Quick Take

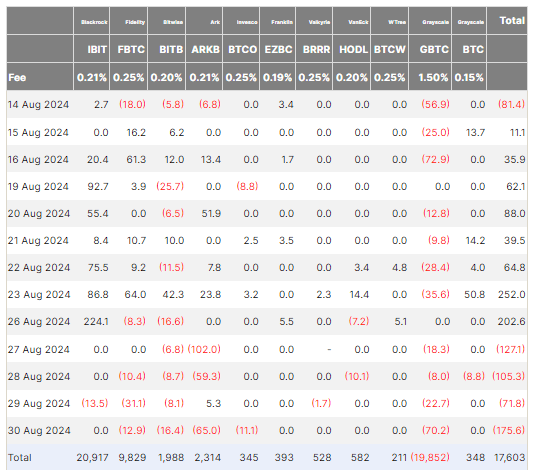

Data from Farside revealed that the Bitcoin market experienced its fourth consecutive day of outflows, totaling $479.8 million for the period. Aug. 30 alone saw an outflow of $175.6 million across various Bitcoin ETFs. Among the most notable were Fidelity’s FBTC, which saw outflows of $12.9 million, Bitwise’s BITB with $16.4 million, ARK’s ARKB with $65 million, Invesco’s BTCO with $11.1 million, and Grayscale’s GBTC with a substantial $70.2 million. Despite these outflows, total ETF inflows stand at $17.6 billion.

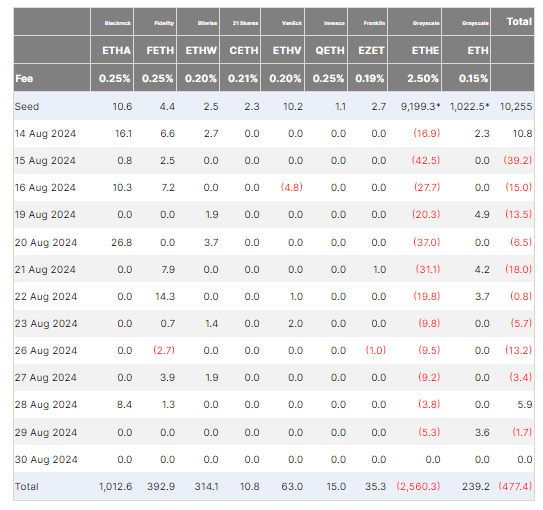

Farside data shows that in contrast to Bitcoin ETFs, Ethereum ETFs showed no activity on Aug. 30, with neither inflows nor outflows recorded across all issuers. This has not occurred before on any day since the Bitcoin ETFs were launched.

In terms of market performance, Bitcoin ended August with a 9% decline, while Ethereum fared worse, dropping 22%. The ETH/BTC ratio now hovers just above 0.043, with Bitcoin’s dominance in the market reaching over 57%, nearing new year-to-date highs. These trends underscore the growing dominance of Bitcoin in the current market environment.

The post Ethereum ETFs showed no activity on Friday, a first since US spot crypto ETFs launched appeared first on CryptoSlate.