Ethereum (ETH), the world’s second-largest cryptocurrency, has been on a tear lately. After months of hovering, the coin has seen a surge in price, and analysts are now pointing to signs within the derivatives market suggesting this rally might have legs.

Taker Buy Sell Ratio Nears Equilibrium

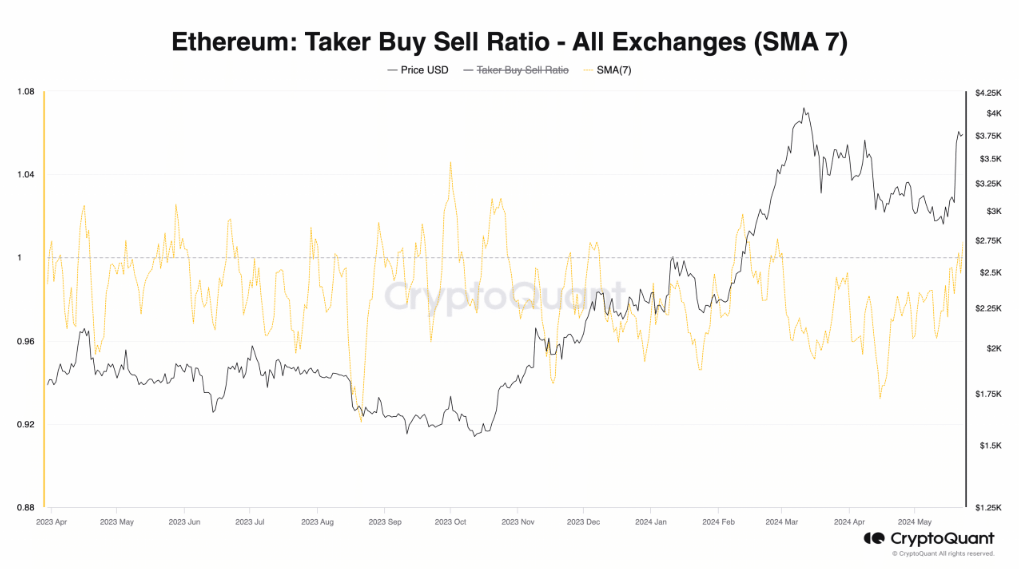

One key indicator is the Taker Buy Sell Ratio, a metric that tracks the volume of buy orders compared to sell orders in ETH’s perpetual futures market. Traditionally, a ratio below 1 suggests more sell orders are flooding the market, potentially driving the price down. Conversely, a ratio above 1 indicates a dominance of buy orders, often a bullish signal.

SEC Okays Spot Ethereum ETFs, Market Expectations Reversed

The news that the US SEC has approved spot Ethereum ETFs has caused a sharp reversal in the market’s expectations for Ethereum ETF rejection this week, and as a result, the price of Ethereum (ETH) is moving erratically in late Thursday activity.

As of right now, Ethereum was trading for about $3,770. That is both considerably higher than the previous session low of $3,500 and sharply lower than the previous session highs of over $4,000.

BOOM!! APPROVED! There it is. The SEC just approved spot #Ethereum ETFs. What a turn of events. It’s really happening.

h/t @PhoenixTrades_ pic.twitter.com/KQ39mDyCbT

— James Seyffart (@JSeyff) May 23, 2024

CryptoQuant, a leading crypto analytics platform, recently reported that ETH’s Taker Buy Sell Ratio, observed using a 7-day simple moving average, is poised to cross above its 1-center line. This signifies a decline in sell orders and a potential rise in buying pressure. This suggests that the coin may soon retake the $4,000 price level.

This upward trend in the Taker Buy Sell Ratio indicates a potential shift in market dynamics, noted ShayanBTC, a pseudonymous analyst at CryptoQuant. If the ratio continues to rise, it may signal a reduction in aggressive selling pressure, which could be a positive development for ETH’s price, ShayanBTC added.

Futures Open Interest Reaches New Highs

Another data point bolstering the bullish case comes from the Futures Open Interest metric. This metric tracks the total amount of outstanding futures contracts that haven’t been closed or settled. A rising Open Interest suggests more traders are entering new positions, potentially anticipating a price increase.

According to Coinglass, another crypto analytics platform, ETH’s Futures Open Interest has skyrocketed to a new all-time high of $16 billion. This signifies a surge in market participation, with more traders betting on ETH’s future.

The all-time high OI suggests a significant increase in investor confidence. This could be due to several factors, including growing institutional adoption of ETH and the upcoming Ethereum 2.0 upgrade.

Featured image from Explorersweb, chart from TradingView