Recent developments in the crypto market indicate a strong bullish sentiment among Ethereum traders, particularly in the options market.

Amid the growing anticipation for potential approvals of spot Ethereum exchange-traded funds (ETFs), there has been a noticeable shift in option pricing, with Ethereum call options becoming more expensive than put options across all expiries.

This pricing pattern suggests the market is optimistic about Ethereum’s price prospects. Notably, A call option gives the holder the right, but not the obligation, to buy an asset at a specified price within a specific time frame.

This option type is typically purchased by traders who believe the asset’s price will increase. Conversely, a put option provides the holder the right to sell the asset at a predetermined price and is often used as protection against a decline in the asset’s price.

Market Indicators Point To A Bullish Ethereum

Luuk Strijers, CEO of Deribit, highlighted this trend in his communication with The Block. He noted that the “put minus call skew is negative across all expiries and increasing further beyond the end-of-June expiry, a quite bullish signal.”

Additionally, the basis, or the annualized premium of the futures price over the spot price, has increased to around 14%, further reinforcing the bullish outlook.

The analysis reveals that traders prefer to purchase call options at a premium compared to put options, particularly for those set to expire at the end of June and later.

This pattern is a sign of a bullish market, indicating that traders are not as interested in securing protection against potential price drops as they are in anticipating that Ethereum’s value will keep climbing.

Meanwhile, after the US Securities and Exchange Commission (SEC) unexpectedly asked for changes in filings, there has been a resurgence in optimism regarding the possible approval of spot Ethereum ETFs.

This optimism has translated into significant market activity, with Deribit experiencing nearly unprecedented trading volumes. Strijers remarked, “We recorded an almost unprecedented trading volume of $12.5 billion notional over the last 24 hours.”

This surge in trading volume and market interest reflects how traders and investors position themselves to capitalize on the potential approval of spot Ethereum ETFs.

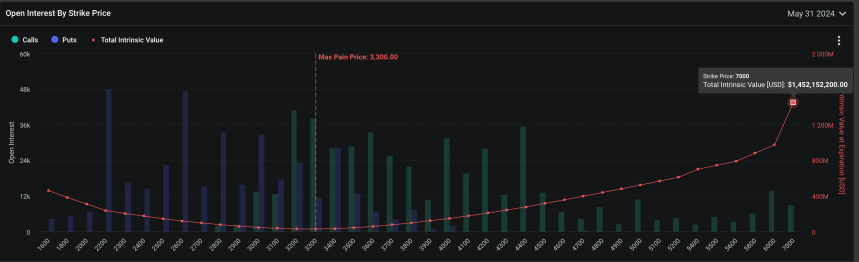

According to data from Deribit, over $480,000 calls will expire by the end of this month, with a notional value of more than $1.7 billion.

The data further reveals that the strike price reaches as high as $7,000, with a total intrinsic value of $1.452 billion, indicating that many Ethereum options traders are highly bullish on ETH.

ETH Price Performance And Forecast

Meanwhile, Ethereum is undergoing slight retracement, down by 2.4% in the past 24 hours, with a trading price of $3,690. Despite this pullback, the asset has maintained a strong uptrend, rising nearly 25% over the past seven days.

As the market’s anticipation around spot ETH ETFs grows, a prominent crypto analyst has suggested a potential price movement for Ethereum, indicating a brief pullback at around $4,000 before surging to new all-time highs.

According to the analyst, while there might be some bumps, reaching an all-time high of $5,000 seems “inevitable” for Ethereum.

$ETH: I think we pullback briefly around 4k but this certainly breaks all time highs if/when ETF gets approved. This still seems like a free trade for ETH going to ATH, which is at 5k. Could be some bumps along the way but it seems inevitable.

I have both SOL and ETH and not… pic.twitter.com/IznlJ0RAyl

— Altcoin Sherpa (@AltcoinSherpa) May 22, 2024

Featured image created with DALL·E, Chart from TradingView