Dogecoin whales have executed a substantial transaction in the last two days, purchasing 110 million DOGE while the price of the meme coin declined.

This systematic accumulation has attracted the interest of experts and traders, igniting discussions regarding a possible price reversal.

With DOGE presently trading at $0.25, many are speculating whether this may indicate a forthcoming bullish breakout.

Whale Accumulation Signifies Assurance

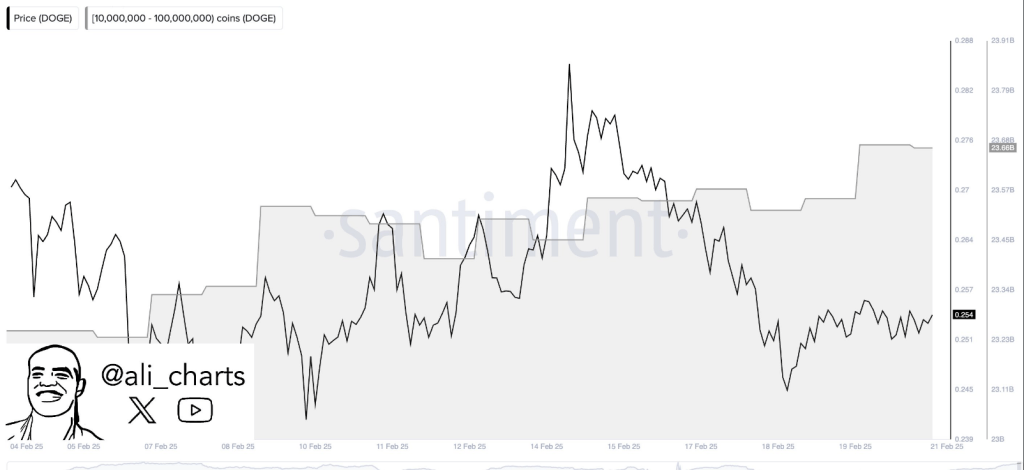

A substantial number of investors, often referred to as “whales,” play a crucial role in shaping market patterns. On-chain data indicates that these whales have accumulated DOGE valued at around $27.5 million in the last 48 hours.

Historical market cycles indicate that such strong buying behavior from significant holders often precedes rising price trends.

The rise in whale accumulation aligns with a broader trend of increased whale activity in the cryptocurrency sector. Analysts suggest that the continued purchase pressure may create substantial support for DOGE, hence reducing the likelihood of a significant fall.

Whales bought 110 million #Dogecoin $DOGE in the last 48 hours! pic.twitter.com/bwMiGNW0gp

— Ali (@ali_charts) February 21, 2025

Essential Support Levels Maintain Stability

Technical analysts have noted that Dogecoin’s most recent fall encountered a resistance close to the $0.22 level. Historically, this level has been a strong demand zone that draws investors even in DOGE’s decline. If the price keeps above this crucial support level, it could stimulate a possible recovery.

Conversely, resistance levels at $0.27 and $0.30 remain pivotal for DOGE’s future upward movement. A breach above these levels may lead to a prolonged rise, whereas a failure to achieve this could result in more consolidation.

Market Sentiment & Price Projection

Despite the recent decline, the majority of sentiments about Dogecoin are still positive. The trading volume and social media conversation around the meme coin suggest that individual traders are closely keeping tabs of its movements, with many estimating a potential breakout.

Additionally, analysts keeping an eye on DOGE’s price movements believe that the symmetrical triangular pattern on the 1-hour chart portends an impending breakthrough. In the coming days, DOGE can face its closest resistance levels if bullish momentum builds.

Meanwhile, despite ongoing concerns over price volatility, historical trends indicate that substantial acquisitions by large investors typically result in price appreciation.

Featured image from Gemini Imagen, chart from TradingView