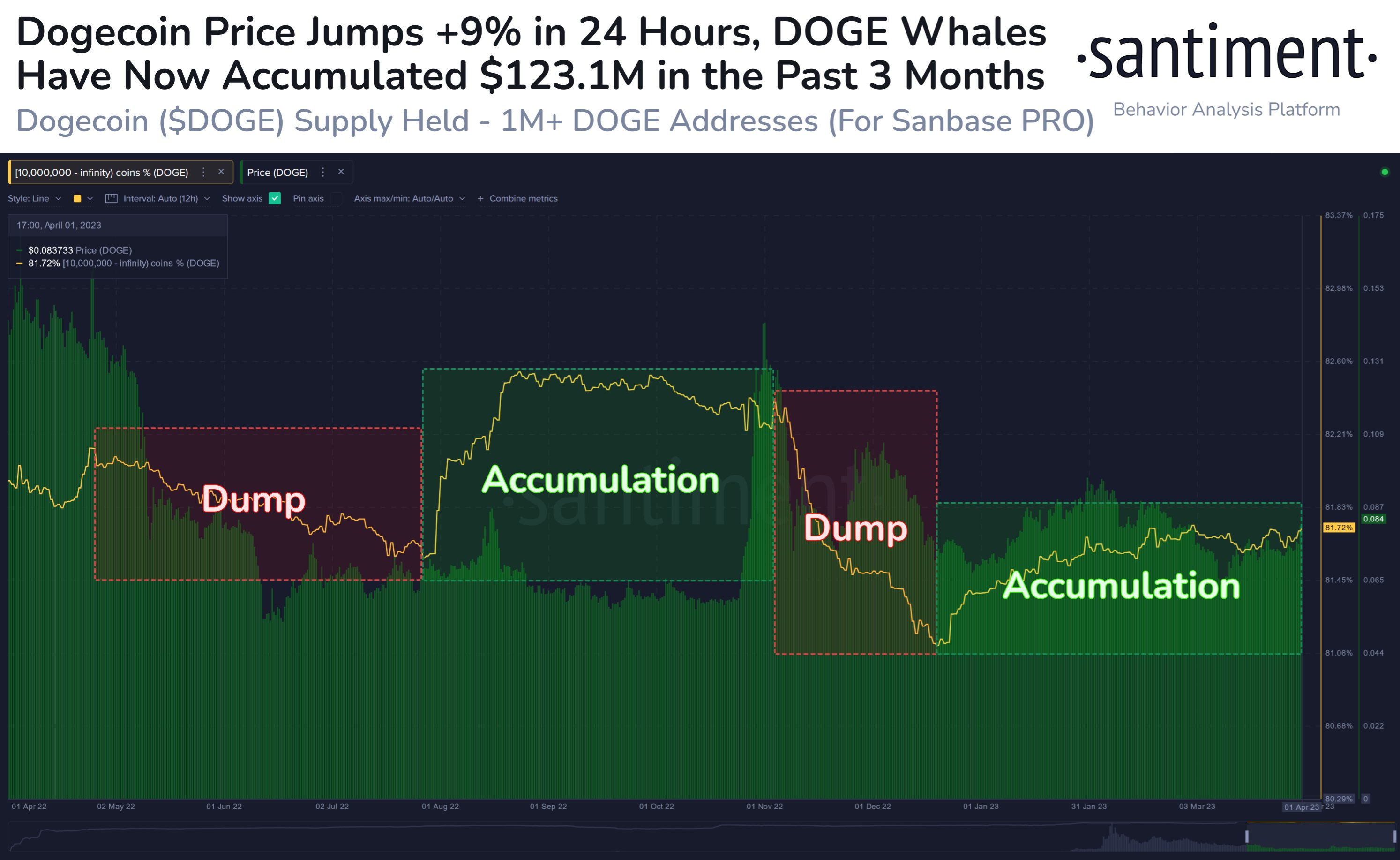

According to data from the on-chain analytics firm Santiment, Dogecoin whales have added DOGE worth $123.1 million to their treasuries since 1 January 2023. The relevant indicator here is the “DOGE Supply Distribution,” which tells us about the total percentage of the Dogecoin supply that each wallet group in the market is holding right now.

Addresses are divided into these “wallet groups” based on the total number of coins that they are carrying currently. For instance, the 1-10 coins cohort includes all addresses that are holding a balance of between 1 and 10 DOGE.

If the Supply Distribution is applied to this particular cohort, it would combine the amounts all such wallets are holding at the moment and calculate the percentage of the total supply that this sum is equal to.

In the context of the current discussion, the groups of interest are those with balances of at least 10 million DOGE. Below is a chart that shows the Dogecoin Supply Distribution for these cohorts over the last year:

To be more precise, three groups fall in this range (10 million to 100 million, 100 million to 10 billion, and 10 billion to infinity), so their Supply Distribution data is displayed after merging them into one group.

Since the range’s lower bound is worth almost $800,000, the investors that these addresses would belong to are likely to be the whales. This holder group can hold immense importance in the market due to the sheer size of the holdings of its investors.

Movements from the whales can hold the power to move the market, as can also be seen in the above graph. When these humongous investors were selling during the past year (the red zones in the chart), the price overall moved downwards.

On the other hand, buying from this cohort (the green zone) has looked to have led to the price climbing higher. In the three months since the start of the year 2023, the whales have once again been busy expanding their holdings.

Overall, these holders have accumulated about 1.47 billion DOGE in this period, and their combined wallet balances now contain almost 82% of the entire circulating supply of the meme coin.

While this new accumulation streak has occurred, Dogecoin’s price has felt some bullish momentum. The year-to-date returns, however, haven’t still been too impressive as the coin is just 12% in the green during the period.

The reason behind it is that the asset has slowed down in recent weeks as the whale supply has also been moving sideways. Nonetheless, as long as the whales don’t sell, the price may at least be able to maintain around the current levels, or even be able to build up some fresh upwards momentum.

DOGE Price

At the time of writing, Dogecoin is trading around $0.0785, up 7% in the last week.