On December 14, 2024, a dormant whale wallet made ripples in the cryptocurrency market by transferring 2.1 trillion PEPE tokens worth over $52 million. This large transfer, which occurred after 600 days of inactivity, has spurred excitement and speculation about a possible price increase for the popular meme coin.

Analysts are keenly tracking PEPE’s moves, anticipating a probable rebound that might take its value to $0.00005 or higher.

Whale Activity Indicates Potential Surge

The current whale behavior is notable in the cryptocurrency market because massive transfers can reflect trust in an asset or predict future price swings.

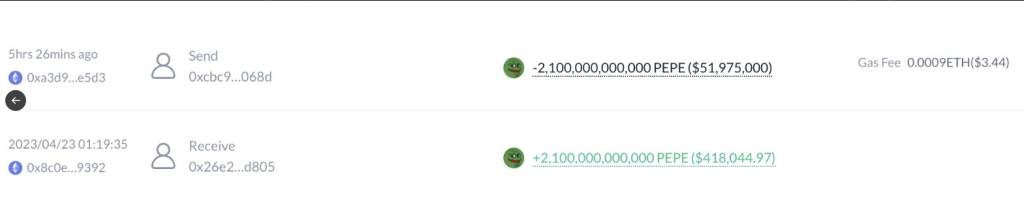

Historically, similar fluctuations have preceded large price hikes. The whale that executed this transfer originally purchased the tokens for 0.0135 ETH (about $27), resulting in an amazing return on investment of roughly 1.9 million percent.

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

This whale initially only spent 0.0135 $ETH($27) to buy 2.1T $PEPE and has held it until now.

From $27 to $52M—an extraordinary 1,900,000x return!https://t.co/Et442zxUGk pic.twitter.com/35sp0Iu46E

— Lookonchain (@lookonchain) December 14, 2024

Experts predict that if PEPE can break through the immediate resistance level of $0.00002810, it will rapidly ascend to $0.000036.

Technical figures support the positive vibe. Currently at $0.00002442, the 10-Day Moving Average shows short-term resistance; the 50-Day Moving Average indicates major support.

Moreover, the Relative Strength Index (RSI) comes out to be 54.4, suggesting neutral momentum with possibility for more development. The MACD also shows some positive activity, which supports the idea that a price increase is just around the bend.

Healthy Crypto Market

The cryptocurrency market as a whole is getting better, and this rise in whale activity is happening at the same time. This is especially true as Ethereum (ETH) gets closer to $4,000.

In the past, other cryptocurrencies, even meme coins like PEPE, have grown along with ETH. Analysts are making comparisons to earlier this year, when similar whale moves happened before PEPE’s price went up.

PEPE Price Set For Big Upside

Analysts believe that if PEPE maintains its pace and breaks important resistance levels, it might reach values as high as $0.000058, or possibly $0.0001 in favorable market conditions. However, meeting such lofty goals will need ongoing investor interest and larger market trends.

Although PEPE’s potential for increase excites investors, before making any financial decisions, they should be careful and do thorough study.

Anyone who wants to engage in this volatile industry has to be abreast on market dynamics and trends since the ecosystem of cryptocurrencies changes fast.

Featured image from DALL-E, chart from TradingView