The 2022 Global Crypto Adoption Index has released its third report indicating where the market may be heading in 2023.

Key highlights from the report:

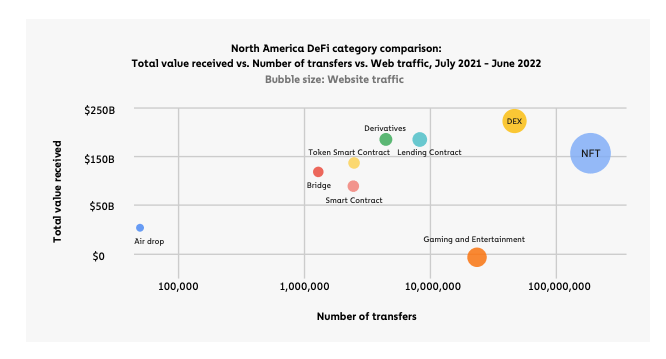

“DeFi-driven cryptocurrency markets in North America were strong but volatile over the last year.”

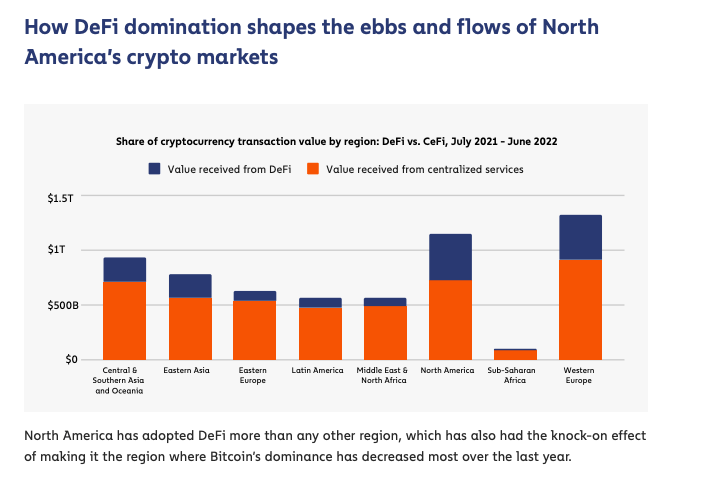

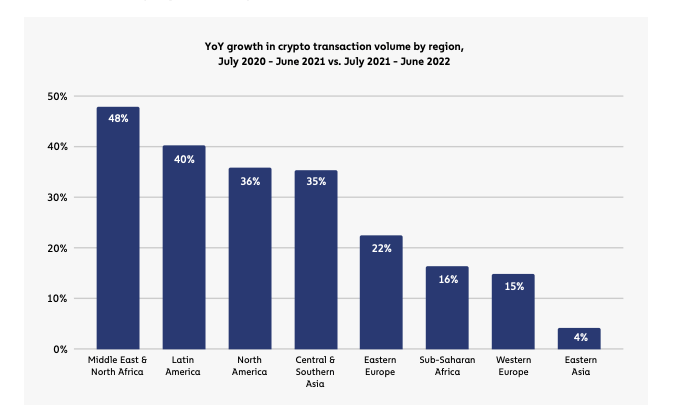

- Key findings: North America ranks 2nd in cryptocurrency activity, receiving $1.15 trillion worth of crypto in the period of July 2021 to June 2022, accounting for 19% of the world’s crypto activity. DeFi has been a major contributor to North America’s crypto surge, making up 37% of the region’s crypto transactions, surpassing Western Europe’s 31% DeFi share. Other regions, such as Sub-Saharan Africa, have much lower DeFi activity at 13%.

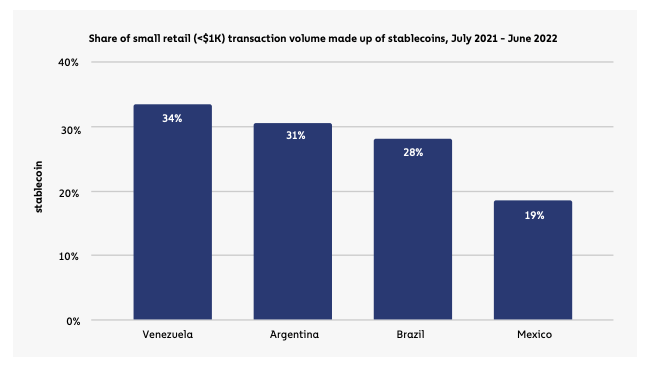

“Latin America’s key crypto adoption drivers: storing value, sending remittances, and seeking alpha.”

- Key findings: Latin America ranks 7th in the year’s cryptocurrency markets, with $562B in crypto received by citizens from July 2021 to June 2022, marking a 40% increase from last year.

- The combined inflation rate of the top 5 Latin American economies (Brazil, Chile, Colombia, Mexico, Peru) hit a 25-year high of 12.1% in August 2022, according to the International Monetary Fund. Bitcoin wasn’t around when inflation last reached such heights, but stablecoins, which are designed to be pegged to fiat currencies like USD, are increasingly popular in the most inflation-hit countries in the region. Surveys show that over a third of Latin American consumers already use stablecoins for everyday purchases.

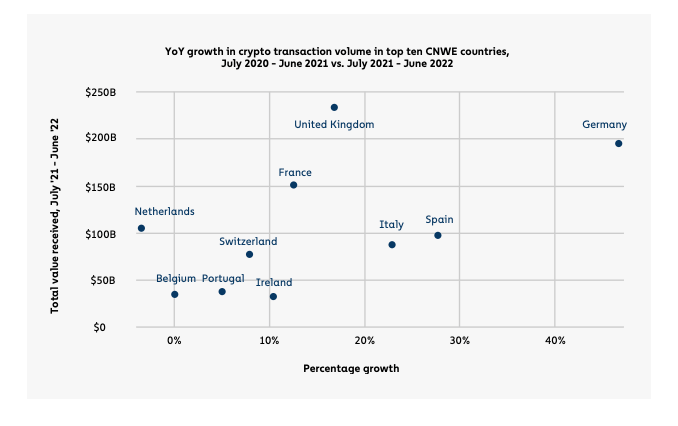

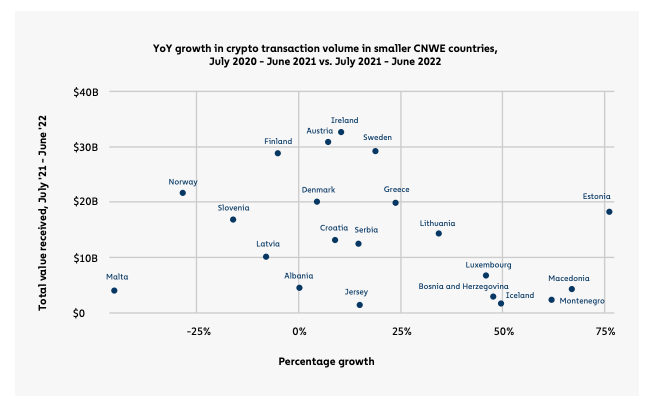

“Central, Northern & Western Europe remains the world’s largest crypto economy thanks to DeFi, NFTs, and growing regulatory clarity.”

- Key findings: CNWE is the largest crypto economy globally, with $1.3 trillion worth of crypto received by users and institutions in the region from July 2021 to June 2022. Western Europe has 6 of the top 40 crypto adopters. DeFi was a major contributor, fuelled by EU regulations like the crypto travel rule and MiCA licensing regime. The UK is the biggest DeFi hub in Europe, ranking 1st in CNWE and 6th globally, with $233 billion in crypto received from July 2021 to June 2022.

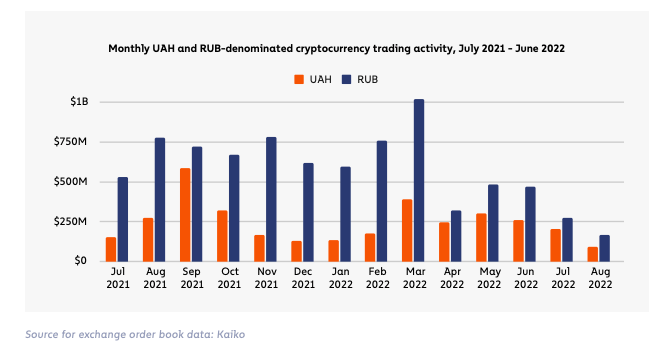

“Eastern Europe’s crypto market active, with spikes in last year driven by Russia-Ukraine War.”

- Key findings: Eastern Europe is the 5th largest crypto market, receiving $630.9 billion in crypto between July 2021 and June 2022, accounting for 10% of global crypto activity. In March 2022, during the war, Ukrainian hryvnia-denominated trade volume increased 121% to $307 million, and Russian ruble-denominated trade volume rose 35% to $805 million. However, after March, trade volumes dropped for both countries, fluctuating until August but never reaching their March peak.

“Crypto adoption steadies in South Asia, soars in the Southeast.”

- Key findings: CSAO is the third largest crypto market, with $932B worth of crypto received by citizens of CSAO countries from July 2021 to June 2022. Play-to-earn games and NFTs are closely connected. Most blockchain games today have NFTs as in-game items, which can be sold on various NFT marketplaces. For countries with high NFT marketplace web traffic, like Thailand, Vietnam, and the Philippines, a significant part of that traffic may come from blockchain game players in games like Axie Infinity.

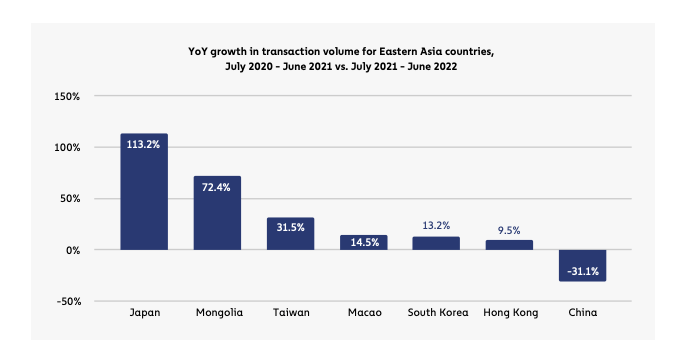

“Cryptocurrency market growth in Eastern Asia grinds to a halt, Chinese market down but not out following government bans.”

- Key findings: In Eastern Asia, the cryptocurrency market is the fourth largest in our analysis, with $777.5 billion worth of cryptocurrency transactions from July 2021 to June 2022, accounting for nearly 13% of global transactions in that time. The region has declined from its 3rd place ranking in the previous Geography of Cryptocurrency Report, with only 4% growth in transaction volume YoY, the lowest among regions analyzed. Despite being the largest crypto market in the area, China saw a 31% decrease in cryptocurrency transactions YoY, while Japan saw a more than 100% increase.

“Middle East & North Africa’s crypto markets grow more than any other region in 2022.”

- Key Findings: The Middle East & North Africa (MENA) region may have a smaller presence in the 2022 Global Crypto Adoption Index, but it’s the fastest-growing crypto market. From July 2021 to June 2022, MENA users received $566 billion in cryptocurrency, a 48% increase from the previous year. In Turkey and Egypt, the instability of fiat currencies has made cryptocurrency an attractive option for preserving savings. The Turkish Lira has experienced 80.5% inflation, while the Egyptian Pound has weakened by 13.5% in the last year. Additionally, the remittance market in Egypt, which accounts for 8% of its GDP, is significant. The country’s central bank has started a project to create a cryptocurrency-based remittance corridor between Egypt and the UAE, where many Egyptians work.

“Cryptocurrency meets residents’ economic needs in Sub-Saharan Africa.”

- Key Findings: Sub-Saharan Africa has the lowest cryptocurrency transaction volume among regions analyzed, with $100.6 billion in on-chain volume received from July 2021 to June 2022, accounting for 2% of global activity and a 16% increase from the previous year.

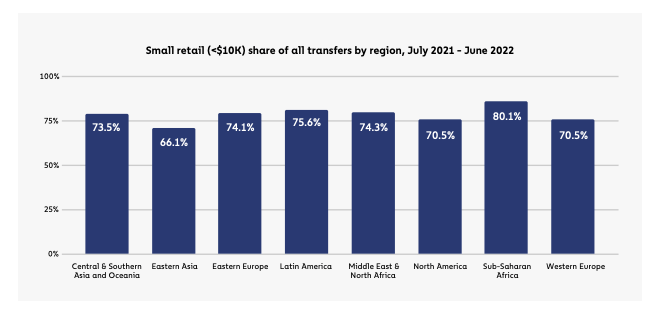

- Small Retail Transactions Drive Crypto in Sub-Saharan Africa The retail market and high usage of P2P platforms in Sub-Saharan Africa set it apart from other regions. Retail transfers below $10,000 USD make up 6.4% of its transaction volume, the highest of any region. The importance of retail becomes clearer when examining the number of individual transfers. Retail transfers make up 95% of all transfers, and 80% of those are small retail transfers under $1,000, also the highest of any region.

The post Emerging markets dominate Chainalysis 2022 Geography of Cryptocurrency Report appeared first on CryptoSlate.