On-chain data shows a large amount of new addresses have popped up on the Ethereum network recently, a sign that ETH adoption is occurring.

Ethereum Network Growth Registered A Sharp Spike Recently

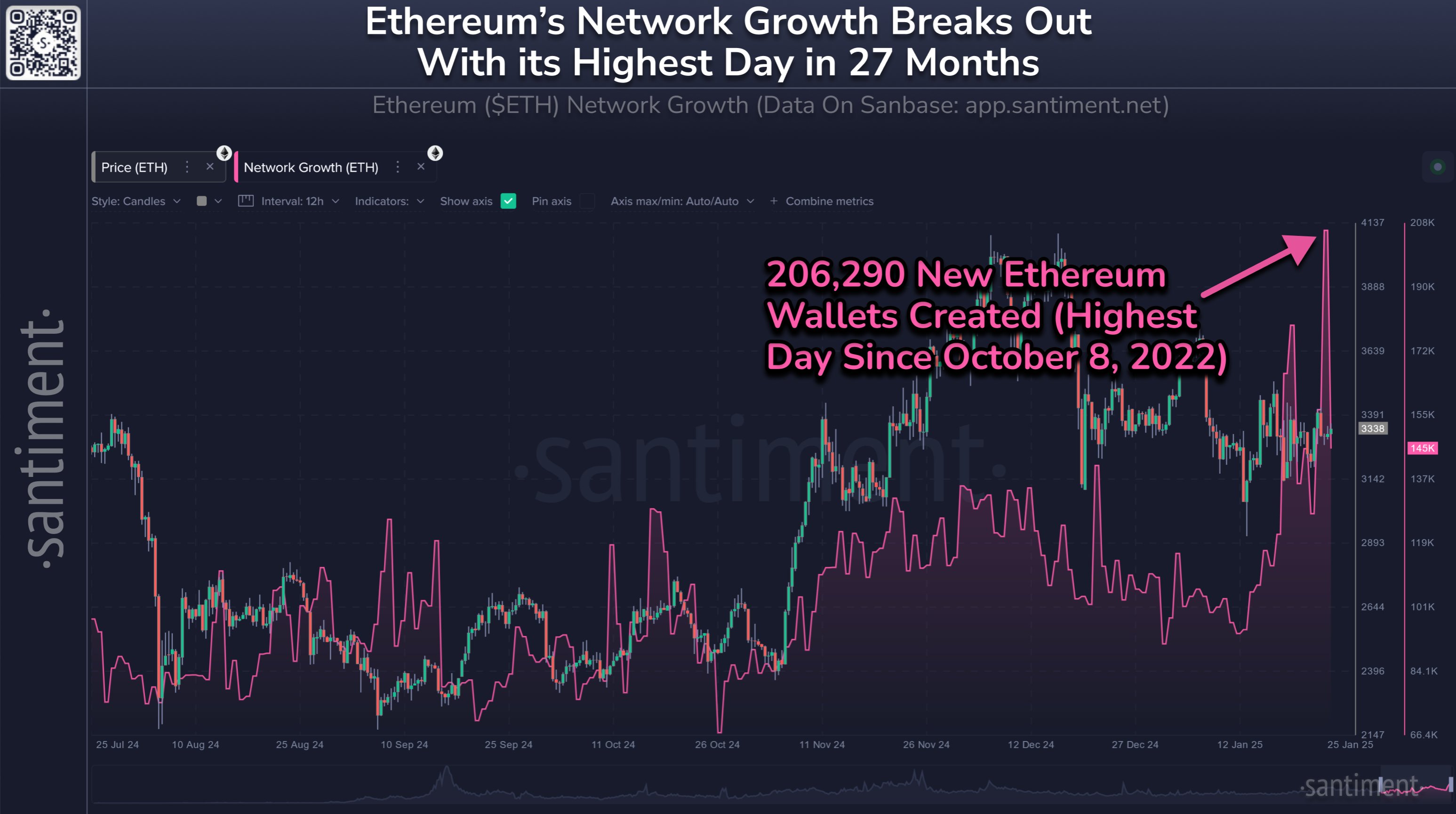

In a new post on X, the on-chain analytics firm Santiment has discussed about the latest trend in the Network Growth for Ethereum. The “Network Growth” here refers to an indicator that keeps track of the total number of addresses that are coming online on the ETH blockchain for the first time.

An address is said to be ‘online’ or active when it participates in some kind of transaction activity on the network, whether as a sender or receiver. Thus, the Network Growth measures the number of addresses making their very first transfer.

When the value of this indicator is high, it means the network is witnessing the creation of a large number of addresses. This kind of trend can arise when new users join the chain or old ones who had sold earlier return.

A spike in the Network Growth can also naturally occur when existing users create multiple wallets for a purpose like privacy. In general, all of these factors are at play to some degree whenever the indicator observes an increase, so some adoption of the cryptocurrency could be assumed to be taking place.

Now, here is the chart shared by the analytics firm that shows the trend in the Ethereum Network Growth over the past six months:

As displayed in the above graph, the Ethereum Network Growth saw a huge spike during the weekend, implying a large number of new addresses were generated on the ETH blockchain.

In total, the users created 206,290 addresses during this spike, which is the largest value for the indicator since October 2022, more than two years ago.

As the analytics firm notes,

The 27-month high in daily wallet creation comes during a time when ETH crowd sentiment has veered particularly negative as other altcoins have outperformed it. Regardless, due to DeFi and staking options for crypto’s #2 market cap asset, Ethereum is still the entire sector’s leader in total non-empty addresses.

Historically, adoption is something that has been constructive for cryptocurrencies, as a wider userbase can provide for a stronger foundation on which future price moves can thrive.

The potential bullish effects of adoption, however, usually only become apparent in the long term. Thus, these new addresses are unlikely to have any noticeable influence on the price of Ethereum in the near future.

ETH Price

Ethereum, like the rest of the cryptocurrency sector, has crashed during the past day. After a drawdown of around 7%, ETH’s price is now trading under $3,100.