Tesla CEO and Twitter chief Elon Musk says the Federal Reserve’s recent rate hikes “might go down in history as most damaging ever.” The billionaire has urged the Fed to cut interest rates immediately, emphasizing that the U.S. central bank is “massively amplifying the probability of a severe recession.”

Elon Musk on Fed Rate Hikes

Tesla, Spacex, and Twitter boss Elon Musk warned Thursday about the damaging impact of the Federal Reserve rapidly raising interest rates.

His warning was in reply to a tweet by former investment manager Genevieve Roch-Decter stating that “the Fed has never raised rates faster” than this year. Musk wrote:

At the risk of being repetitive, these Fed rate increases might go down in history as most damaging ever.

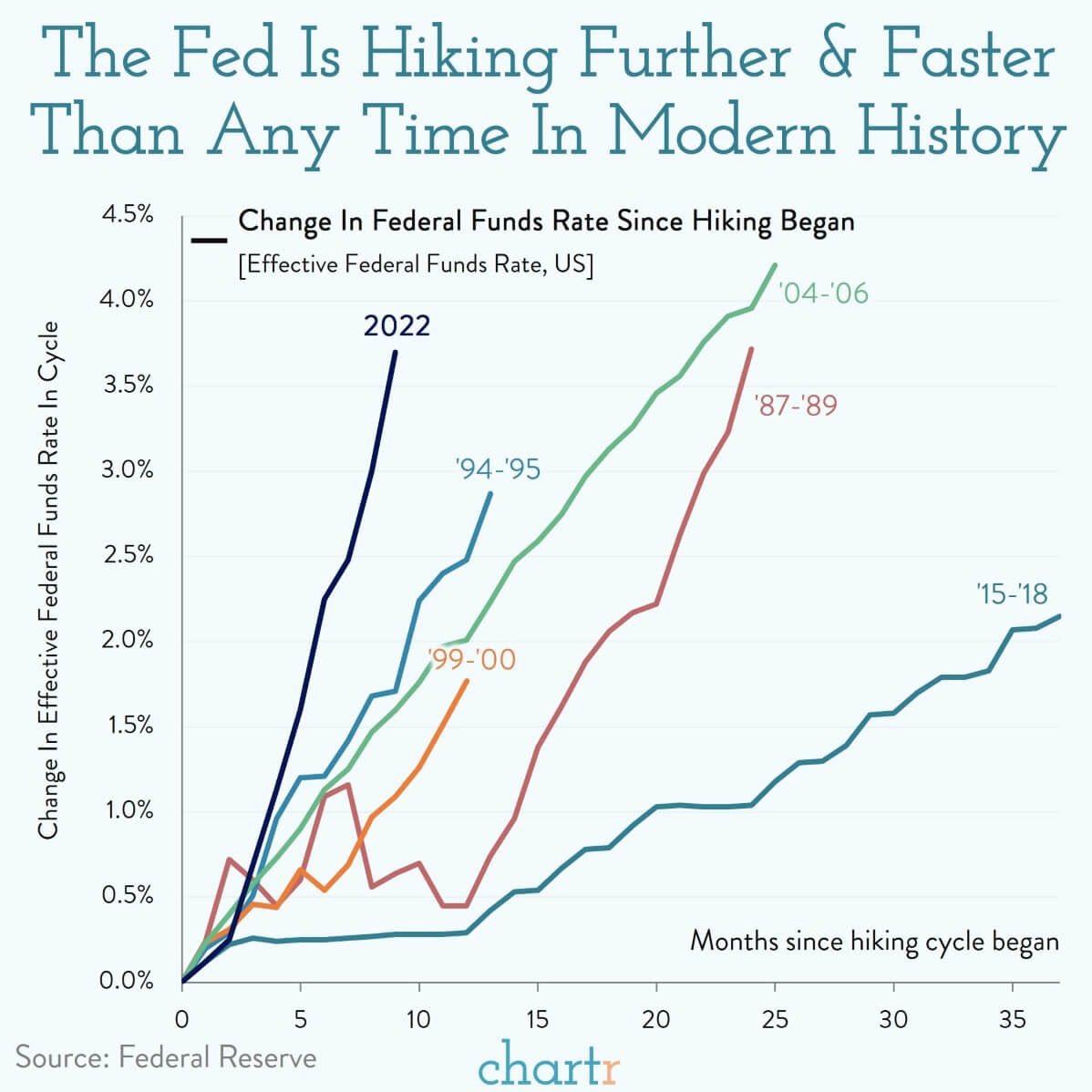

Roch-Decter also included a chart with her tweet showing that the Fed has hiked interest rates further and faster this year than at any other time in modern history.

Many people agreed with Musk. “I agree, Elon. The mortgage industry is taking a blood bath. Good professionals like me (marketing) laid off. Applications at historic lows. This is a disaster,” one Twitter user wrote. Another described: “This is what happens when the government artificially infuses $3.5 trillion into the U.S. economy. The Fed makes up for it in damaging interest hikes … It’s going to get worse.”

Musk also blamed the Federal Reserve for Tesla’s loss of market value. Investment advisor Ross Gerber tweeted last week: “Elon has now erased $600 billion of Tesla wealth and still nothing from the Tesla BOD [board of directors]. It’s wholly unacceptable.” Musk replied:

Tesla is executing better than ever. We don’t control the Federal Reserve. That is the real problem here.

The billionaire has warned several times about the risks of the Federal Reserve hiking interest rates. Earlier this month, he cautioned that the recession will be greatly amplified if the Fed raised interest rates again. The central bank then raised rates by 50 basis points following four consecutive 75-basis-point hikes.

Last month, Musk warned that the “trend is concerning,” emphasizing that the Fed “needs to cut interest rates immediately.” He added: “They are massively amplifying the probability of a severe recession.” The billionaire also previously said that he believes the recession will last until the spring of 2024.

What do you think about the warning by Tesla CEO Elon Musk about the Fed’s rate hikes? Let us know in the comments section below.