This week, the dog-themed sensation Dogwifhat (WIF) has recovered from its drop below the $2 support zone. The Solana-based memecoin flipped Ethereum’s Layer-2 (L2) Arbitrum (ARB) and is currently testing the $2.5 resistance level. However, a crypto analyst has warned investors of a possible retrace for WIF.

WIF Puts Its Hat Back On

Dogwifhat became the memecoin sensation of 2024’s first quarter (Q1), giving returns of over 2,000% earlier this year. The Solana token reached an all-time high (ATH) of $4.8 in March but has declined 45% since then.

Despite this, investors remain bullish on the memecoin, some stating it has shown strength through its sharpest correction. Asad Saddique, Cryptonary’s CTO, highlighted that the token “withstood like 5 or 6 corrections of >70%.” To Saddique, Dogwifhat solidified during the retraces and “challenges” for the dog-themed memecoin throne.

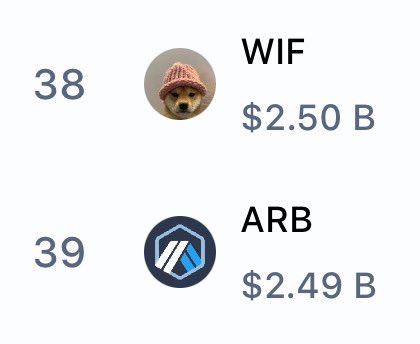

Notably, WIF flipped Arbitrum as the 38th largest cryptocurrency by market capitalization today with a $2.5 billion market cap. This feat was first achieved on March 31, when WIF reached its ATH and a market cap of $4.57 billion.

A month ago, crypto trader Bluntz, who made several bullish forecasts for WIF during Q1, shared a bearish prediction for the memecoin. Per the trader, the Solana token was set to an “inevitable” fall to the $1 range.

However, this prediction was based on a previous bullish analysis. Bluntz stated that WIF was headed for a large retrace before the next parabolic run, which could lead to a new ATH.

Following the market downturn, the dog-themed memecoin saw a price reduction of over 43%. Earlier this month, WIF dropped from the $2.6 price range to as low as $1.51 on July 11.

Nonetheless, it had a remarkable performance this week. The token reclaimed the $2 support zone and exhibits green numbers in several timeframes.

Will It Shred Another 40% Soon?

WIF surged 8% in the last 24 hours and trades at $2.54, at the time of this writing. This performance represents a 60% and 25% price increase in the weekly and monthly timeframes.

The recent price action has seemingly revitalized the bullish sentiment towards the token. Crypto analyst Hornhairs claimed that the memecoin “looks solid.” To the analyst, WIF could retest the $3 resistance level if it holds above the $2.2 price range.

However, another market watcher has warned investors about a potential downside for Dogwifhat. CrediBull stated that people are taking most altcoins’ bounces as “a sign of strength, but the reality is, alts and especially memes are just higher beta versions of BTC.”

To the analyst, the current bounce is “nice,” but, if Bitcoin (BTC) bounces or falls, Dogwifhat will follow the flagship cryptocurrency’s movement “harder/stronger.

The memecoin “left a triple bottom right below us” after making a lower high on higher timeframes. This suggests to the trader that the token “is likely to follow with a 40% move back down of its own to take those triple lows.”