The post Ethereum Buy Signal? Investors Accumulate 1.63 Million ETH appeared first on Coinpedia Fintech News

In the past few days, the overall cryptocurrency market has experienced a notable price decline. Amid this, Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, has reached a crucial level near $1,800 for the first time since 2023. However, investors and long-term holders view this level as an ideal buying opportunity.

Key Level for Ethereum (ETH)

Today, March 13, 2025, a prominent crypto expert shared a post on X (formerly Twitter), stating that the key level for Ethereum is $1,887, where whales and investors have accumulated 1.63 million ETH tokens. This post is gaining massive attention from crypto enthusiasts and raising concerns about whether it is a bullish sign for investors or an ideal buying opportunity.

Ethereum (ETH) Technical Analysis and Upcoming Levels

According to expert technical analysis, ETH is near a crucial support level of $1,800. However, if the asset fails to hold this level, a massive price decline may occur in the coming days.

Based on recent price action and historical patterns, if the asset remains above the $1,800 level, it could soar by 20% to reach $2,200 in the coming days. On the other hand, if ETH falls and closes a daily candle below $1,780, it could drop by over 16% to reach $1,500.

As of now, ETH’s Relative Strength Index (RSI) is near the oversold area, indicating low strength in the asset and suggesting that the price may fall in the coming days.

Current Price Momentum

At press time, ETH is trading near $1,840, having registered a price drop of over 2.5% in the past 24 hours. However, during the same period, its trading volume dropped by 30%, indicating lower participation from traders and investors compared to previous days.

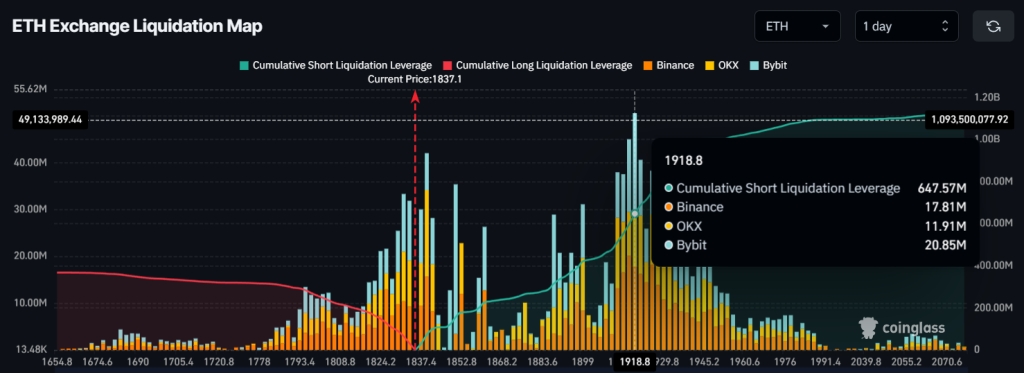

Traders Over-Leveraged Levels

Looking at the price drop, intraday traders seem to have a bearish outlook, as reported by the on-chain analytics firm Coinglass.

Data shows that traders are over-leveraged at $1,795, currently holding $285 million worth of long positions. Meanwhile, another over-leveraged level is at $1,920, where traders hold $650 million worth of short positions.

This on-chain metric partially confirms that traders are currently bearish on ETH and believe the price won’t rise above the $1,920 level.