The Ethereum Foundation (EF), a nonprofit supporting Ethereum’s blockchain ecosystem, has released its 2024 annual report detailing financial updates, treasury holdings, and recent policy initiatives.

The report highlighted the organization’s budget breakdown, spending from recent years, and new policies designed to foster transparency and integrity across the Ethereum ecosystem.

Treasury holding

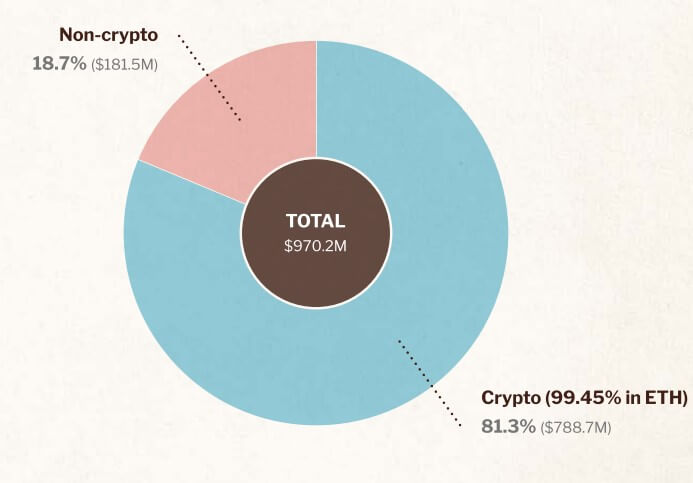

As of Oct. 31, 2024, the EF’s treasury totaled approximately $970.2 million, comprising $788.7 million in crypto—primarily ETH—and $181.5 million in non-crypto investments.

EF’s said its ETH holdings represent around 0.26% of Ethereum’s total supply as of Oct. 31. These substantial ETH reserves reflect the Foundation’s confidence in Ethereum’s long-term potential and its commitment to maintaining a strong presence within the network.

The EF clarified that its treasury serves as a financial backbone for essential projects within the Ethereum ecosystem. The Foundation periodically converts a portion of its ETH holdings to fiat currency, especially during market upswings, to ensure adequate resources during market downturns.

Ecosystem treasury

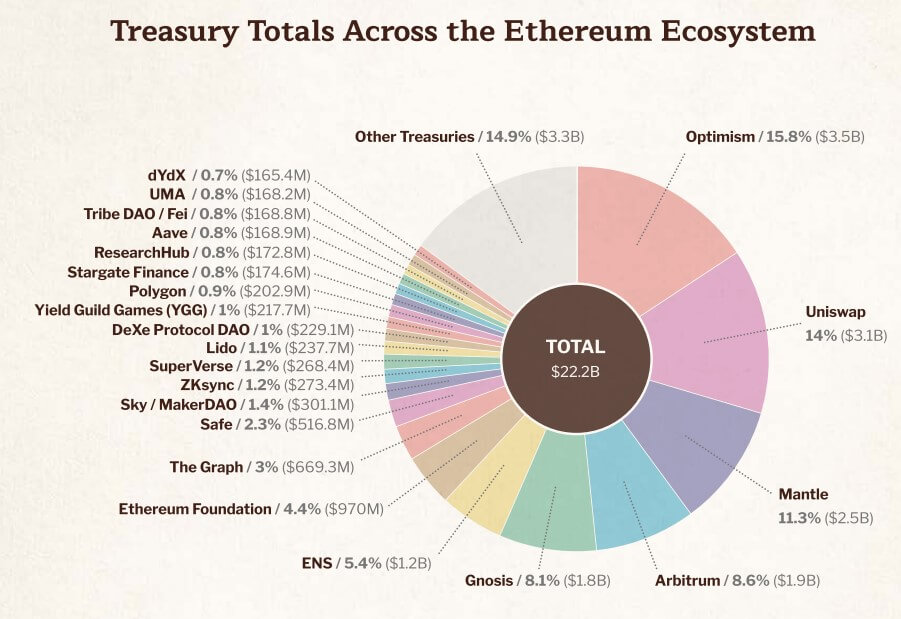

Beyond EF’s holdings, Ethereum’s ecosystem benefits from over $22 billion in combined treasury assets held by various foundations, organizations, and DAOs.

The treasuries primarily comprise the native tokens of crypto projects like dYdX, Aave, Polygon, The Graph, Optimism, Uniswap, Mantle, Arbitrum, Lido, Gnosis, and the Ethereum Name Service.

The report emphasizes that even a small allocation from these treasuries would provide significant resources to sustain and grow the Ethereum ecosystem over the long term.

Ecosystem funding

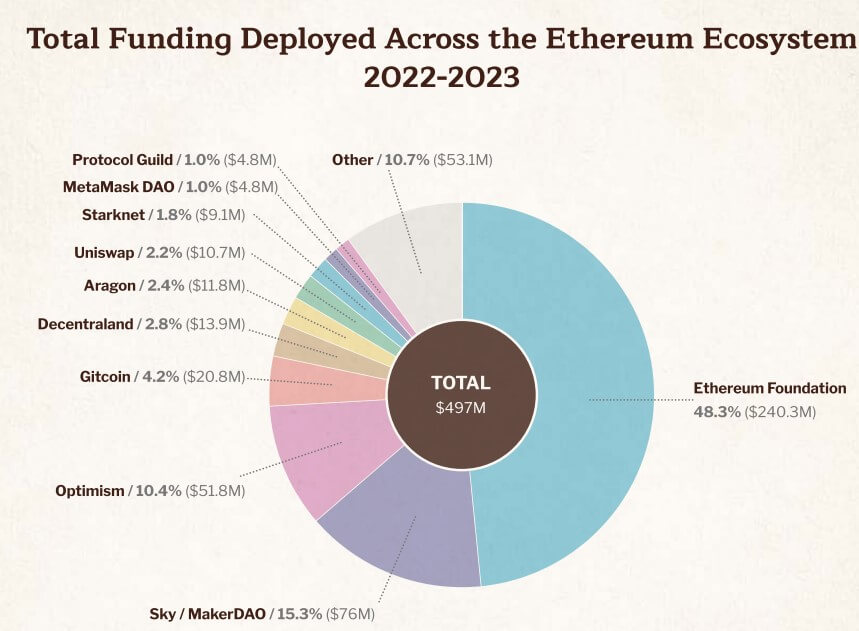

The Ethereum Foundation and ecosystem partners allocated nearly $500 million to ecosystem projects across 2022 and 2023.

EF contributed $240.3 million (48.3% of total funding), with the remaining support from organizations like MakerDAO (rebranded as Sky), Optimism, Gitcoin, Decentraland, Aragon, Uniswap, Starknet, MetaMask DAO, and Protocol Guild.

This collective funding emphasizes the collaborative nature of Ethereum’s ecosystem, driving innovation and support for builders within the community.

EF Director Aya Miyaguchi emphasized that this funding approach parallels Ethereum’s decentralized research and development processes, which encourage collaboration and resource-sharing projects. She stated:

“Proud to say that ecosystem funding is a shared effort today, much like Ethereum’s R&D process, which helps builders across the Ethereum ecosystem find more paths to keep innovating.”

Conflict of interest policy

To strengthen its transparency, the Ethereum Foundation has implemented a conflict of interest policy, mandating disclosure for investments e to strengthen its transparency exceeding $500,000 (excluding ETH).

The policy aims to prevent potential conflicts among EF members by excluding them from relevant decisions if they are highly exposed to related assets. Miyaguchi explained that this move represents a step toward enhancing integrity within EF and the wider Ethereum ecosystem.

It is particularly prescient considering Ethereum Foundation researchers recently came under fire for taking advisory roles with restaking protocol EigenLayer.

The post Ethereum ecosystem treasuries top $22 billion, with resources poised to support network’s future growth appeared first on CryptoSlate.