Ethereum is under pressure at press time, tumbling roughly 15% from March 2024. As sellers press on, reversing all gains posted from May 20, on-chain data points to a bullish picture.

Ethereum HODLers Scoop 298,000 ETH In 24 Hours

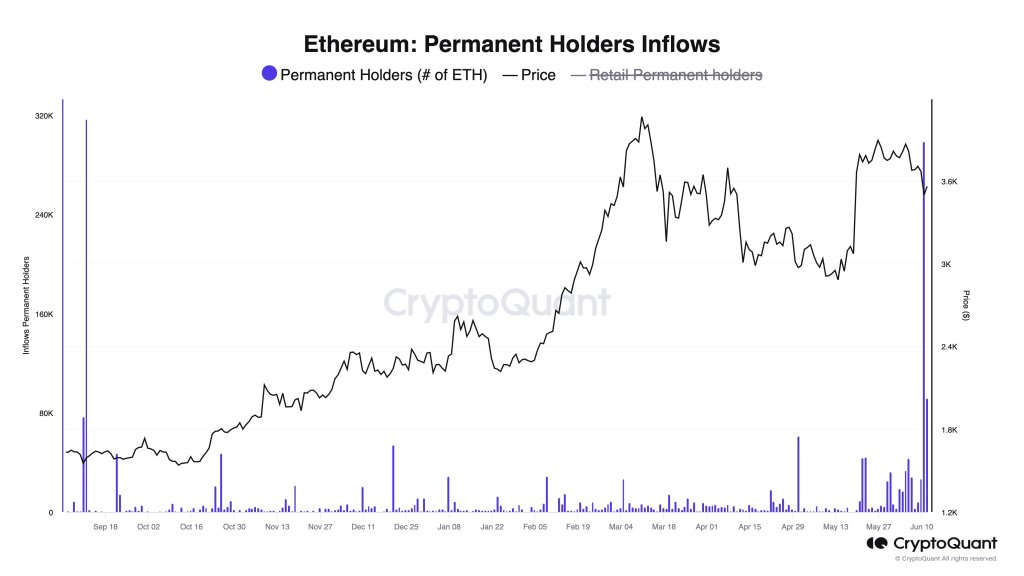

Taking to X, one analyst notes a spike in ETH demand, especially from permanent holders. Most likely, these permanent holders are institutions with deeper pockets and are willing to hang on. Unlike retailers, these entities can often choose to hold for longer and won’t be shaken out by market volatility.

Citing CryptoQuant data, the analyst said these permanent holders, according to records, are responsible for the second-highest daily purchase. On June 12, when prices briefly rose, they bought a staggering 298,000 ETH. Impressively, this figure just falls short of the all-time high of 317,000 ETH purchased on September 11, 2023.

In light of this, despite the wave of lower lows clear in the daily chart, the surge in demand points to strong bullish sentiment.

Also, considering the amount of ETH scooped from the markets, it could signal that institutions, possibly hedge funds or billionaires, are beginning to position themselves in the market.

They appear to be taking advantage of the lower prices.

At press time, there is weakness in Ethereum, evident in the daily chart. Even with the bounce on June 12, bulls didn’t completely reverse losses of June 11. The dip on June 13 means sellers are back in the equation, and prices could align toward the conspicuous June 11 bar.

From the candlestick arrangement in the daily chart, $3,700 is emerging as a resistance level. After the breakout on June 7, ETH has been free-falling to spot rates, actively filling the May 20 gap.

If the dump continues, it is likely that ETH, even with all the optimism across the crypto scene, will once more re-test $3,300.

Spot ETFs To Begin Trading This Summer: Gensler

Whether prices will recover from current levels or slip towards $3,300 remains to be seen. Overall, the market is upbeat, according to comments from Gary Gensler, the chair of the United States Securities and Exchange Commission (SEC).

Appearing in a senate hearing, Gensler said the spot Ethereum exchange-traded fund (ETF), whose 194-b forms were approved in May, may begin trading at a tentative time in summer. BlackRock has already resubmitted its S-1 filing and is waiting for approval.

If the product is approved in the next few weeks, it will be a major liquidity boost for ETH. Like spot Bitcoin ETFs, institutions will likely channel billions to ETH, allowing their clients to get exposure.