Ethena Labs’ USDe, a synthetic dollar stablecoin, has garnered significant community adoption, propelling it to become the fourth-largest stablecoin by market capitalization.

This achievement comes at a notable juncture, as the stablecoin surpassed the entire Solana blockchain in revenue generation within the past week.

USDe supply crosses $3 billion

According to data from CryptoSlate, the supply of the USDe stablecoin has surpassed $3 billion four months after its public launch in February. This remarkable growth rate makes USDe the fastest-growing USD-pegged asset in crypto history. Its market capitalization now exceeds the Binance-favored FDUSD stablecoin and trails behind MakerDAO’s DAI.

Notably, USDe’s market cap has exceeded the combined value of all stablecoins on the Solana blockchain. Data from DeFillama indicates that the rapidly growing USDe currently accounts for approximately 2% of the overall stablecoin market share.

Speaking on this milestone, DeFi analyst Patrick Scott said the focus would be on whether USDe can sustain this growth, develop deep liquidity, and further integrate into the DeFi ecosystem.

USDe’s exponential growth can be attributed to its high yield rate of over 30% and adoption by major crypto projects like MakerDAO and the Bybit exchange. However, some market experts have criticized USDe’s incorporation of Bitcoin as a backing asset for its synthetic dollar, expressing concerns about potential contagion risk for the broader market.

Revenue generation

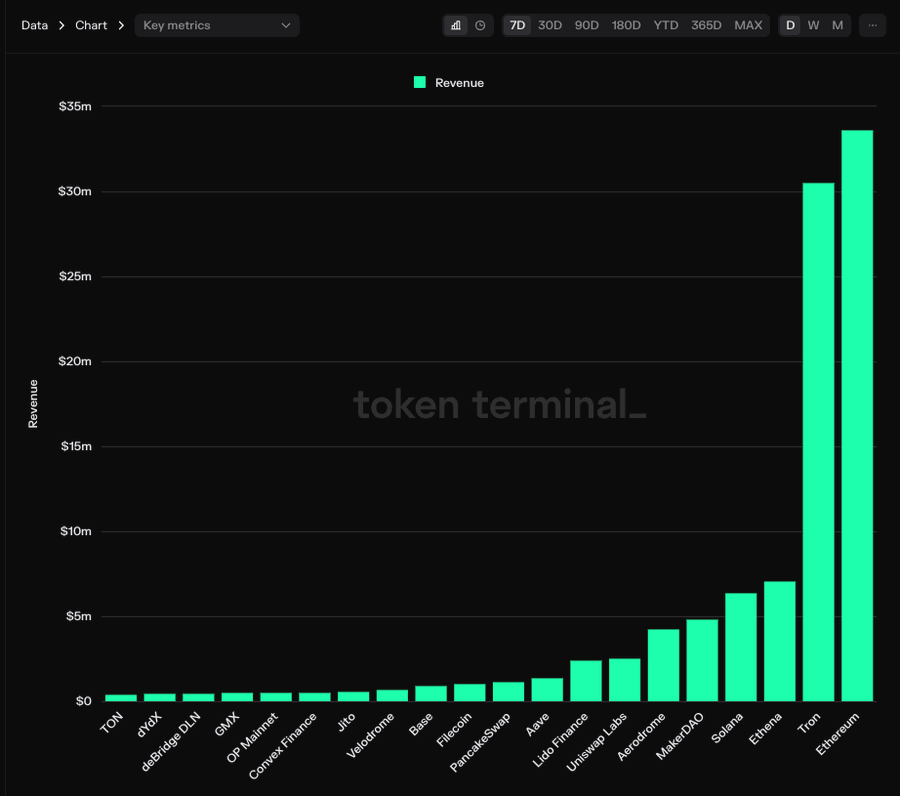

During the past week, Ethena’s USDe emerged as the highest-earning decentralized application (DApp), generating an impressive $7 million in revenue. This figure surpasses Solana’s $6.3 million revenue during the same period.

Notably, the Token Terminal data shared by Ethena founder Guy Young on X showed that only Tron and Ethereum outperformed the DApp’s revenue generation.

This remarkable achievement lends credence to the prediction made by Token Terminal that Ethena is on track to generate a staggering $222.5 million in revenue over the next 12 months.

José Maria Macedo, the CEO of Delphi Labs, stated that Ethena Labs is poised to become the highest revenue-generating crypto project in the market. He said:

“USDe will become the largest stablecoin outside of USDC/USDT in 2024. Ethena will become the highest revenue-generating project in all of crypto.”

The post Ethena USDe overtakes Solana in revenue, hits $3 billion market cap appeared first on CryptoSlate.