Quick Take

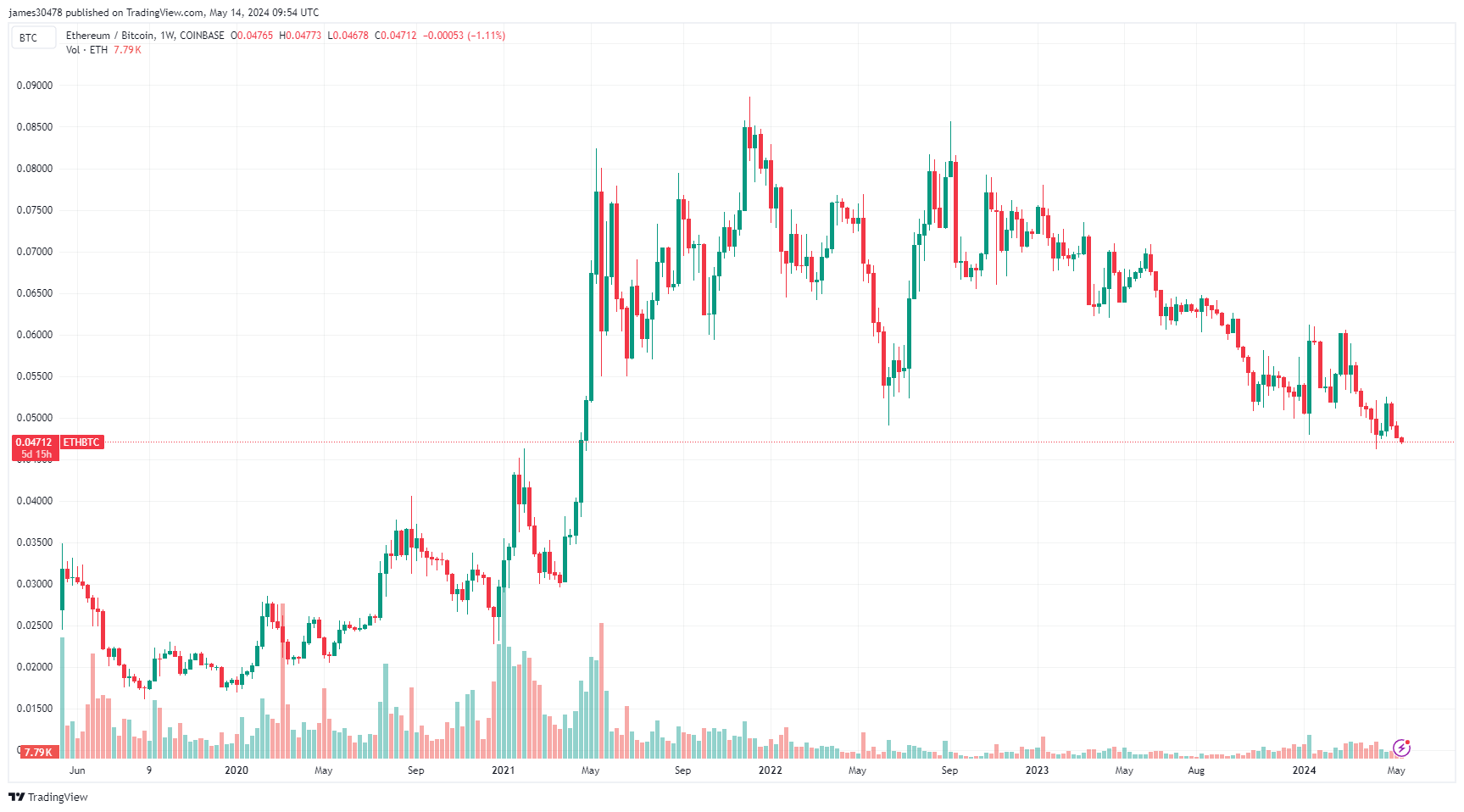

The Ethereum to Bitcoin (ETHBTC) ratio recently hit 0.046, a low not seen since April 2021, briefly revisiting levels from April 2024. This downward trajectory highlights Ethereum’s ongoing struggle against Bitcoin’s dominance in the digital assets market. The ETHBTC pair is down 30% in the past year and over 11% year-to-date.

Market movements are primarily driven by narratives and liquidity from central banks. Ethereum currently finds itself in an inflationary state, while the verdict on a potential Ethereum ETF in the US is looming, which could further impact its price.

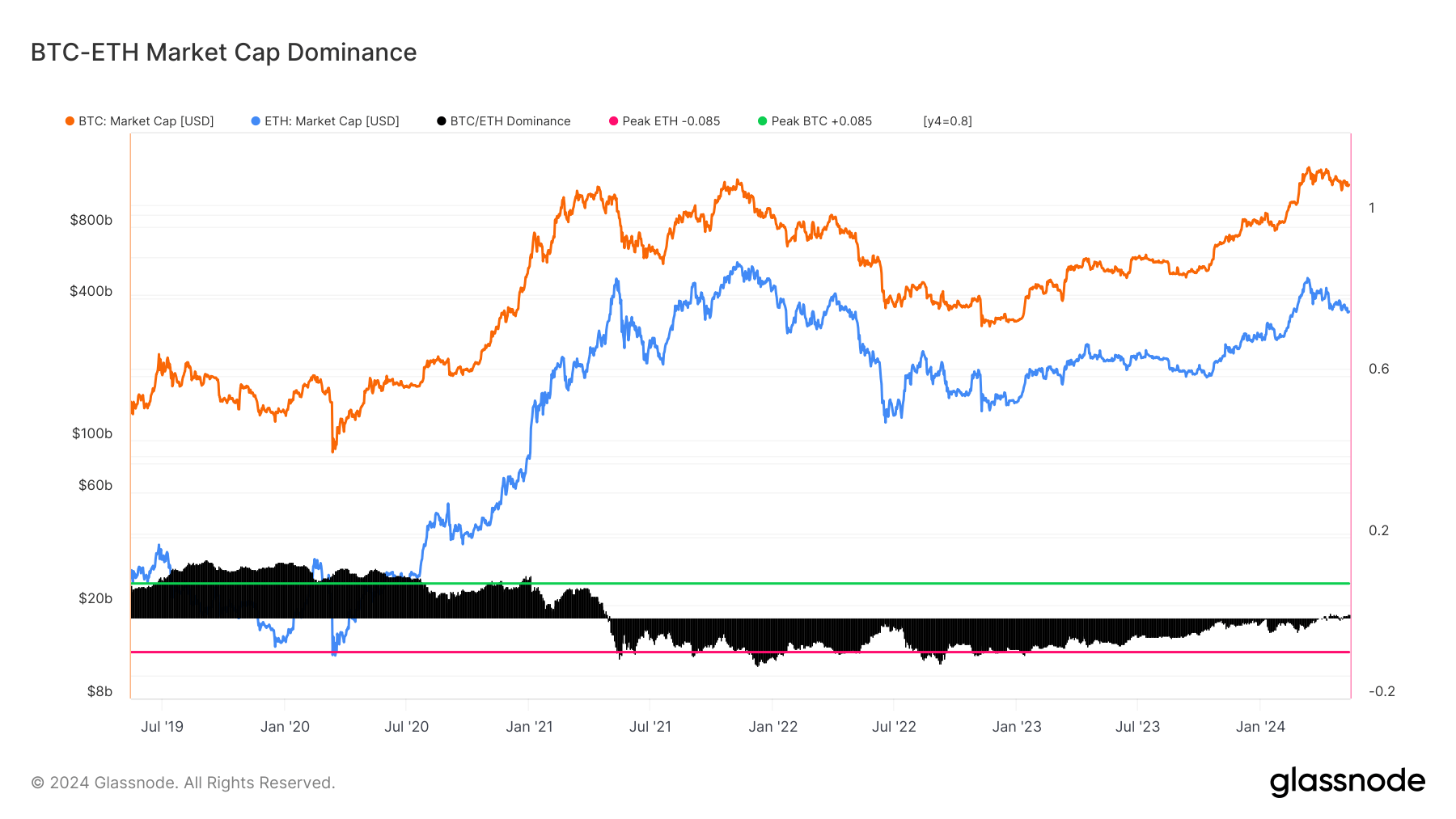

To gauge the macro trends between these top two digital assets, examine the BTC-ETH Dominance metric using Glassnode data. This oscillator tracks the relative market cap dominance of Bitcoin compared to the combined market cap of Bitcoin and Ethereum. It is calculated as: `Dominance = BTC Market Cap / (BTC Market Cap + ETH Market Cap) – 0.765`, with the 0.765 factor included to visualize the oscillator around a long-term mean.

In early April, Bitcoin dominance broke out against Ethereum for the first time since April 2021, a trend CryptoSlate had anticipated. Meanwhile, CryptoSlate expects Bitcoin’s dominance over Ethereum to continue trending higher in the coming months.

The post ETH/BTC ratio falls 30% year-over-year amidst rising Bitcoin market dominance appeared first on CryptoSlate.