Quick Take

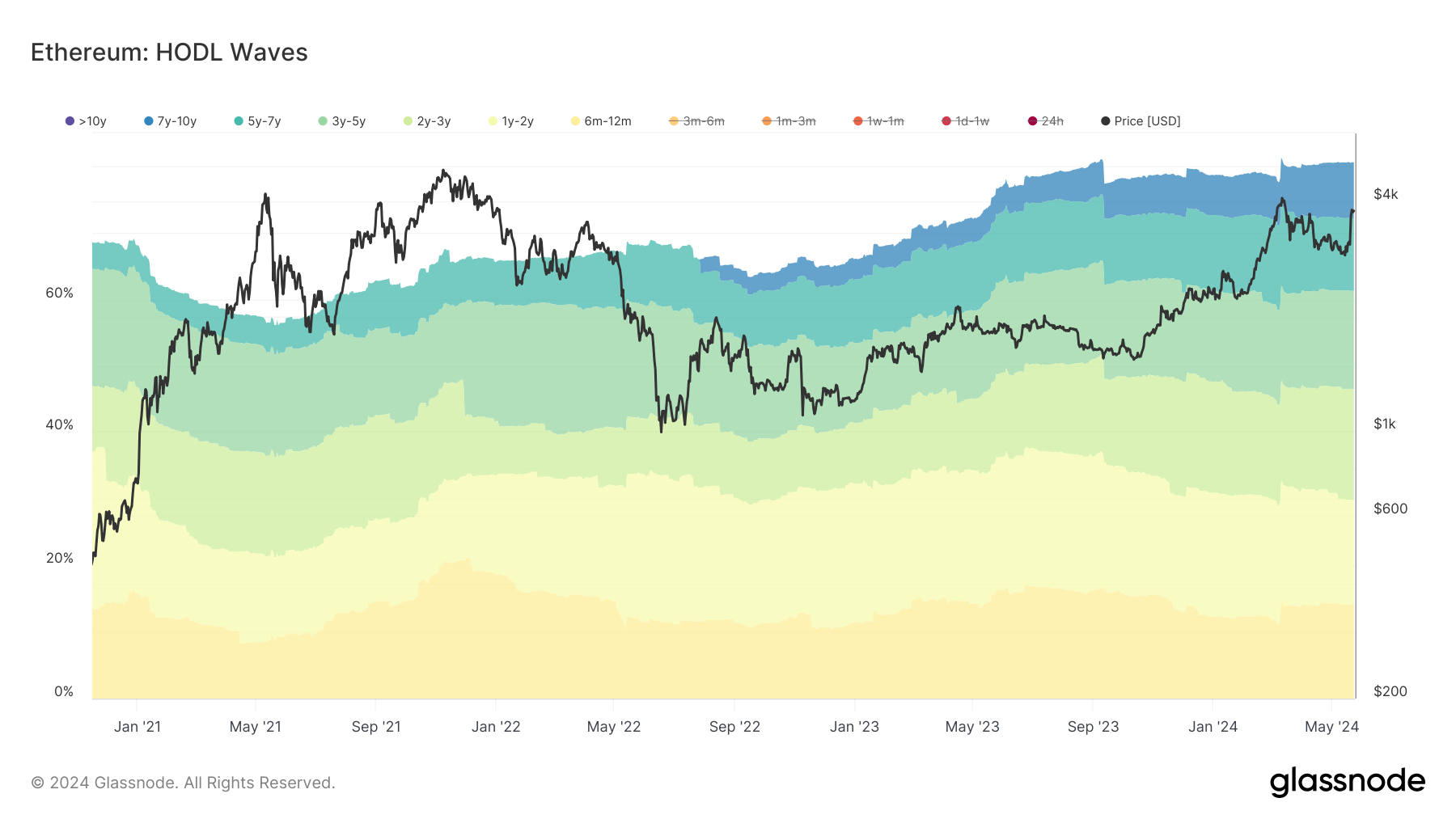

A recent analysis of Ethereum’s supply, visualized through the “HODL waves” chart created by Glassnode, reveals that a significant portion of Ethereum supply remains unmoved over various time frames, indicating a trend of long-term holding among investors. The chart illustrates that over 80% of the Ethereum circulating supply has not moved for six months or longer.

Breaking down these figures, 14% of Ethereum has been held for six to 12 months, 16% for one to two years, and 17% for two to three years. Additionally, 15% has been held for three to five years, 11% for five to seven years, and 8% for seven to ten years.

| Years | Percentage (%) |

|---|---|

| Six months to 12 months | 14% |

| One year to 2 years | 16% |

| 2 to 3 years | 17% |

| 3 to 5 years | 15% |

| 5 to 7 years | 11% |

| 7 to 10 years | 8% |

Source: Glassnode

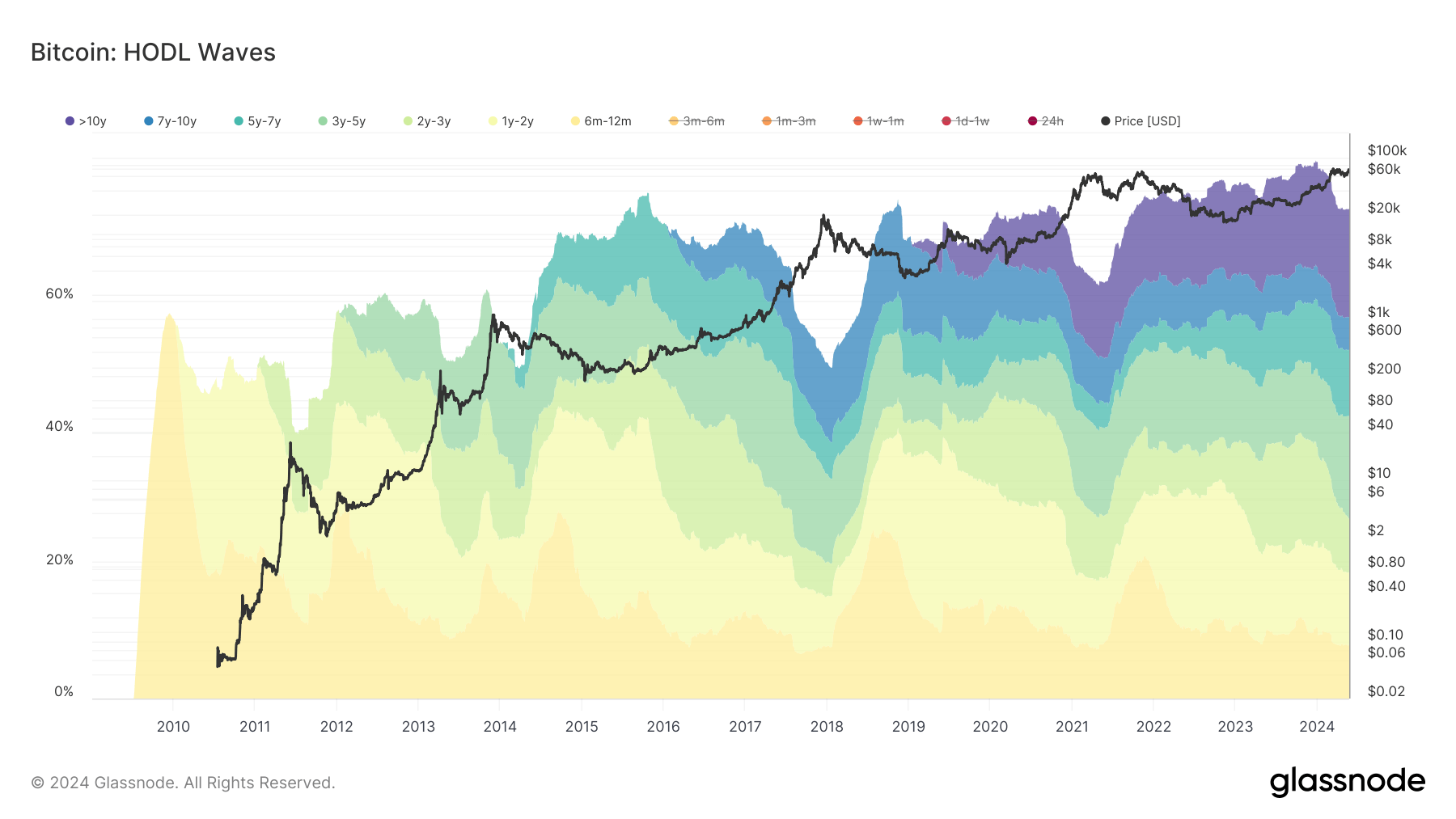

When compared to Bitcoin, 76% of Bitcoin’s supply hasn’t moved for at least six months, according to Glassnode. This comparative analysis suggests that investors increasingly view Ethereum as a speculative store of value, much like Bitcoin. The substantial portion of unmoved Ethereum highlights investor confidence in the long-term potential of the digital asset. CryptoSlate anticipates this trend will persist following the recent approval of spot Ethereum ETFs.

The post Ethereum HODLing milestone: over 80% unmoved for six months or more appeared first on CryptoSlate.