Data shows the Ethereum whales and sharks have continued to fill up their bags recently, a sign that may prove to be bullish for the price of the crypto.

Ethereum Whales And Sharks Bought 561k ETH In A Single Day

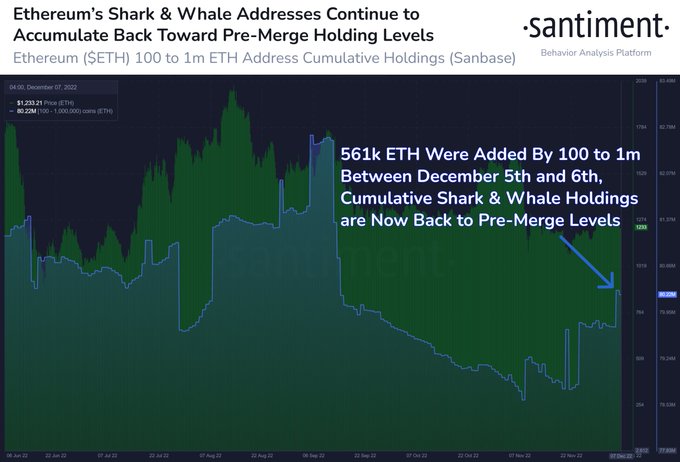

As per data from analytics firm Santiment, ETH whale and shark addresses are accumulating back towards pre-Merge levels.

The relevant indicator here is the “ETH supply distribution,” which tells us which wallet groups are currently holding what percentage of the total Ethereum supply.

Wallet addresses are divided into these groups based on the total number of coins that they are holding currently.

For example, the 1-10 coins group includes all addresses that are carrying between 1 and 10 ETH right now.

In the current discussion, the holders of interest are those with at least 100 ETH and at most 1 million ETH in their balances. Here is a chart that shows the trend in the combined Ethereum supply distribution for all the wallet groups falling into this range:

The value of the metric seems to have shown some sharp uptrend in recent days | Source: Santiment

As you can see in the above graph, the percentage of the Ethereum supply held by wallets in the 100-1m coins range has observed rapid growth recently.

Between the 5th and the 6th of this month alone, the indicator saw its value go up by 561k ETH.

The holder cohorts with wallet balances lying in the range are sharks and whales. Movements from these investors (especially the whales) can have noticeable impacts on the market.

The latest uptrend suggests that these groups have been filling up their bags with more Ethereum recently. Such an accumulation implies the ETH whales and sharks are bullish on the crypto right now.

Earlier in the year, these humongous investors accumulated during the Merge hype, and subsequently dumped the crypto in a sell-the-news event as soon as the actual PoS transition took place (which can be seen by the sharp plunge in the chart).

After the recent accumulation, the whale and shark holdings have now returned close to the levels they were before the Merge leadup.

ETH Price

At the time of writing, Ethereum’s price floats around $1.2k, down 1% in the last week. Over the past month, the crypto has lost 21% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has struggled in the last few days | Source: ETHUSD on TradingView

Featured image from Todd Cravens on Unsplash.com, charts from TradingView.com, Santiment.net