The winds of change are blowing through the Ethereum (ETH) ecosystem. Despite tentative signs of recovery after recent dips, the price has struggled to stay afloat in the last 30 days. Additionally, a more intriguing trend has emerged: a mass exodus of ETH from cryptocurrency exchanges. This movement, marked by declining exchange supply and net outflows, has analysts buzzing with potential bullish implications.

Related Reading: Bitcoin Takes Control In Market Meltdown, Dominance Climbs To 9-Week Peak

Dwindling Stockpiles: Exchanges Feeling The Squeeze

For years, cryptocurrency exchanges have served as the lifeblood of the digital asset market. They provide the platform for buying, selling, and trading cryptocurrencies, with a significant portion of any given coin’s total supply residing within their digital vaults. However, when it comes to ETH, a dramatic shift seems to be underway.

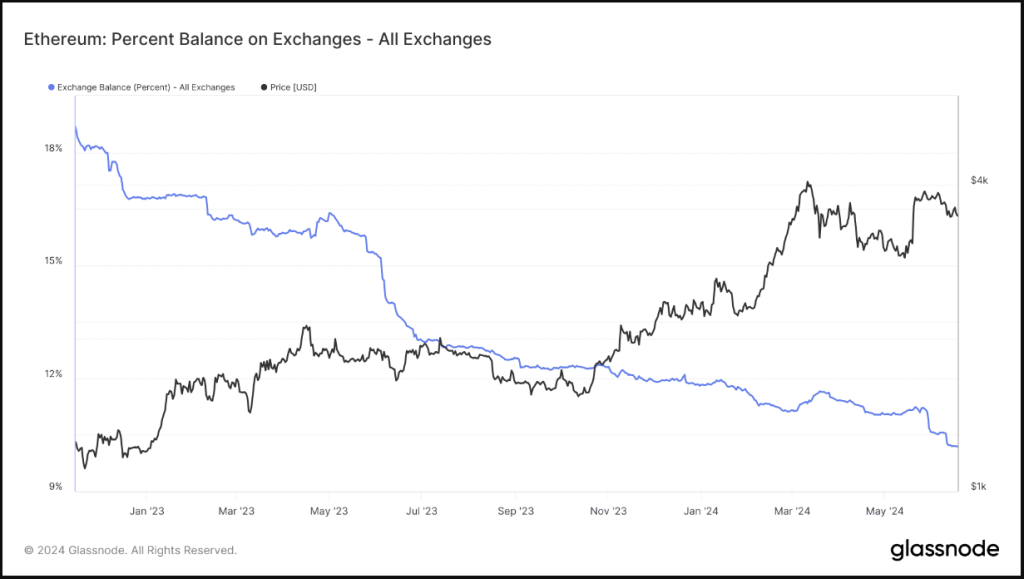

According to a recent analysis of on-chain data, the balance of ETH on exchanges has plummeted to its lowest level in eight years, hovering around a mere 10.20%. This translates to a significant portion of ETH holders withdrawing their coins from exchanges, effectively taking them off the market for immediate sale.

The reasons behind this exodus remain open to speculation. Some experts believe it could be a strategic move in anticipation of the upcoming Ethereum Merge, a major network upgrade that will transition the blockchain from proof-of-work to a more energy-efficient proof-of-stake model. This shift could potentially unlock staking opportunities for ETH holders, incentivizing them to hold onto their coins for longer periods.

Outflows Dominate: A Sign Of Accumulation Or Caution?

Further bolstering the “accumulation theory” is the dominance of net outflows on exchanges in recent days. This metric tracks the difference between ETH entering and leaving exchange wallets. A negative netflow, as seen currently, indicates that more ETH is flowing out than coming in. This suggests that investors are not only withdrawing their existing holdings but also refraining from depositing new ETH onto exchanges, potentially signaling a growing sense of long-term bullishness.

However, some analysts caution against overly optimistic interpretations. The decline in exchange supply could also be attributed to a more cautious investor sentiment in the face of recent market volatility. With the broader cryptocurrency market still recovering from a slump, some holders might be opting to move their ETH to private wallets for safekeeping, waiting for a more opportune moment to re-enter the market.

Featured image from iStock, chart from TradingView