Onchain Highlights

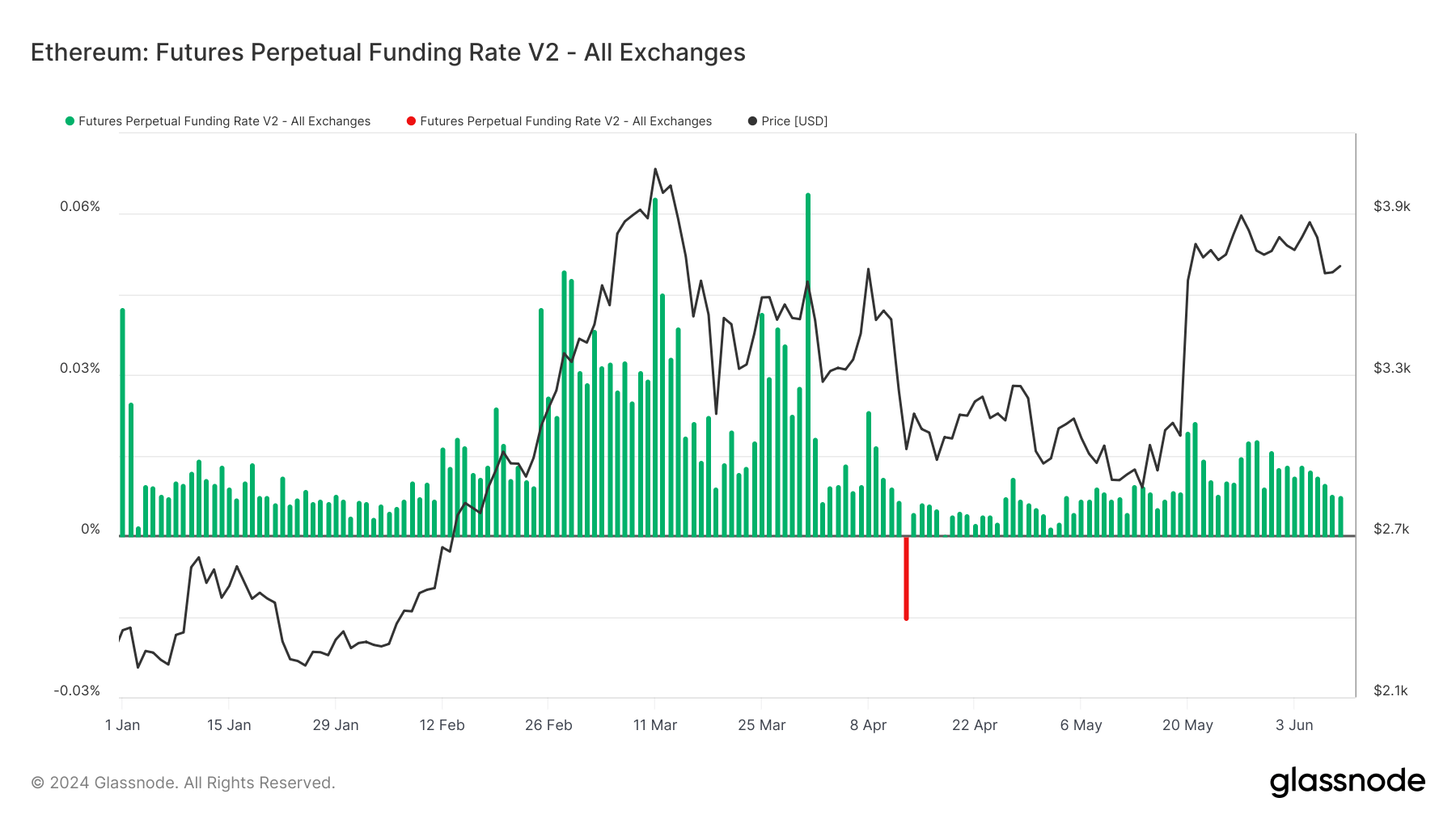

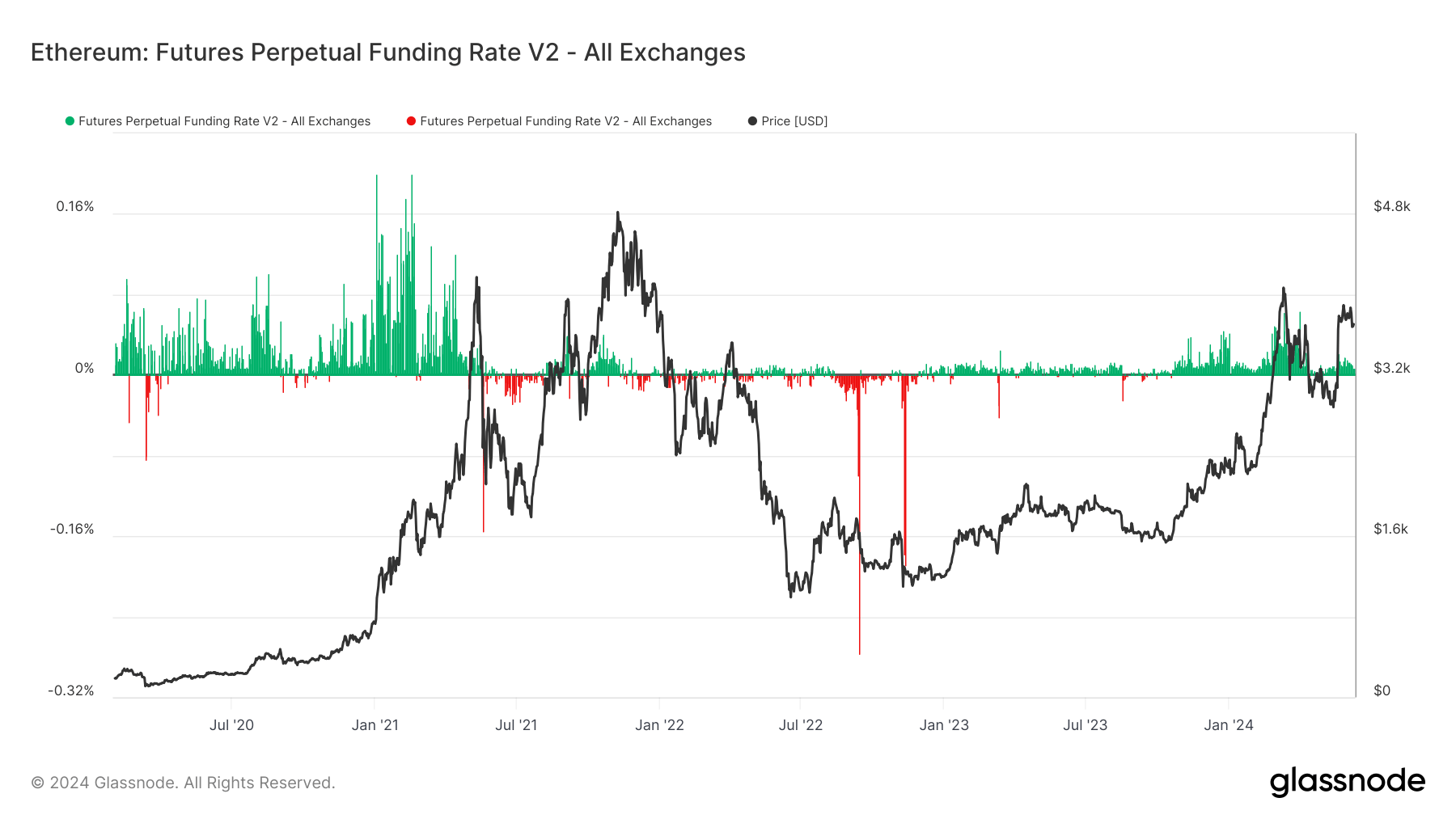

DEFINITION: Ethereum futures perpetual funding rate V2 – All Exchange is the average funding rate (in %) set by exchanges for perpetual futures contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions.

Ethereum’s futures perpetual funding rate across all exchanges has exhibited significant fluctuations, as observed in recent market trends. The perpetual funding rate, a key indicator for market sentiment and trader positioning, demonstrated volatility throughout the first half of 2024. Notably, spikes in the funding rate often coincide with notable price movements in Ethereum, suggesting shifts in market sentiment.

In May 2024, Ethereum saw a substantial price increase, rising nearly 30%, marking its best month since February. This surge was attributed to the approval of Ethereum ETFs, which boosted investor confidence after a significant dip in April.

Funding rate anomalies, as reported, often highlight localized trading imbalances, which can signal potential market shifts. The funding rate for Ethereum has been stable yet showed sporadic spikes, correlating with market activities and investor behavior. This dynamic illustrates the complex interplay between futures funding rates and underlying market trends. Levels are still well below the 2021 peak but elevated from the 2023 bear market, indicating potential movements in the market.

The post Ethereum futures funding rate volatility mirrors significant price movements appeared first on CryptoSlate.