Antonio Juliano, the founder of dYdX Trading Inc., has announced his decision to “step down” as Chief Executive Officer (CEO), citing a mix of “personal and professional reasons.”

This move marks a significant change for the company behind the decentralized derivatives exchange dYdX. Juliano will transition to the roles of Chairman and President, with Ivo Crnkovic-Rubsamen set to take over as CEO.

Juliano Reflects On His Tenure And The Evolution Of dYdX

Juliano’s tenure as CEO saw dYdX grow into a prominent player in the decentralized finance (DeFi) sector, especially in derivatives trading.

Reflecting on his journey since the dYdX whitepaper in 2017, Juliano shared in the announcement that moments of “overwhelming” pressure made him consider stepping aside.

Juliano noted:

For my own part in this journey, I too have come far. I feel as though I’ve been gifted (and endured) a lifetime’s worth of adventure and growth since solo founding dYdX at 24. Chris Dixon once told me “founding is an emotional challenge disguised as an intellectual one”. I have now lived this, and know it to be true. dYdX has given me the rollercoaster of intense experiences from ibar, to excitement, to elation, to desolation. There have been times, many of them, when l’ve felt so overwhelmed I wanted to leave.

Notably, Juliano’s decision to change roles, as highlighted in the announcement, comes from a place of “personal satisfaction” and the “realization” that while he is irreplaceable as the founder, the role of CEO can be handed over to someone else.

Today, @AntonioMJuliano, announced that he is transitioning from CEO of dYdX Trading Inc. to the role of President and Chairman. Antonio’s product vision, leadership, and relentless dedication over the past 7 years have transformed dYdX from an idea into one of the largest DeFi… https://t.co/iUdSmjtQ5T

— dYdX (@dYdX) May 13, 2024

Impact Of The CEO Transition – Token Sees Sudden Drop

Ivo Crnkovic-Rubsamen, a long-time friend and collaborator of Juliano, is set to become the new CEO. Juliano expressed confidence in Crnkovic-Rubsamen’s ability to lead, noting that he has been “progressively” stepping back over the past two years, preparing for this transition.

Juliano will continue influencing “major decisions” and strategy at dYdX, working closely with the new CEO to oversee day-to-day operations.

He emphasized that dYdX’s mission is far from complete, pointing to the growing importance of DeFi and derivatives in the crypto landscape, noting:

dYdX is not finished. Not even close. The opportunity is bigger than ever now. It’s becoming incredibly obvious that DeFi will be the dominant way crypto is used, and derivatives will pily a large part in that.

Following the announcement of Juliano’s step-down, the price of the dYdX’s token experienced a decline, dropping by approximately 1.2% in the past 24 hours to a trading price of $2.01, with a 24-hour low of $1.94.

This downturn contrasts with the general recovery in the crypto market, highlighted by a 2.8% increase in Bitcoin over the same period.

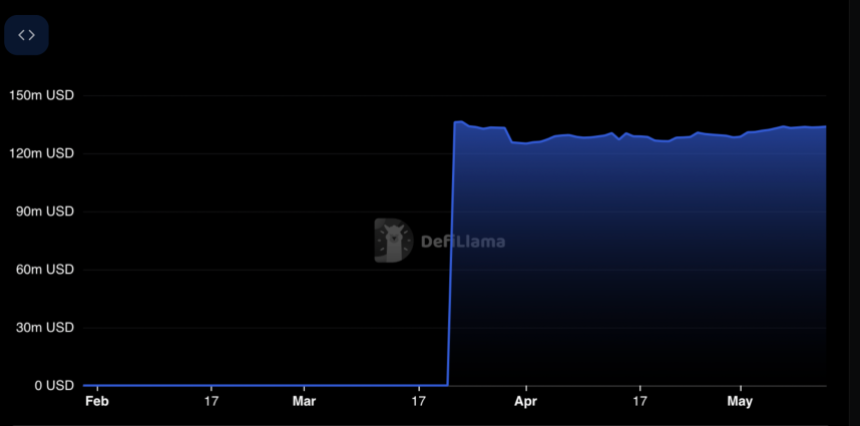

Despite the dip in token price, dYdX’s total value locked (TVL) has remained stable, with a slight increase of 2.37% over the past month. It has maintained a level above $130 million since March.

Featured image from Unsplash, Chart from Tradingview