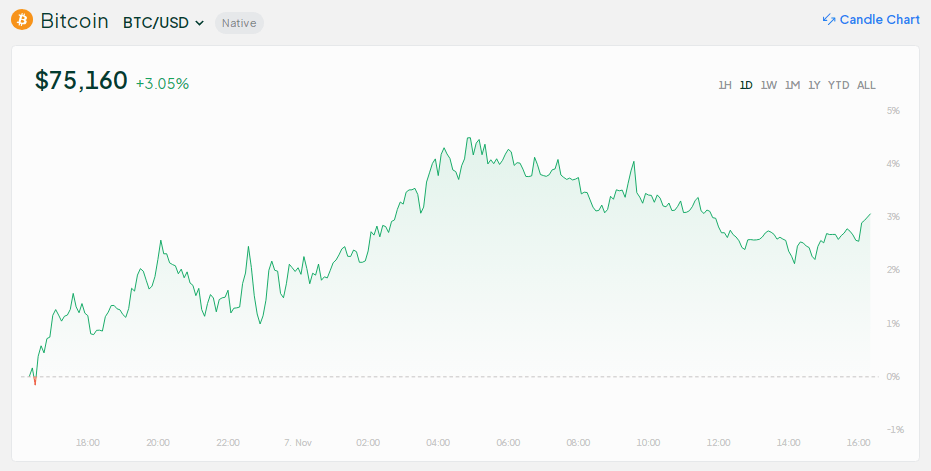

As expected, the Bitcoin and crypto frenzy will occur hours after Republican Donald Trump’s election. Crypto has become an election issue, with Trump offering a more friendly policy tone than his rival, Kamala Harris, who conceded to Trump’s victory, yesterday. Bitcoin surged by 8% during the early hours of trading, topping $75,000, better than its March record. This is just the start of a Bitcoin price surge for many market analysts.

According to Ki Young Ju, CryptoQuant’s CEO, Bitcoin’s price can still increase in the short term, with up to 40% upside. Based on today’s Bitcoin price range, it’s now part of the Top 10 largest financial assets by market cap. However, Young Ju cautions holders to become realistic in the short term and recommends gradual selling as “max pain” eases.

Crypto Market Sees ‘Easing Period,’ Setting Up For A Price Surge

Now that the election fever has settled, market analysts and observers focus on Bitcoin and crypto’s cyclical nature. According to Ki Young Ju, BTC holders’ behavior often coincides with the asset’s cyclical nature. He shared that new holders frequently endure price breakdowns during bear months, only to discover these assets change hands two years after the “max pain” has subsided.

New investors often hold $BTC through bear markets, enduring losses.

After about two years, it changes hands when pain eases. That time is now.

It could go up +30-40% from here, but not like the +368% we saw from $16K. Time to consider gradual selling, not all-in buying, imo. pic.twitter.com/hXRT6YBsxS

— Ki Young Ju (@ki_young_ju) November 6, 2024

In a Twitter/X post, Ju added that the assets’ “changing of hands and easing of pain” happen now. From here, the CEO projects the price to surge by 30 or even 40%. However, he cautioned the holders that today’s market differs from when BTC jumped by 368% and traded at $16k. For Ju, the best strategy is to sell the asset gradually and never adopt an all-in buying strategy.

Bitcoin Technicals Tell A Bullish Short-Term Story

Holders and crypto investors may also use Bitcoin’s technical data for more insights. Based on TradingView data, BTC’s price is approaching the upper Bollinger Band, indicating a bullish momentum. But when these bands expand, holders and trades can expect higher volatility.

Also, the asset’s Relative Strength Index (RSI) is 63, suggesting upward momentum. Bitcoin’s RSI dropped to 56% three days before the US elections, representing a balanced market. A neutral RSI score means that price action is steady, with no significant decline, increase, or period of consolidation. But two days after the elections, it’s now up to 63, indicating a bullish sentiment but not yet overbought.

Staking Platforms Benefit From Positive Price Action

In addition to holders and investors, staking platforms benefit from Bitcoin’s recent price action. For example, Solv Protocol, a leading BTC staking platform, hit over $2 billion in Total Value Locked (TVL). DeFiLlama reports that roughly 30k Bitcoins are staked on Solv Protocol, an increase from 16,340 tokens listed in mid-October. Solv Protocol’s increased activities across blockchains coincide with Bitcoin’s recent price action.

Among the products available at Solv Protocol, SolvBTC is arguably the most popular, locking almost $1.11 billion in value. The increase in activities at Solv Protocol highlights the growing importance of staking in generating more yield in the face of erratic price action.

Featured image from DALL-E, chart from TradingView