Quick Take

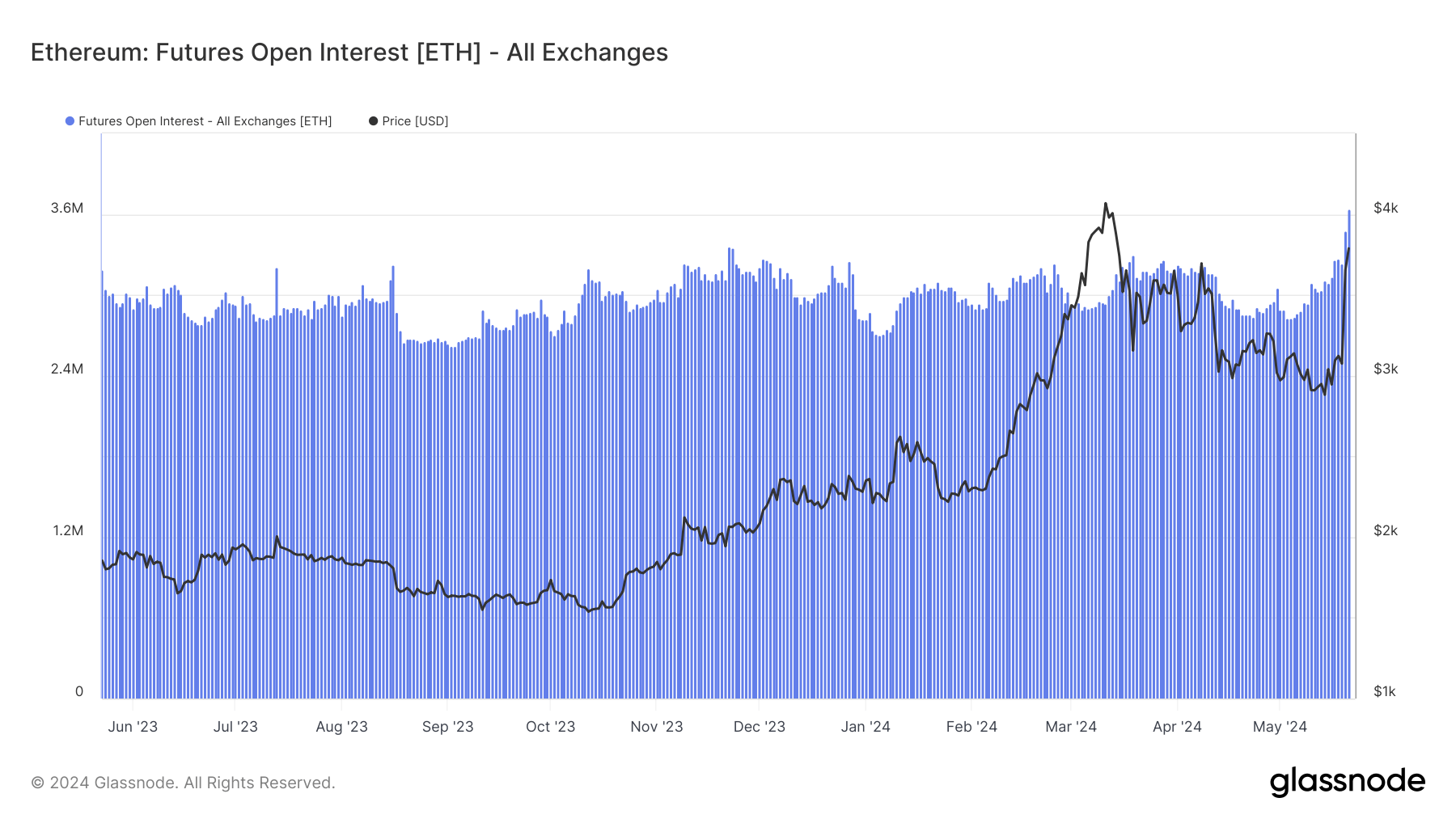

Ethereum has skyrocketed 20% over the past five days, fueled by speculation that a highly-anticipated Ethereum ETF has a 75% chance of approval. This has driven increased activity in Ethereum futures markets, with open interest (the total value of open futures contracts) hitting a one-year high of 3.6 million ETH, up 25% from May lows, according to Glassnode data.

However, some on-chain data points raise concerns about the sustainability of the rally. On March 11, when Ethereum was around $4,000, the open interest was only 2.9 million ETH. This suggests more speculative money has piled in, but the price is lower, raising the risk of a sharp liquidation event.

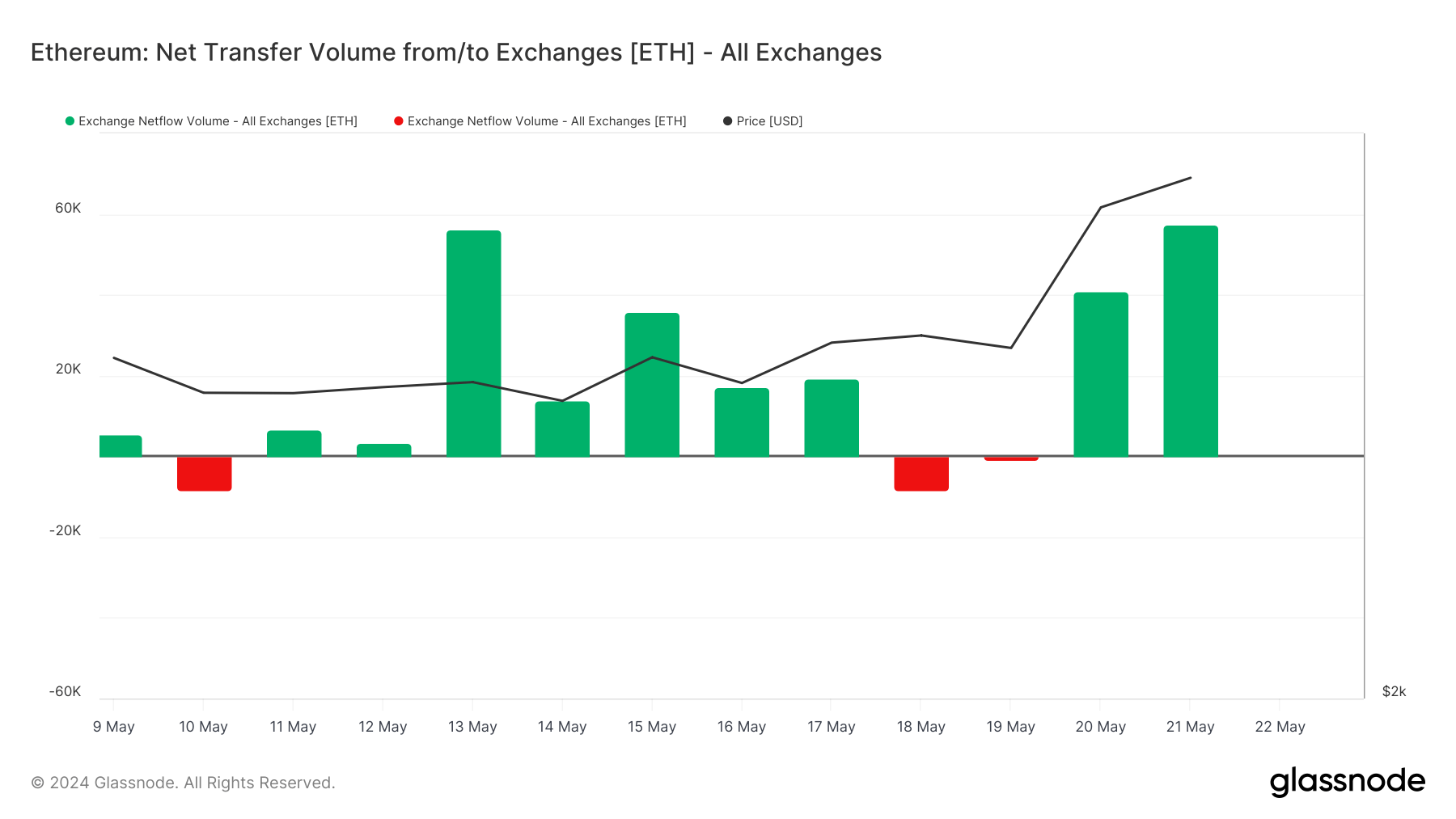

Additionally, there hasn’t been a meaningful amount of Ethereum being withdrawn from exchanges for storage in personal wallets. In the past two days, roughly 100k Ethereum has actually flowed onto exchanges recently, according to Glassnode data.

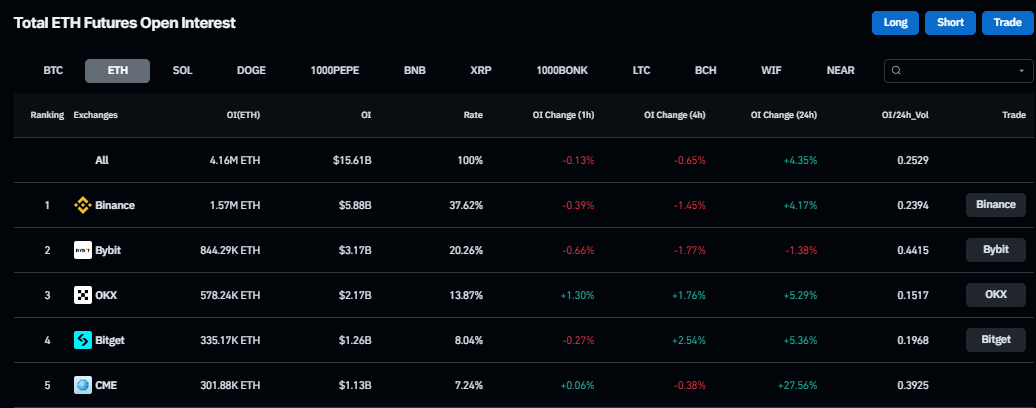

One positive indicator is the fast growth of CME’s Ethereum futures trading, up 28% in 24 hours, according to Coinglass data. If Ethereum follows Bitcoin’s path toward institutionalization through the ETFs, with CME becoming the dominant futures exchange, this could buoy prices further.

The post Ethereum futures hit one-year high, liquidation risks loom appeared first on CryptoSlate.