The post Ethereum Eyes Another Correction as Selloff Risks Grow: What’s Next for ETH Price? appeared first on Coinpedia Fintech News

Following comments by Federal Reserve Chair Jerome Powell, Ethereum’s price is struggling as it fails to validate a clear upward trend. On April 16, during a speech in Chicago, Powell stated that the Federal Reserve is not in a hurry to lower interest rates, highlighting a cautious “wait-and-see” approach that depends on further economic data. This announcement led to an increase in Ethereum’s exchange inflows, signaling increased chances of a potential bearish correction.

Ethereum Faces Rising Bearish Threats

Ethereum’s price has been trending downward, impacted by the Federal Reserve’s cautious outlook on the economy, which has dampened investor sentiment. According to data from Coinglass, Ethereum saw approximately $40.6 million in liquidations over the past 24 hours. Of this, long positions accounted for about $26 million, while short positions made up roughly $14.6 million.

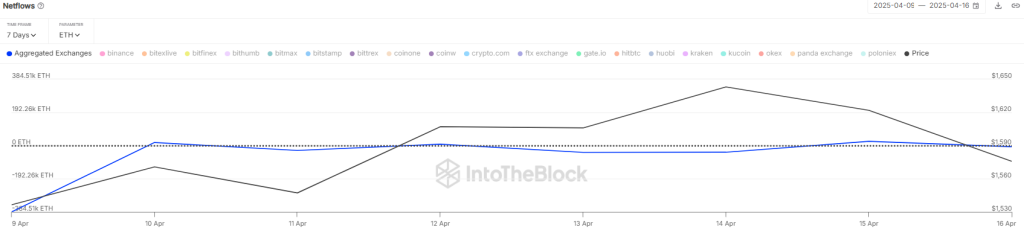

The recent price decline coincided with a sharp increase in exchange reserves. On the previous day alone, more than 77,000 ETH were transferred to derivative exchanges, marking the largest single-day net inflow in several months. This sudden rise in supply increases the potential for selling pressure.

Also read: Large Inflows Hit Ethereum: Will ETH Price Drop Again?

However, data from IntoTheBlock reveals that the Netflow metric remains negative, at approximately -6,800 ETH. This indicates that overall outflows have exceeded inflows, suggesting that many investors were accumulating Ethereum amid the price decline.

Coinglass further reveals that open interest for Ethereum has been rising despite the downward pressure. The OI metric surged by over 3.87%, touching over $18 billion. However, the funding rate has been trending around the negative region at 0.0015%. As a result, bears still have the control to consolidate ETH with immediate Fib support levels.

However, the current decline might turn out to be a strong rebound soon. According to a CryptoQuant analyst, Ethereum is trading close to its realized price, a level that has often signaled major rebounds in the past. The realized price, now around $1,585, is seen as a strong point for value buying.

What’s Next for ETH Price?

Ether’s attempt at a price recovery is losing momentum around EMA trend lines as bears strongly defend EMA20 level. As a result, the price is hovering around the descending resistance line. Currently, ETH price trades at $1,588, declining over 1.5% in the last 24 hours.

If sellers manage to drive the price below $1,400, it could trigger a deeper decline toward the end of the bearish channel at $1,130. This level is expected to attract buying interest, but if bearish momentum remains strong, a further drop toward $1K is possible.

On the upside, a decisive break and close above $1,700 would be the first indication that buyers are regaining control. Such a move could open the path for a rally toward $2K. Although the 50-day SMA might slow down the recovery, it is likely to be surpassed if bullish momentum builds. A strong push above $2K would suggest that the downtrend may be reversing.