On-chain data shows that Ethereum realized volatility has now declined to rare levels observed only three times before in history.

Ethereum 1-Month Realized Volatility Has Plummeted To Just 39.8%

As per data from the on-chain analytics firm Glassnode, the month of December 2022 was historically quiet for both Ethereum and Bitcoin. The “realized volatility” is an indicator that measures the standard deviation of daily returns from the mean for the market in question.

The indicator is usually taken over a rolling window, with the one-week and one-month versions being generally the most useful timespans for it. In the context of the current discussion, the relevant metric is the one-month realized volatility.

When the value of the metric is high, it means the asset’s price has been showing greater fluctuations from the average recently. Such a trend implies that the market is providing a high trading risk currently. On the other hand, low values suggest returns haven’t deviated much from the mean, and hence that the price has been stuck in stale consolidation.

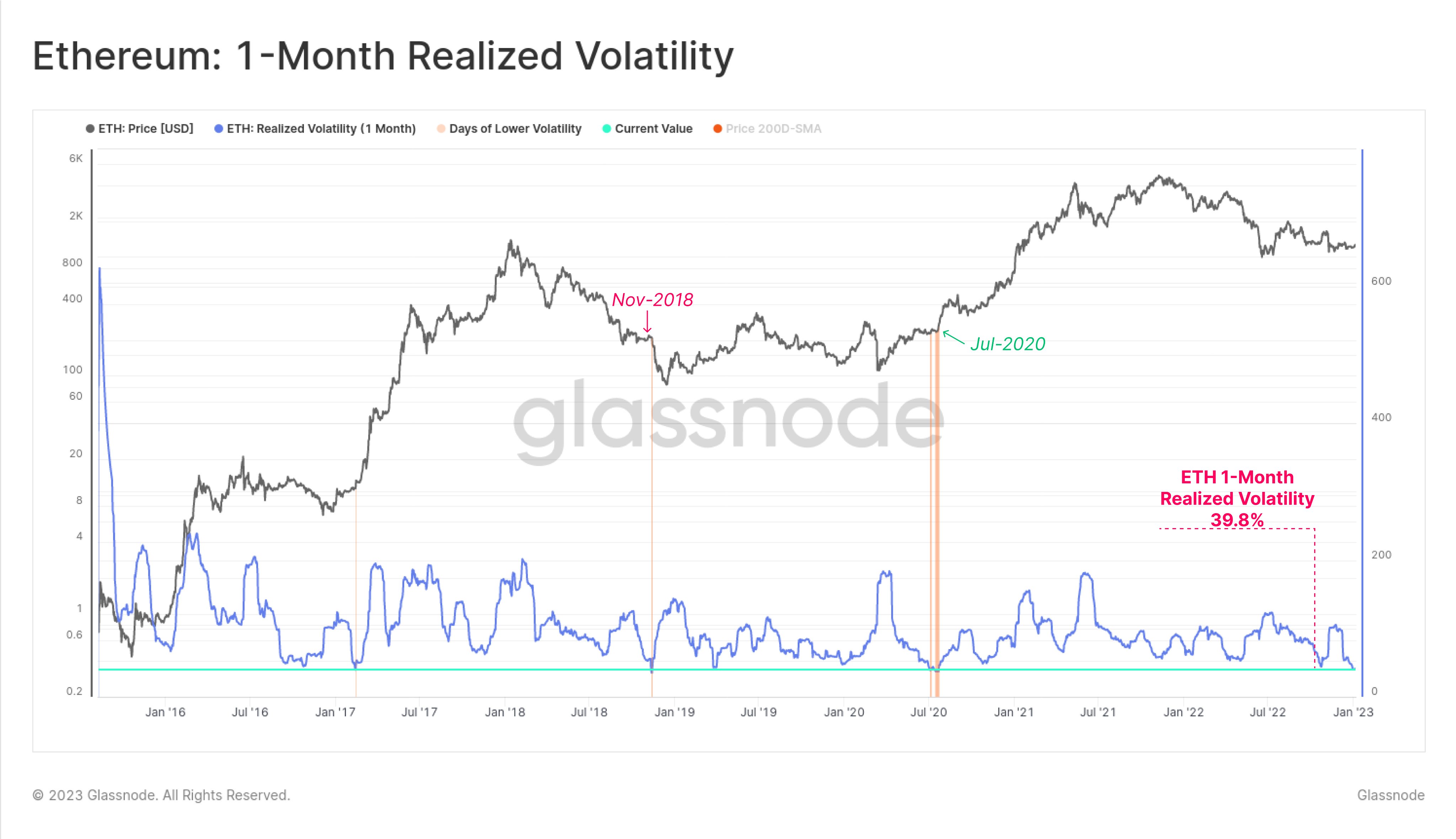

Now, here is a chart that shows the trend in the one-month Ethereum realized volatility over the last few years:

As displayed in the above graph, the Ethereum one-month realized volatility has plunged to just 39.8% recently, suggesting that the past month has had very little diversity in day-to-day returns. This current level of the indicator is actually a historically low value, and as is apparent from the chart, there have only been three instances in the history of the crypto where the price has been this stable.

Interestingly, after each occurrence of the volatility hitting these lows, the price has made a sharp move and the indicator has jumped back up. An important example of this was back in November 2018, when the value of ETH collapsed toward the bottom of the bear market in a sudden move, after the metric had reached these rare levels.

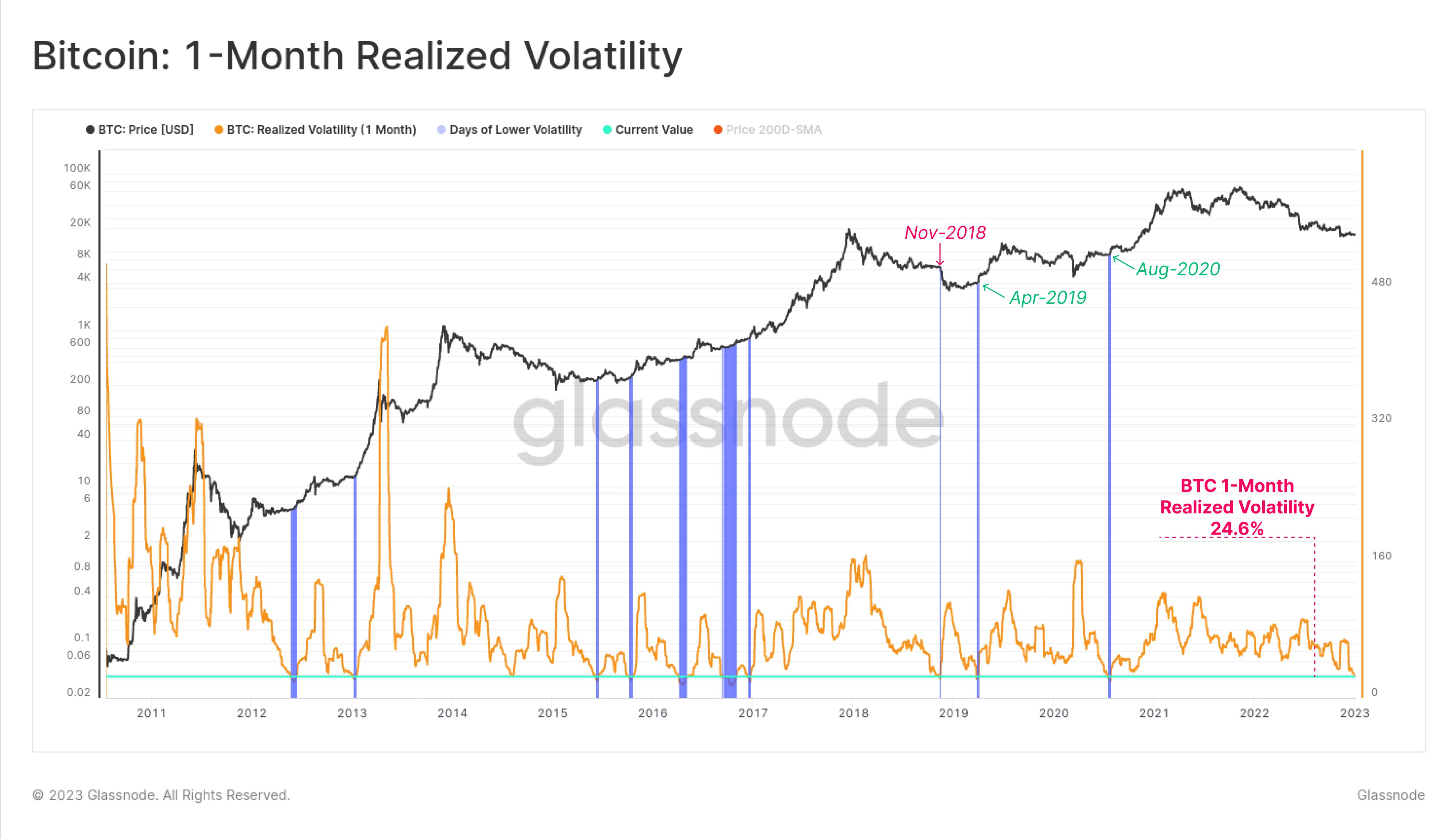

Glassnode also points out that, just like for Ethereum, the one-month realized volatility for Bitcoin has also plunged to historical lows recently, as the below chart highlights.

As you can see above, the Bitcoin one-month realized volatility has only been lower than the current value (24.6%) a few times in the entire history of the crypto. A notable instance here was also in November 2018, where, just like ETH, BTC crashed down to form its bottom.

If these historical trends are anything to consider, then the current extremely low values in the one-month volatility for Ethereum and Bitcoin could mean both the cryptos may soon see a significant spike in the metric soon, but the accompanying price move could be toward either direction.

ETH Price

At the time of writing, Ethereum’s price floats around $1,300, up 8% in the last week.