The post Ethereum Eyes $2000 Breakout Amid Surging On-Chain Metrics: Is a Bigger Rally Ahead? appeared first on Coinpedia Fintech News

Ethereum’s price has been going up due to the rising buying pressure following overall market recovery. The easing of tensions in the China-US trade war has also made investors feel more positive about Ethereum. Because of this, crucial on-chain numbers for Ethereum have jumped, and activity in DeFi has also increased. All of this makes it more likely that Ethereum’s price could rise toward $2,000.

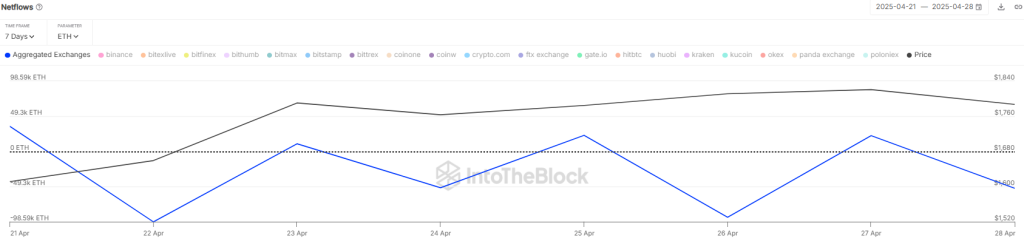

Ethereum’s Netflow Turns Negative

Over the last 24 hours, the price of Ethereum has been facing rising volatility from both buyers and sellers. As a result, the liquidation volume has been rising amid a drop in open interest. Data from Coinglass shows that Ethereum witnessed a total liquidation of around $26.7 million in the last 24 hours. Of this, buyers liquidated $10.6 million and sellers closed $16.1 million worth of short positions.

Ethereum’s recent price rebound is being backed by strong on-chain data. According to IntoTheBlock, the netflow of ETH has turned negative, currently sitting at 51,590 ETH. This means that more Ethereum is leaving exchanges than entering them, as holders move their coins to cold wallets. When reserves on exchanges fall like this, it usually signals that investors want to hold their assets rather than sell, reducing selling pressure.

Also read: Ethereum Price Prediction 2025, 2026 – 2030: ETH Bull Run to Start in May?

In addition to that, Ethereum exchange-traded funds (ETFs) brought in $64 million in net inflows on April 28. This comes after a strong $151.7 million inflow during the week ending April 25, the highest weekly inflow since February 2025.

Meanwhile, in the DeFi space, Ethereum continues to dominate. Data from DefiLlama shows that the network’s total value locked (TVL) has climbed to over $51.7 billion, up about 15.5% in the past week.

Ethereum’s activity on decentralized exchanges has also surged, with daily trading volumes rising more than 30% over the last week, reaching $1.65 billion. This sharp increase in DEX and on-chain activity points to strong momentum, raising the chances that Ethereum could soon break above the $2,000 mark.

What’s Next for ETH Price?

Ether closed above its 50-day moving average as buying demand surged. However, buyers are struggling to surge above $1,900 as selling pressure intensifies. As of writing, ETH price trades at $1,826, surging over 1.4% in the last 24 hours.

The key level to watch on the downside is the 20-day moving average ($1,802). If the price bounces strongly from there, buyers will likely try to push ETH/USDT back up toward $1,950— the zone where the earlier drop started. However, sellers will probably put up a tough fight here because if the price breaks above that level, it could quickly rally up to $2,100. A strong buying demand might even send the price above $2.5K.

On the flip side, if Ether falls below the 20-day moving average and closes there, it would show that sellers are still in control. In that case, the ETH/USDT pair could drop further, all the way down to $1,560.