In the past three weeks, two of the biggest names in DeFi – Andre Cronje and Daniele Sestagalli – have been hyping up crypto twitter on an upcoming collaboration project to be launched on Fantom.

The name of the project was finally unveiled to be “Solid Swap” on a recent Frog Radio podcast, an automated market maker (AMM) decentralized exchange.

How is Solid Swap different?

Cronje and Sestagalli’s latest brainchild Solid Swap is built on a new AMM model that its developers are referring to as “ve(3,3)”. This clunky term is derived from a combination of mechanics from two popular DeFi protocols: Curve Finance and Olympus.

The first is the vested escrow (“ve”) mechanic adopted from the stablecoin decentralized exchange Curve Finance, which enables CRV token holders to vote on which Curve liquidity pools receive the highest future CRV emissions, thereby making that pool more attractive to liquidity providers.

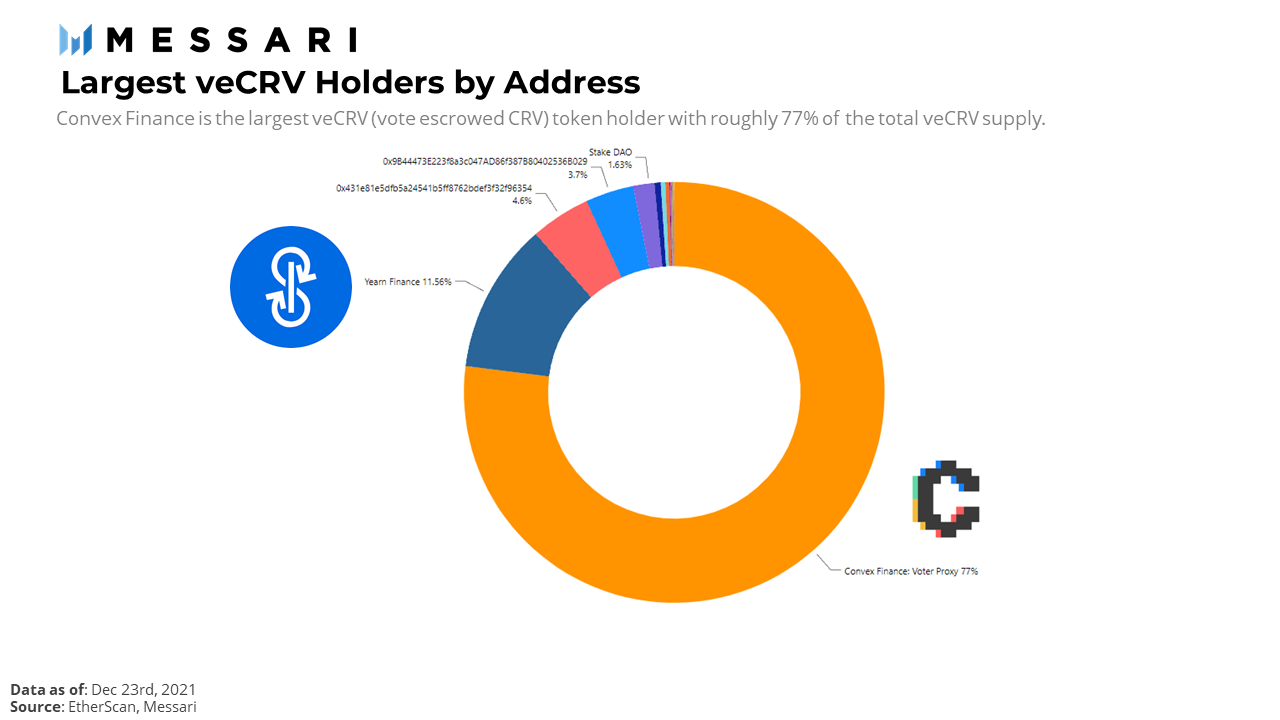

This “liquidity gauge” mechanic has been in the spotlight lately due to the so-called Curve Wars, where protocols such as Convex and Yearn Finance have commanded a large proportion of CRV tokens, effectively allowing them to sell this voting power to protocols that want to attract liquidity to their Curve pools.

In short, he who owns the most CRV tokens has the power to decide which Curve pools earn higher CRV rewards.

The second 3,3 mechanic that Solid Swap is adopting was first popularized by Olympus DAO, an Ethereum-based decentralized reserve currency protocol that is spearheading a new wave of “DeFi 2.0” protocols. The 3,3 term is a game-theoretic element that states the mutual benefits for both users and developers to keep their tokens staked into the protocol, thereby creating a positive-sum game for both parties.

Anecdotally, Olympus Pro hasn't changed, we are still using it, its still working exactly as it did ~3 months ago. No fundamentals changed, just mass belief. Which means their 3,3 thesis was 100% accurate.

— Andre Cronje

(@AndreCronjeTech) January 18, 2022

Solid Swap seeks to merge both these mechanics into a new DEX design that would compete with the standard AMM model that Uniswap pioneered.

This is how ve(3,3) was born. The tokenomics seems Solid. pic.twitter.com/O8Zfvd7Z0i

— Mudit Gupta (@Mudit__Gupta) January 12, 2022

Solid Swap in practice

In a series of Medium blog posts, Cronje details how the ve(3,3) model might work in practice.

Solid Swap’s native token ROCK, is designed to be emissions-based and will be highly inflationary, with 2 million new tokens weekly (for context, CRV has a daily inflationary rate of 2 million). ROCK holders can:

- lock up their tokens,

- gain voting power that decides which liquidity pools ROCK emissions should be directed to,

- and then receive trading fees from only the particular liquidity pools they voted on.

What’s new here? This contrasts with DEX’s like Uniswap, where liquidity providers across the board are incentivized with UNI tokens that the treasury has pre-allocated, regardless of which pools they provide liquidity in.

Solid Swap in effect, aligns the emissions of its native token with the incentives of token holders, rather than with liquidity providers.

For staking their tokens, users receive in return a locked voting token (veROCK). This is where the Olympus 3,3 mechanic comes in. The value of veROCK will be backed by funds in Solid Swap’s treasury, and holders of the token are incentivized to keep them staked (3,3) in exchange for farming yields.

Finally, veROCK comes in the form of a non-fungible token, which can be subsequently traded on secondary markets. This is similar to how lending protocols like Rari Capital unlock liquidity for staked OHM (sOHM) holders by allowing them to borrow stablecoins against their collateral.

In ve3, locks (that have power over distribution) are NFTs, these can be sold on secondary markets. @paint_swap messaged me and want to list the collection as soon as the contract goes live.

At launch, the top 20 Fantom TVL teams will each get 1 NFT. I plan on bidding on these.

— Andre Cronje

(@AndreCronjeTech) January 13, 2022

In short, the utility value of ROCK is manifold:

- Protocols on Fantom will want to amass ROCK because it makes their liquidity pools on Solid Swap more attractive to liquidity providers.

- ROCK holders will want to stake them, because the token is being backed by the Solid Swap treasury and earning yields (assuming it is over-backed)

- ROCK holders will want to remain staked, because they still retain some liquidity in their locked-up tokens

As a whole, this makes Solid Swap more of a “B2B” product, rather than “B2C”. This is a subtle point that can be easy to miss.

Solid Swap’s concept empowers Fantom protocols directly because holding ROCK allows them to vote and make their liquidity pools more attractive liquidity providers. This makes it easier for protocols to buttress their own liquidity by adding incentives, rather than be subject to mercenary capital.

A fair distribution

In an unusual twist, Cronje’s blog states that these tokens will be airdropped to the top twenty Fantom protocols by TVL rankings, effectively starting off Fantom’s own “Curve Wars” on more or less equal footing across its strongest protocols:

Locked ve(3,3) tokens will be given to each project in the top 20, it is then up to each project to create their pools and vote for their initial distribution or have their communities vote for their initial distribution. It is up to them to decide what they will incentivize, be it their own token, stable coin, or other liquidity. The timeline for this will thus be 2 weeks post protocol launch until distribution starts.

Whole DAOs have already emerged on Fantom in a bid to qualify as part of this top twenty protocols. According to DeFiLlama, the sixth largest Fantom protocol by TVL ($626 million) is veDAO. Its Medium article plainly states that its native token WeVE:

… is not designed or intended to carry any monetary value, regardless of whether the DAO successfully acquires a Cronje ve3 NFT. $WeVE represents only governance rights over a Cronje ve3 NFT. If veDAO fails to reach the top 20 in TVL, participants can simply withdraw their staked assets from the pools and move on.

In response, a team of veteran Fantom developers also formed 0xDAO (TVL $4.2 billion) to counterbalance the potential of ROCK being concentrated into veDAO.

What all this means is that the race to amass as much ROCK as possible has already begun, and protocols like veDAO and 0xDAO are jockeying to be the Convex-equivalent on Ethereum’s Curve Wars.

The post Enter Fantom’s “Curve Wars”: How Andre Cronje and Daniele Sesta are changing liquidity provision appeared first on CryptoSlate.