The post Ethereum (ETH) Price Prediction For February 25 appeared first on Coinpedia Fintech News

After the $1.7 billion Ethereum (ETH) heist from the Bybit cryptocurrency exchange, the overall cryptocurrency market experienced a significant price drop. However, it now appears that Bybit is once again accumulating ETH to continue its operations.

Bybit Buy Back Ethereum Worth $87.50 Million

Today, February 25, 2025, the blockchain-based transaction tracker Eyeonchain posted on X (formerly Twitter) that Bybit purchased a significant 36,893 ETH worth $87.50 million through an over-the-counter (OTC) trade.

However, this isn’t the first time Bybit has bought ETH since the heist. Data reveals that over the past three days, the firm has purchased nearly 212,101 ETH worth $574 million through OTC trades.

Looking at these substantial purchases, industry giants may be drawn to buying ETH, potentially increasing buying pressure and driving further upside momentum.

Despite these substantial purchases, ETH’s price remains unaffected and has witnessed a notable 10% drop in the past 24 hours. Currently, ETH is trading near the $2,423 level and has experienced a 70% surge in trading volume during the same period compared to the previous day.

Ethereum (ETH) Price Action and Upcoming Level

With this price drop and market uncertainty, ETH has breached its prolonged consolidation zone and appears to be falling toward the next support level. Based on the current market sentiment and the recent breakdown of a crucial support level, there is a strong possibility that the asset could experience a further price drop of over 10%, reaching the $2,200 mark in the coming days.

As of now, the asset is trading below the 200-day Exponential Moving Average (EMA) on the daily timeframe, indicating that it is in a downtrend.

Traders Bearish Bet

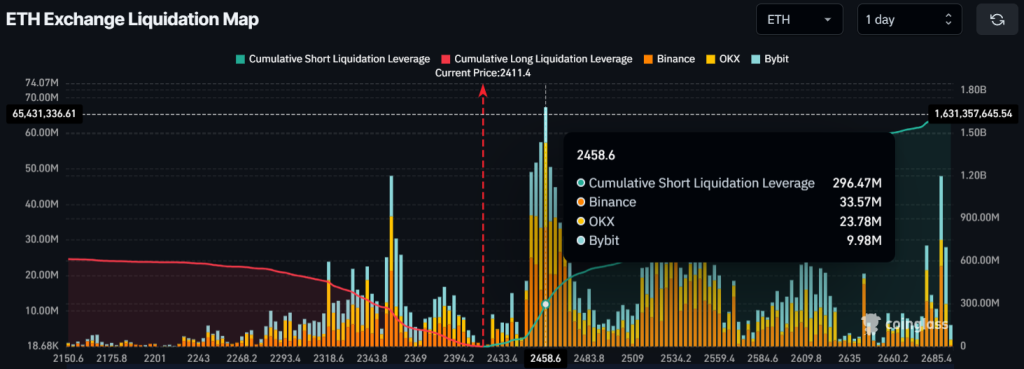

With the bearish price action, traders seem to be betting on the short side, believing that the price won’t rally soon, as reported by the on-chain analytics firm Coinglass.

Data from the ETH exchange liquidation map reveals that traders are over-leveraged at $2,355 on the lower side and $2,458 on the upper side. In the past 24 hours, they have built $247 million worth of long positions and $296 million worth of short positions at these over-leveraged levels.

These levels and positions hint at the current market sentiment, which appears to favor the short side in the short-term timeframe.