Quick Take

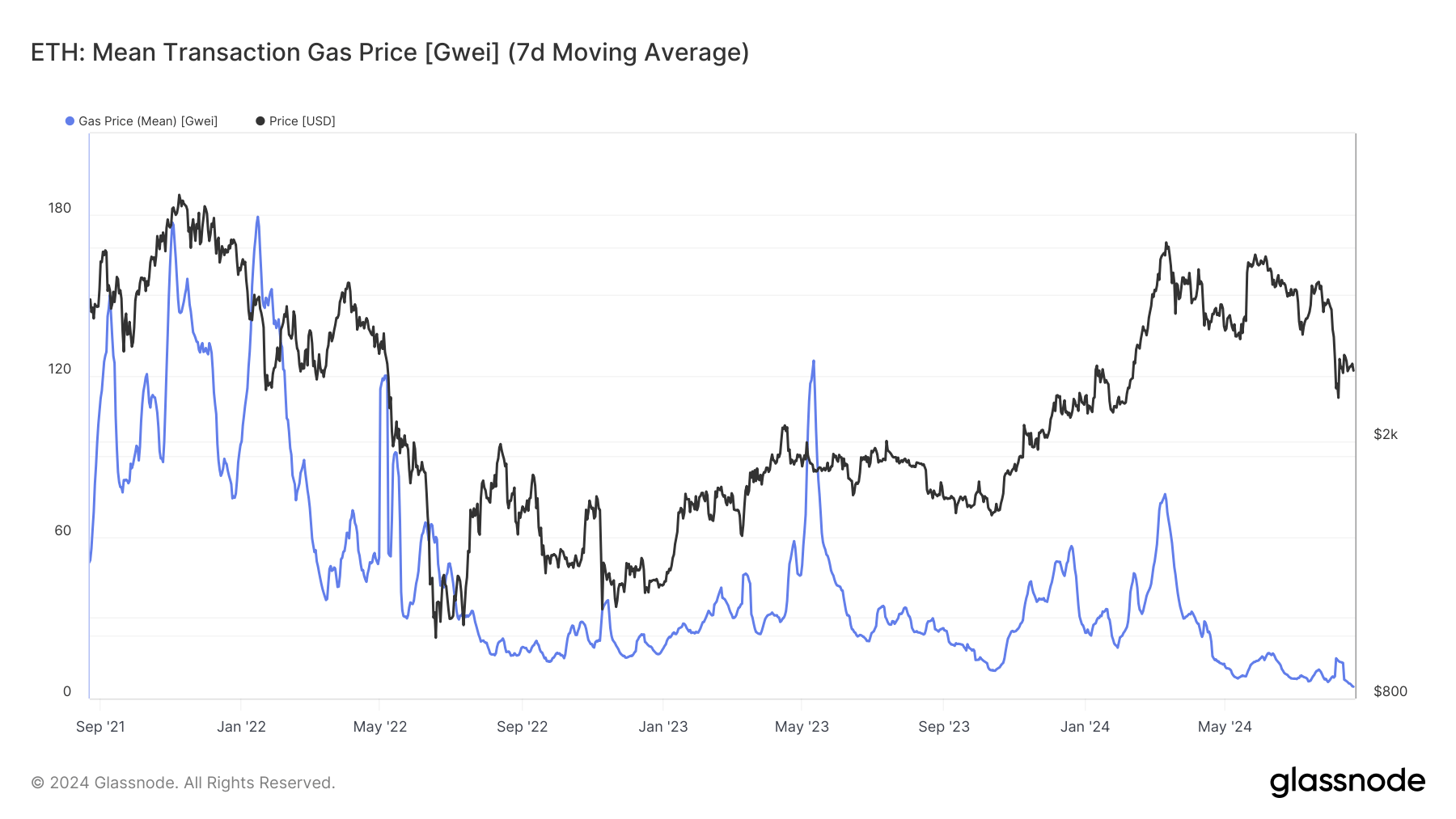

Ethereum’s network has recently seen significant transaction fees and burn rate reductions. The mean transaction gas price, calculated on a 7-day moving average, has plummeted to a four-year low of 4.4 Gwei.

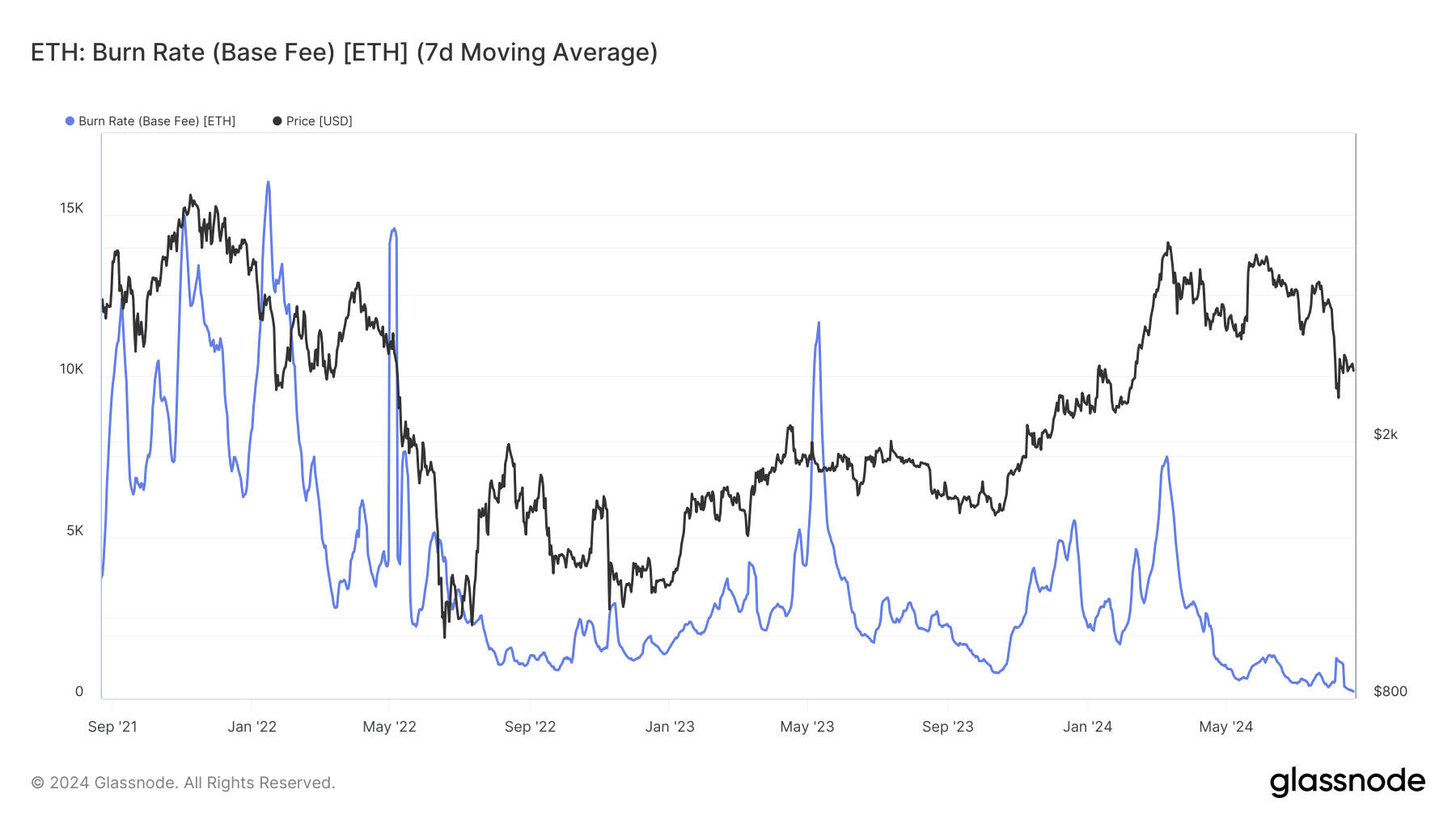

This drop is mirrored in the mean fee per transaction, which has hit a multi-year low of $1.21, a level not seen since 2020. As a result, the pace at which Ethereum (ETH) is burned has also reached a historic low, with only 218 ETH burned daily.

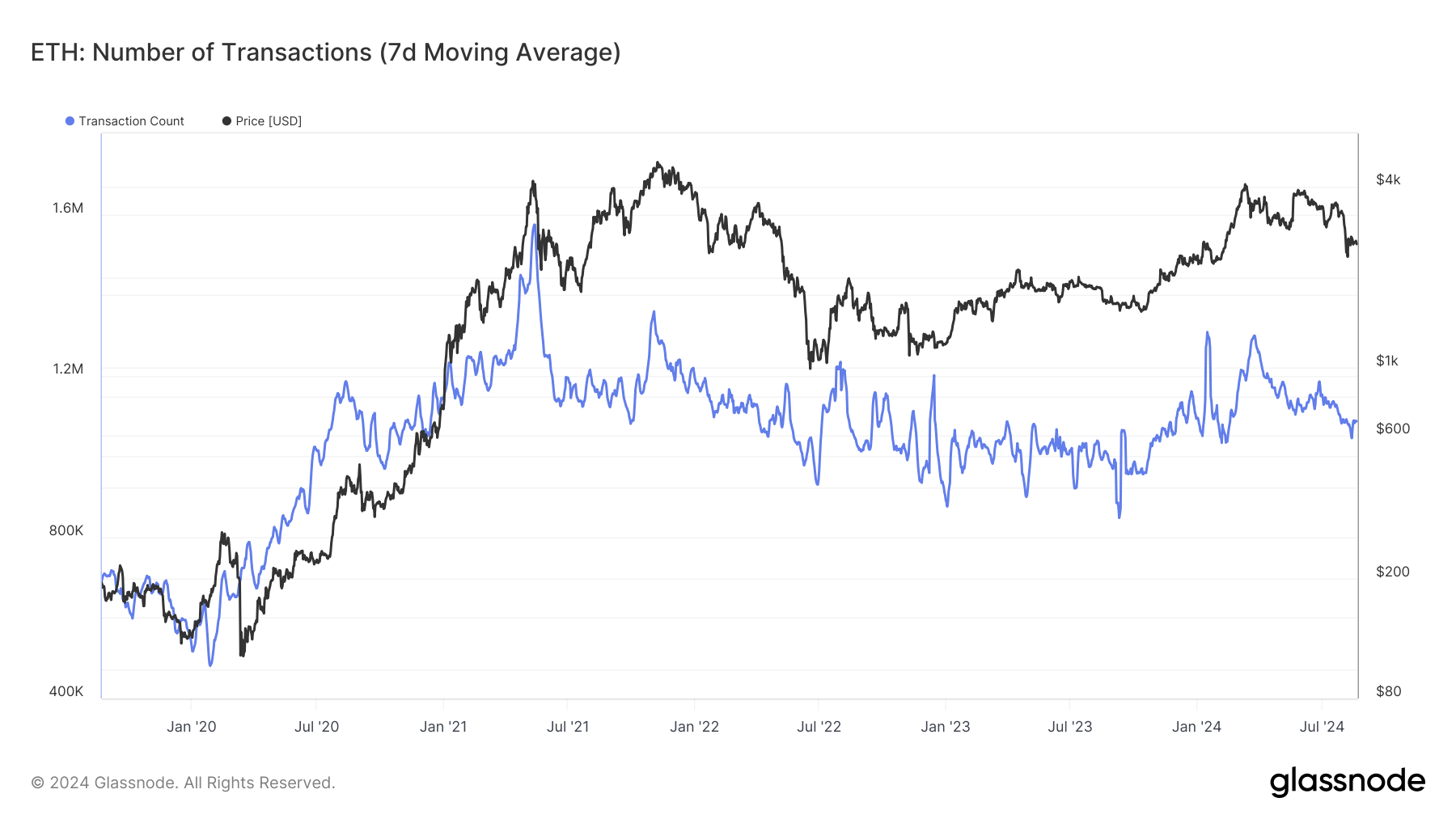

Despite these changes, the total number of transactions on the Ethereum network has not increased and has remained relatively stable, hovering around 1 million transactions per day, a level consistent for several years.

The decline in fees can be attributed to the Dencun upgrade, which went live in March 2024. This upgrade introduced Ethereum ‘blobs,’ temporary data storage mechanisms that have significantly reduced transaction fees and enhanced throughput for Layer 2 networks.

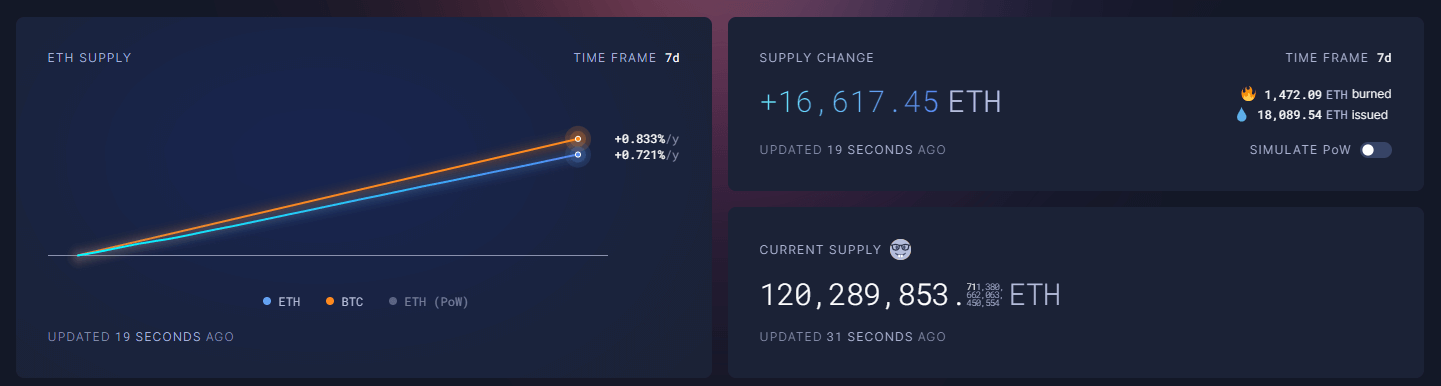

While low fees benefit users, they also lead to less ETH being burned, increasing the overall supply. Ethereum’s inflation rate has reached +0.7% over the past week, with a supply increase of nearly 17,000 ETH, according to Ultrasoundmoney.

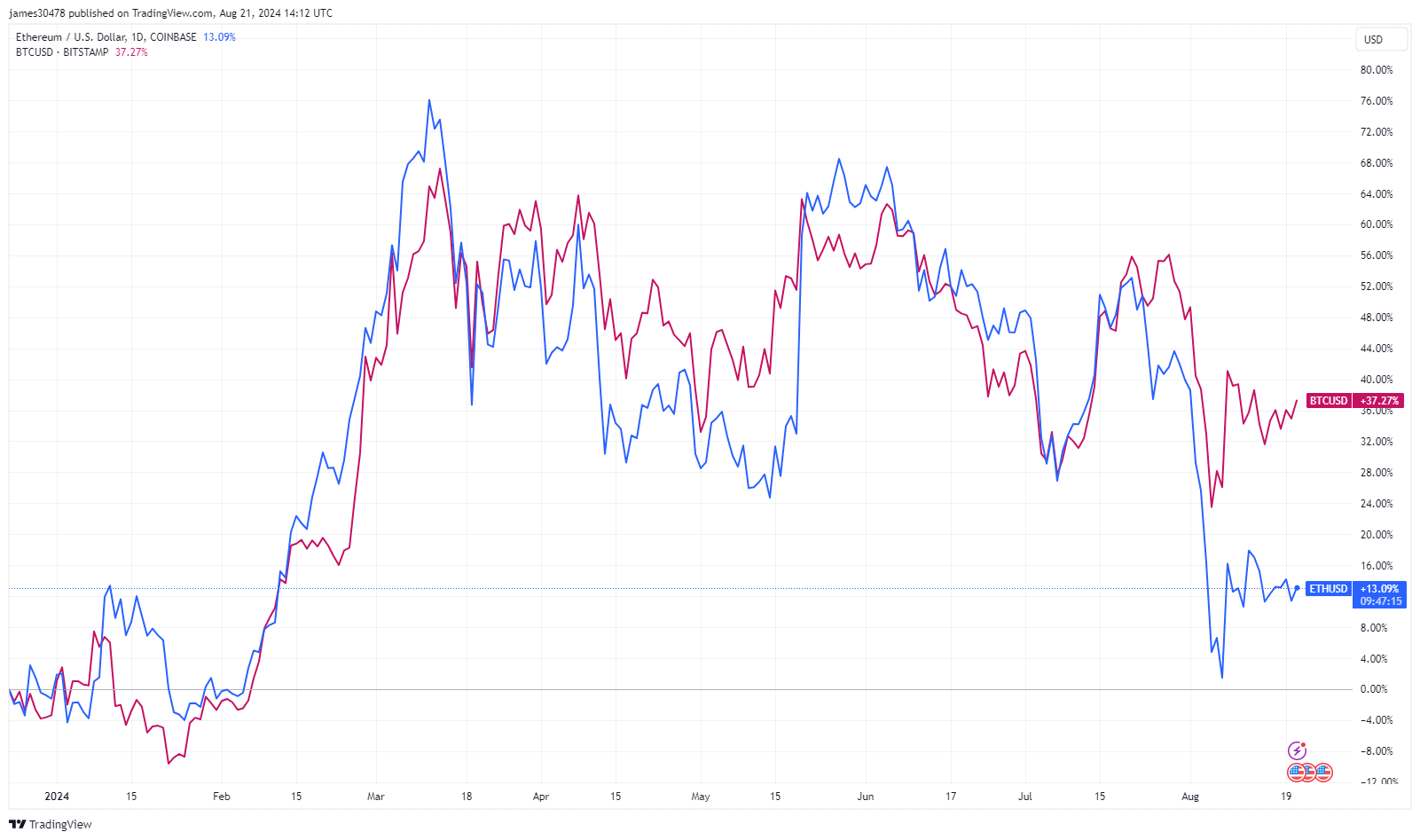

This inflationary trend has contributed to Ethereum’s relatively weak price performance. Up only 13% year-to-date compared to Bitcoin’s 37%, the ETH/BTC ratio hovers just above 0.043.

Additionally, since their launch on July 23, Ethereum ETFs have seen total outflows of $440.5 million. According to Farside data, BlackRock’s ETHA saw total inflows exceeding $1 billion, while Grayscale’s ETHE reported total outflows of $2.5 billion.

The post Ethereum gas and fee plummet drive inflation to +0.7% appeared first on CryptoSlate.