Ethereum has broken the $1,900 mark today as on-chain data shows sharks have been continuing to accumulate more of the asset.

Ethereum Sharks Are Currently Holding Their Highest Amount In A Year

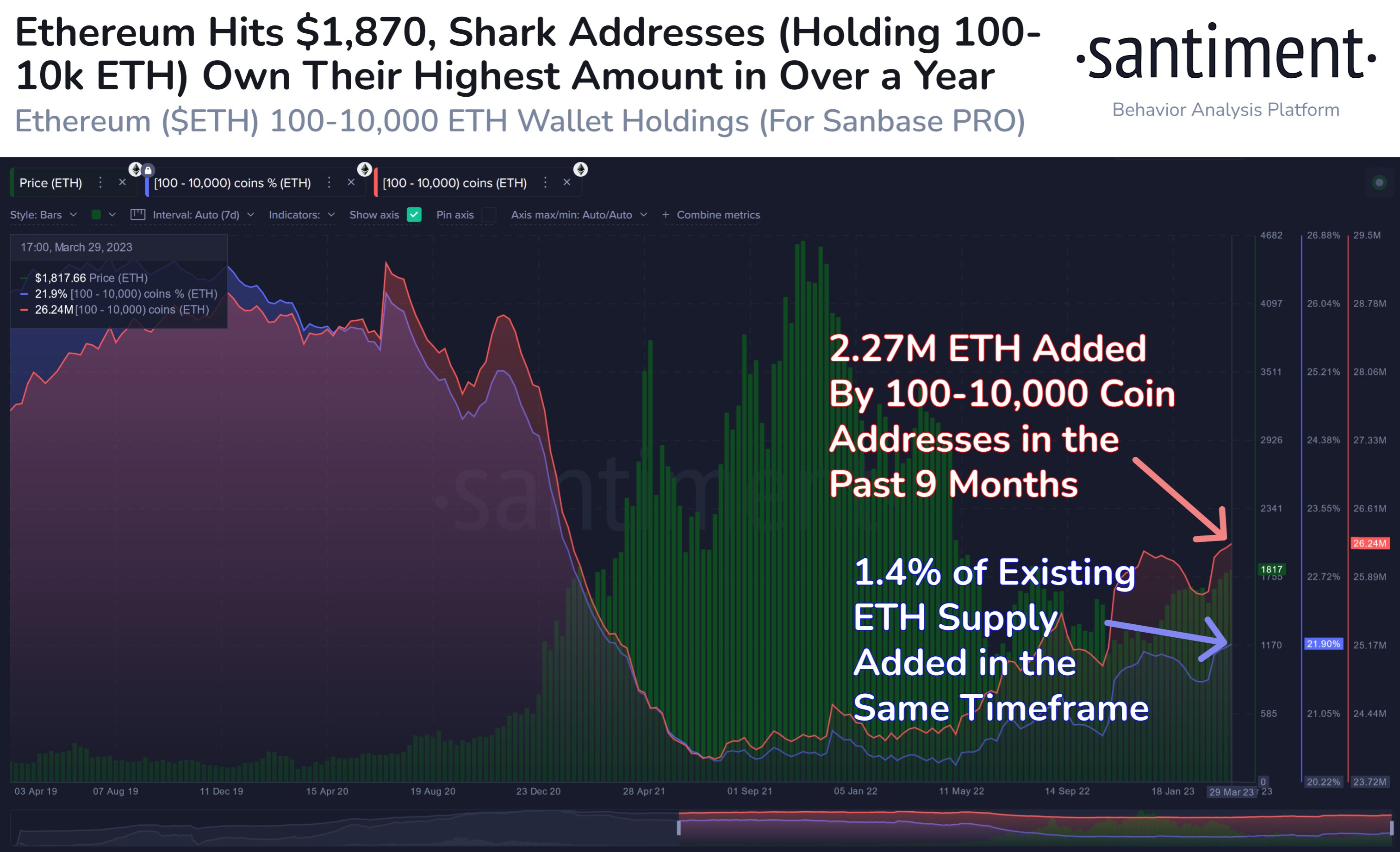

According to data from the on-chain analytics firm Santiment, the sharks have been constantly adding to their holdings since last summer. The relevant indicator here is the “ETH Supply Distribution,” which keeps track of the data related to the total Ethereum supply being held by each wallet group in the market.

Wallets are divided into these wallet groups based on the total number of coins that are currently sitting in their balances. The 10 -100 coins group, for instance, includes all addresses that are holding between 10 and 100 ETH.

When the Supply Distribution metric is applied to this specific cohort, it will tell us about the total number of coins such investors as a whole are holding right now, as well as what percentage of the total ETH supply is being contributed by these combined holdings.

In the context of the current discussion, the investor group of interest is made up of the “sharks,” who are entities that hold at least 100 and at most 10,000 ETH. At the current exchange rate, this range converts to about $191,000 at the lower bound and $19,100,000 at the upper end.

As these amounts are quite significant, the sharks make up an important part of the Ethereum ecosystem. Their movements can, therefore, be worth watching as they may have visible influences on the price (though, not as much as the movement of the whales).

Now, here is a chart that shows the trend in the Supply Distribution for these Ethereum sharks over the last few years:

As displayed in the above graph, the Ethereum Supply Distribution of the sharks has been riding an uptrend for quite a while now. In the last nine months, these investors have accumulated a total of 2.27 million ETH, about $4.3 billion at the current price.

From the chart, it’s also visible that with the buying spree over this period, these investors have added 1.4% of the total Ethereum supply to their combined wallets.

Just earlier in the year, this cohort faltered a little as some selling took place when the price of the cryptocurrency was at relatively high levels. This can be seen in the graph with the depression in the curve of the sharks’ supply.

Recently, however, these Ethereum holders have once again sharply accumulated more of the asset and have taken their supply to the highest level in more than a year.

Generally, accumulation from the sharks can be a bullish sign for the price of the coin. And indeed, as this fresh buying from them has taken place recently, the asset has been climbing and has now breached the $1,900 level for the first time since August 2022.

ETH Price

At the time of writing, Ethereum is trading around $1,900, up 5% in the last week.