Like Bitcoin and top altcoins, including Solana, Ethereum is holding steady. At the time of writing, it is trading above the local support at $3,300 and floating higher, targeting $3,700.

Speculators Flowing To ETH As Bulls Set Sight On $3,700

The leg up is fueled by multiple market-related factors, mainly the anticipated launch of spot Ethereum ETFs in the next few days. As seen from the daily chart, news of the United States Securities and Exchange Commission (SEC) fast-tracking the approval of 19b-4 forms sparked a wave of demand from May 20.

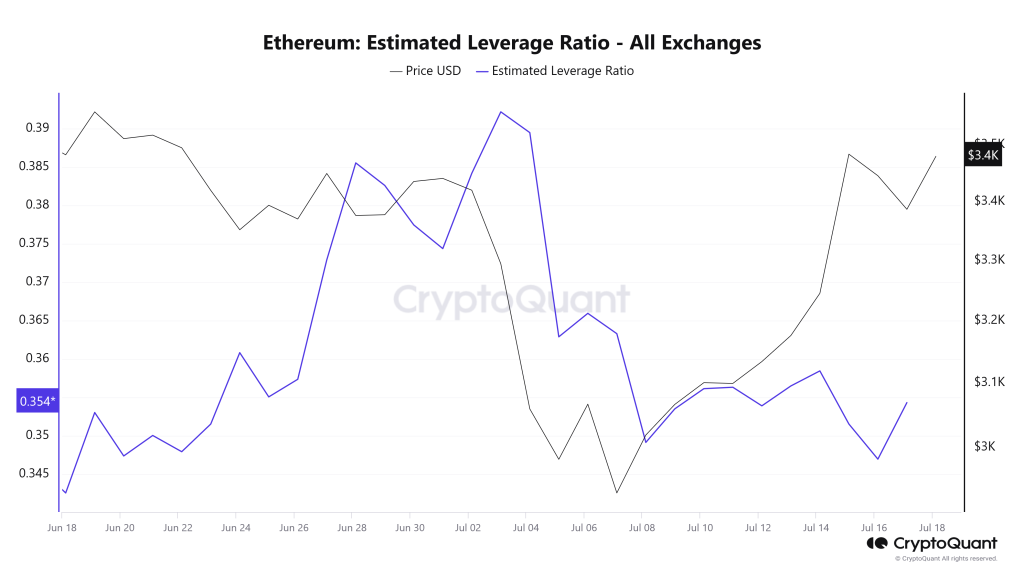

However, speculators are permeating the scene even as prices remain steady and uptrend. CryptoQuant data shows that the estimated leverage ratio has risen in the past few trading days.

With this reading ticking higher, the ETH scene receives more leveraged traders keen more on profiting from price volatility rather than benefiting from what ETH as a digital asset presents.

According to CryptoQuant, the estimated leverage ratio stood at 0.347 on July 16 before rising to 0.354 on July 17. The expansion suggests that traders are increasingly borrowing funds on perpetual trading platforms like Binance and OKX, hoping to make a killing if ETH bulls push prices above $3,700.

As prices rally, the estimated leverage ratio will likely climb even higher. The local top is at 0.358, as recorded on July 14. The all-time leverage ratio was at 0.392, registered in early July 2024.

Eyes On Spot Ethereum ETFs: Will It Be A Success?

Ethereum traders are confident that prices will rise, even breaching all-time highs, once spot ETH ETFs are launched. The latest reports show that the derivative product will launch early next week, allowing institutional investors to gain exposure.

The United States SEC has given the green light to three issuers to launch. However, it is expected that all spot Ethereum ETF applicants whose 19b-4 forms have been approved will be permitted to launch simultaneously.

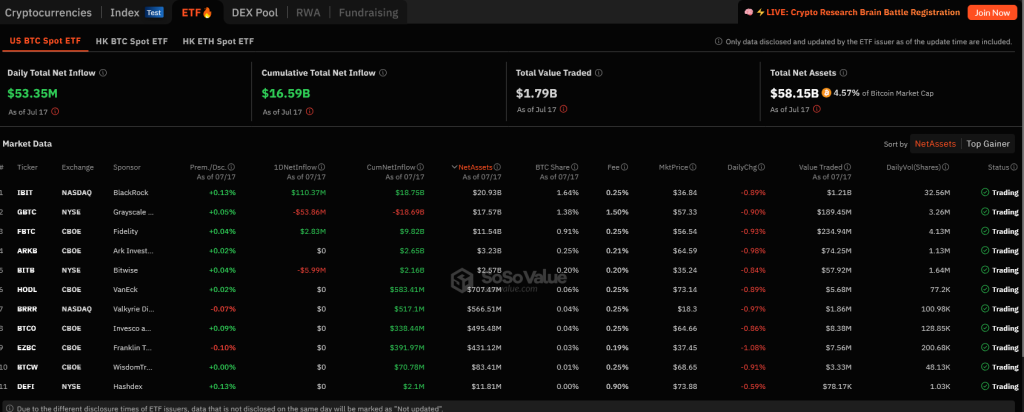

Confidence is high that spot Ethereum ETFs will follow the success of their spot Bitcoin ETFs. According to SosoValue, all spot Bitcoin ETF issuers manage over $53 billion of BTC as of July 18.

Even so, though highly anticipated and likely to positively impact prices, the product will see a different level of demand than when spot Bitcoin ETFs launched.

Analysts pin this to Ethereum’s lower market cap and the United States SEC’s decision not to allow spot ETF issuers to stake ETH. By staking, issuers would receive rewards on behalf of their clients.