Onchain Highlights

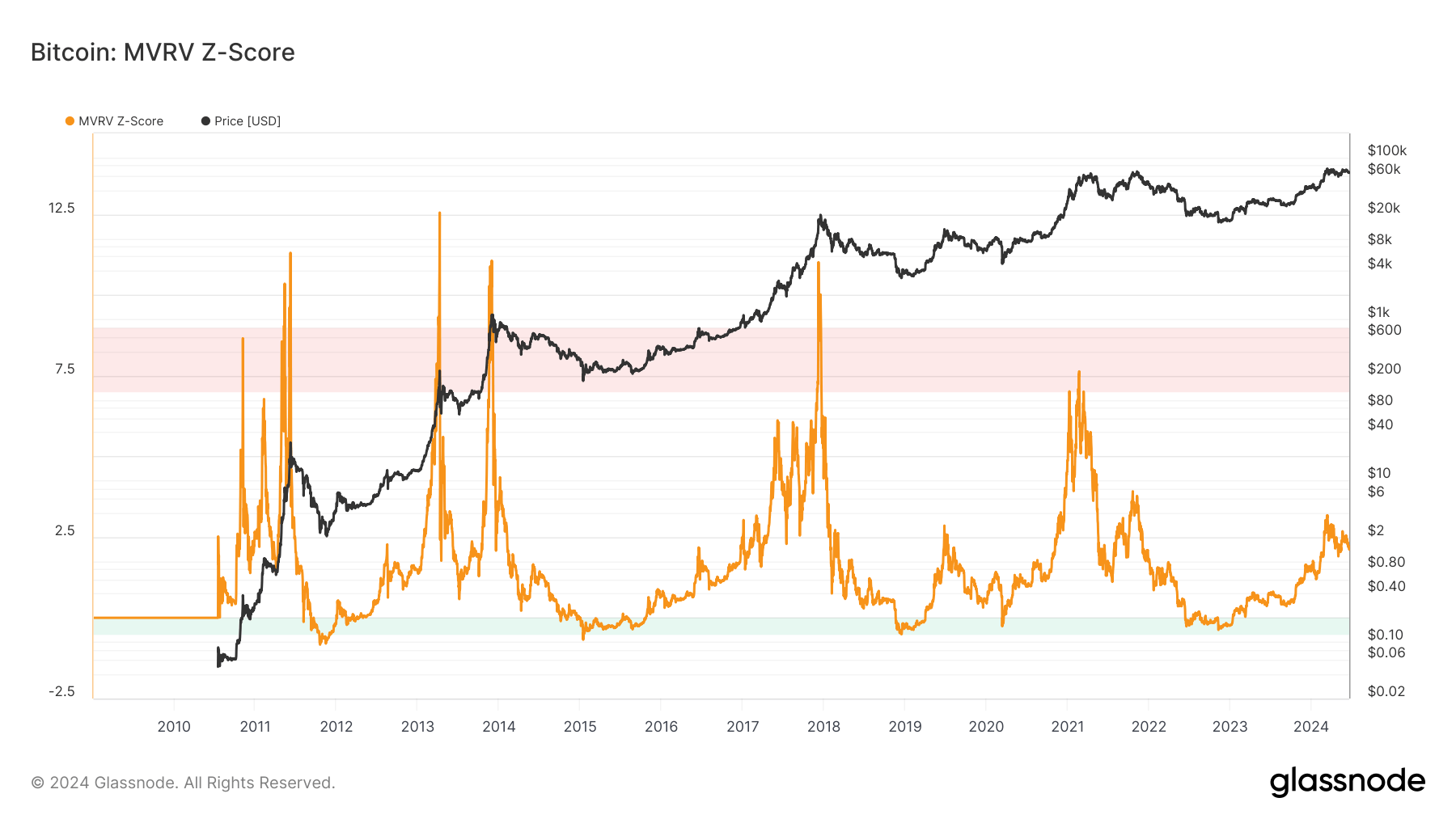

DEFINITION: The MVRV Z-Score evaluates whether Bitcoin is overvalued or undervalued relative to its “fair value”. Instead of using a traditional z-score method, the MVRV Z-Score uniquely compares the market value to the realized value. When the market value, measured as network valuation by spot price multiplied by supply, is significantly higher than the realized value, represented by the cumulative capital inflow into the asset, it has typically signaled a market top (red zone). Conversely, a significantly lower market value than the realized value has often indicated market bottoms (green zone).

Historically, spikes in the MVRV Z-Score have often preceded significant market corrections. Notably, the MVRV Z-Score peaked during the bull runs of 2013, 2017, and 2021, each time signaling an overvalued market and subsequent price declines.

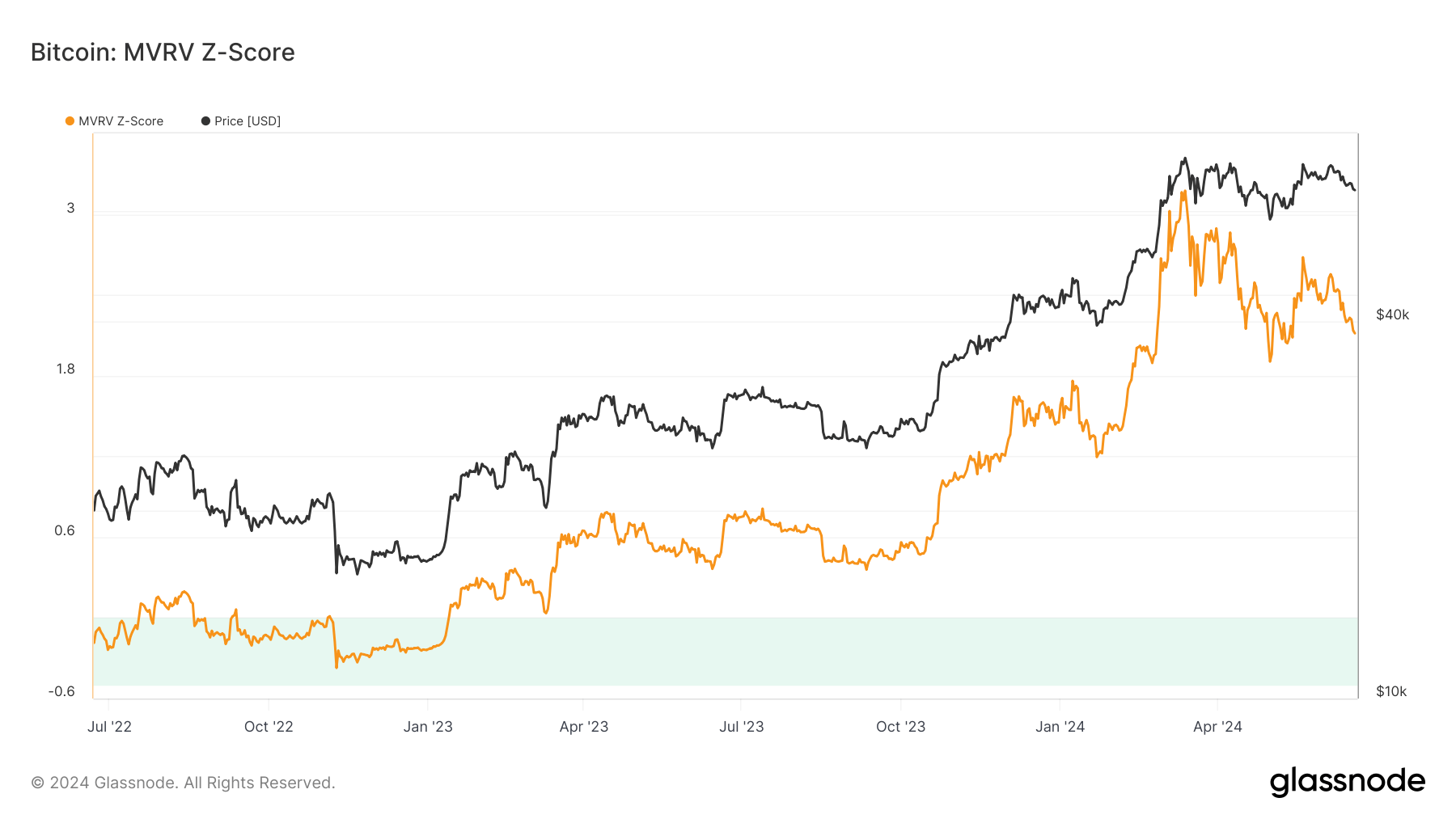

In the recent context, early 2024 saw the MVRV Z-Score rise sharply following Bitcoin’s price surge pre-halving, earlier than historical trends. This spike, suggesting market overvaluation, has since moderated, aligning with a typical post-peak correction phase.

During 2023, the MVRV Z-Score exhibited stability, reflecting a balanced market without extreme deviations. However, the pronounced increase in early 2024 and the subsequent decline highlight the MVRV Z-Score’s predictive capability in identifying potential market tops and correction phases. The current descent from the 2024 highs, while still above historical lows, suggests that the market is correcting but not yet undervalued.

The post Early 2024 MVRV Z-Score spike signaled possible correction phase for Bitcoin appeared first on CryptoSlate.