DWF Labs, a prominent crypto trading and market-making firm, is preparing to enter the booming stablecoin sector.

In an Aug. 1 statement on social media platform X, Andrei Grachev, the firm’s managing partner, stated:

“Following our plans to be a global web3 financial institution, I am happy to announce that DWF Labs is working on a CeDeFi synthetic stablecoin that will allow users to receive a nice yield without losing any flexibility in using their assets.”

Grachev did not disclose further details about the stablecoin. However, this move signals increasing institutional interest in the stablecoin market. Over the past year, major financial institutions like PayPal and Ripple have shown interest in the rapidly expanding sector.

Stablecoins have proven to be one of the most practical applications of crypto, offering a stable alternative to the volatility of digital assets like Bitcoin.

Stablecoin users in emerging economies like Venezuela and Nigeria often rely on the assets to hedge against declining national currencies and for everyday transactions.

CryptoSlate’s data shows that Tether’s USDT and Circle’s USDC dominate the $164 billion stablecoin industry, holding approximately 90% of the market share.

Stablecoin’s market cap grows.

DWF Labs’ move comes amid the continued rise in stablecoins market capitalization.

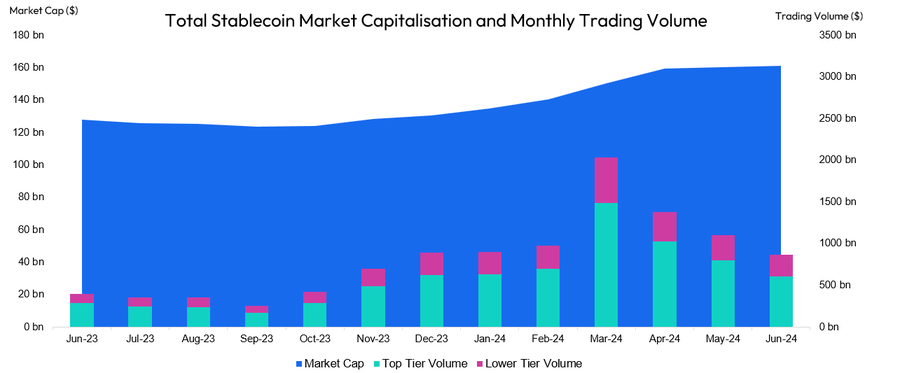

CCData reported that the total market capitalization for the assets grew by 2.11% in July to $164 billion, its highest point since Terra’s ecosystem collapsed in May 2022.

This increase marks the tenth consecutive month of growth for the sector and is the highest monthly rise since April.

Market observers explained that the increase indicates new capital entering the market, reflected in the positive movement of digital asset prices in July.

Despite this rising supply, stablecoins trading volume on centralized exchanges fell for the fourth month, dropping by 8.35% to $795 billion as of July 25.

Conversely, on-chain transactions surged by 18.3%, reaching $999 billion in July, the highest level since April. This represents a 69.4% increase from the previous year, driven by the impact of spot ETFs in the US.

The post DWF Labs to debut synthetic stablecoin amid sector’s explosive growth appeared first on CryptoSlate.