The post Ethereum Hits Key Resistance Line: Will Bulls Break Through or Face Rejection? appeared first on Coinpedia Fintech News

Ethereum has seen strong buying interest recently after breaking through some key resistance levels. Its market dominance is growing, especially now that Bitcoin has bounced back above $85,000. On top of that, several on-chain indicators are showing positive signs, suggesting growing bullish momentum as Ethereum moves near a descending resistance line. However, a drop in whale interest might change the forecast.

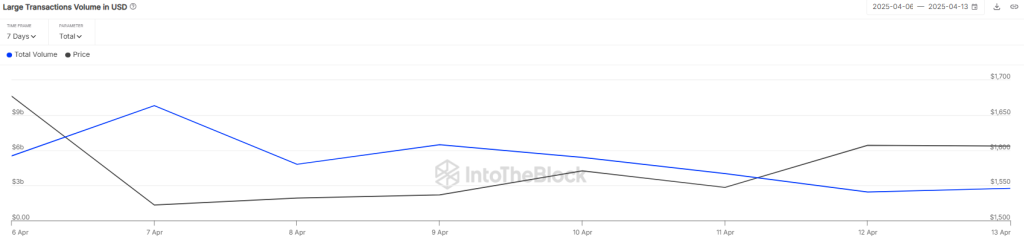

Ethereum’s Large Transaction Volume Declines

Ethereum has seen growing buying interest recently, with its price rising nearly 6% over the past week. According to data from Coinglass, about $82.8 million worth of trading positions in Ethereum were liquidated, with buyers losing around $43.5 million and sellers about $39.2 million.

Last week, ETH dropped to its lowest point since March 2023. However, a pause in tariffs helped the price recover slightly. Still, this recovery hasn’t been enough to boost investor confidence. Glassnode data shows that the number of wallets holding at least $1 million worth of ETH has dropped significantly this year, hitting the lowest level since January 2023. This points to a decline in interest from wealthier investors.

According to data from IntoTheBlock, the volume of large Ethereum transactions has dropped significantly. Whale activity has fallen from a peak of $9.81 billion to just $2.75 billion, showing a clear decline in interest from big investors. Recent activity supports this trend—on April 14, a whale moved 20,000 ETH (worth about $32.4 million) to the Kraken exchange, likely in preparation for selling.

Also read: Cardano Price Prediction 2025, 2026 – 2030: Will ADA Price Hit $2?

Adding to the pressure, an on-chain analyst reported that an early investor from Ethereum’s 2015 ICO has been consistently selling. On April 13, this whale sold 632 ETH, worth around $1 million.

Meanwhile, market sentiment remains mixed, and Ethereum’s open interest (the total value of outstanding derivatives contracts) has dropped by 1.16%, now sitting around $17.91 billion. This dip in open interest could slow down Ethereum’s recovery and increase the chances of a short-term pullback.

What’s Next for ETH Price?

Ether has bounced back from the key $1,500 level, as sellers are struggling to push the price any lower. Buyers are now focused on keeping the price above a descending resistance line to strengthen the current bullish momentum. At the moment, ETH is trading around $1,640, up more than 2% in the past 24 hours.

The moving averages are pointing upward, and the RSI is in positive territory—both signs that buyers currently have the advantage. If they can keep the price above the descending resistance line, ETH might make a strong move toward the important $2,000 level in the coming hours.

On the other hand, if sellers want to regain control, they’ll need to push the price below the EMA20 trend line. If that happens, Ether could drop toward $1,384—a key support level. A break below that could signal a short-term shift in momentum in favor of the bears.