Ethereum, the world’s second-largest blockchain platform, has entered a new era marked by record-low transaction fees. This dramatic shift, the most significant since 2016, has sent ripples of excitement through the cryptocurrency community, raising hopes for increased adoption and a more accessible DeFi (Decentralized Finance) landscape.

From Pricey To Penny-Pinching

Previously, Ethereum’s notorious gas fees, the cost of processing transactions on the network, had become a major barrier to entry. During peak periods in 2021, fees skyrocketed to a staggering 100 gwei, effectively pricing out many users and hindering the network’s growth.

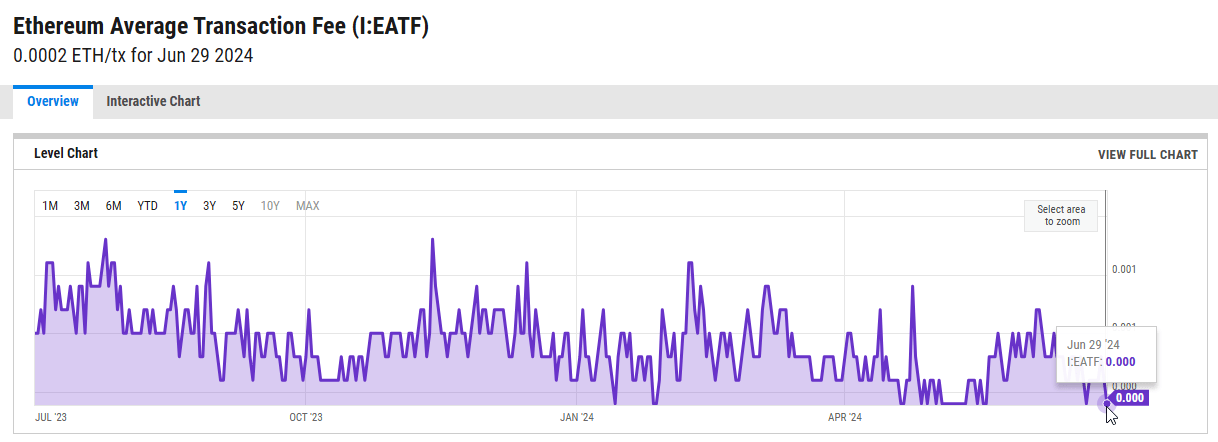

This recent fee freefall, however, paints a drastically different picture. With average fees hovering around 3 gwei (equivalent to a fraction of a US cent), interacting with the Ethereum network has become significantly more affordable.

News of the record-low gas fees first surfaced via Wu Blockchain, a respected online source for cryptocurrency news. The information was then corroborated by Coinbase Director Conor, lending further weight to the reports.

According to data shared by Coinbase Director Conor, Ethereum is experiencing the lowest average network fee since 2016. Among the 10 periods with the lowest average fee per hour on the Ethereum network, 9 were recorded this week, all below 3.3 gwei. At 4:00 UTC on June 30, the…

— Wu Blockchain (@WuBlockchain) June 30, 2024

Analysts attribute this dramatic decline to a confluence of factors. Recent network upgrades, specifically those focused on improving efficiency, have played a crucial role in streamlining transaction processing. Additionally, the overall decrease in network activity, potentially due to a broader crypto market slump, has also contributed to the lower fees.

A Boon For Builders And Blockchain Beginners?

The implications of these low fees are far-reaching. For developers, the Ethereum network has become a more attractive platform for deploying decentralized applications (dApps). Lower transaction costs make it easier to experiment and iterate on new projects, potentially leading to a surge in innovative dApp development.

YCharts offers a visualization tool for tracking the Ethereum Average Transaction Fee. This chart (above) allows users to monitor fee trends over time, providing valuable insights into network activity and user behavior.

For users, particularly those new to the crypto space, the reduced fees significantly lower the barrier to entry. This opens the door for a wider range of individuals to participate in DeFi activities, such as lending, borrowing, and trading digital assets. A more accessible Ethereum could lead to a broader user base and a more robust DeFi ecosystem.

However, some experts caution that the long-term implications of these low fees remain to be seen. The Ethereum network relies on transaction fees to incentivize miners who validate transactions and secure the network. A sustained period of extremely low fees could potentially impact network security, raising concerns about the long-term health of the ecosystem.

Featured image from Swyftx Learn, chart from TradingView