According to data from CoinMarketCap, the price of Ethereum slipped by 10.23% over the last seven days in line with the general market negative movement. This crypto market downturn has been attributed to multiple factors including heightened geopolitical tensions in the Middle East and rising liquidations of long positions.

While Ethereum has experienced some rebound in the last day gaining by 3.21%, investors remain uncertain of a full price recovery with bearish sentiments raving through the market. Notably, an Ethereum ICO participant has now sold off a substantial amount of ETH intensifying concerns of a prolonged downward trend.

Ethereum ICO Wallet Continues Selling Spree, Offloads 40,000 ETH In Two Weeks

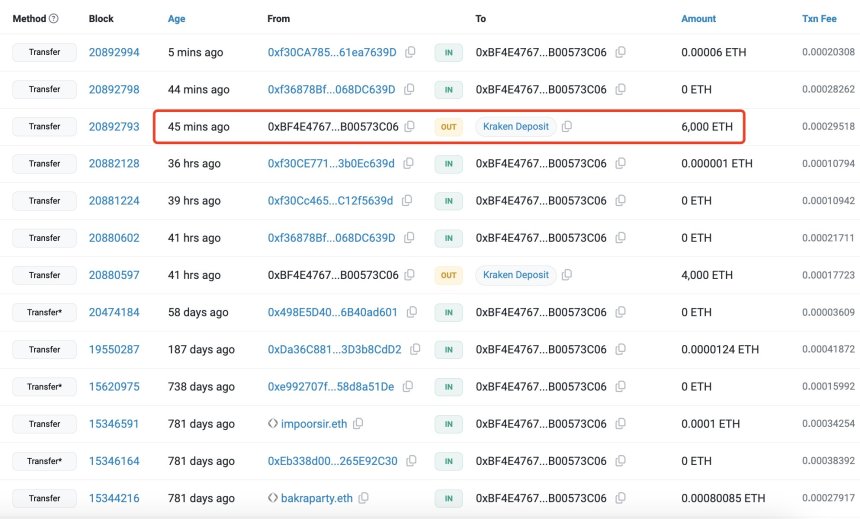

According to data from blockchain analytics firm, Lookonchain, an Ethereum wallet with the address “0xBF4” moved 6,000 ETH worth $14.11 million to the Kraken exchange on Friday. So far, the address has been identified as an early Ethereum investor who acquired 150,000 ETH valued at $368 million in the asset’s initial coin offering (ICO) in 2014.

Data from Lookonchain highlights this is the second ETH sale by “0xBF4” in the last week after the ICO participant initially sold 19,000 ETH, valued at $47.54 million over Wednesday and Thursday. Notably, this ETH whale has transferred out 40,000 ETH worth $101 million since September 22, holding a balance of 99,500 ETH valued at $238 million.

Generally, massive token offloads by large holders e.g. whales are interpreted as bearish signals as they indicate a lack of confidence in the asset’s long-term profitability. Sales such as those seen from “0xBF4” may trigger a panic selling from smaller investors inducing a stronger downward pressure on Ethereum’s price.

Related Reading: Crypto Capo Returns After 2 Months To Predict Ethereum Decline To $1,800, Is It Time To Go Long?

108,000 ETH Moved To Exchanges In 24 Hours

Aside from the wallet address “0xBF4”, other investors have recently sold off large amounts of ETH. According to analyst Ali Martinez, 108,000 ETH valued at $259.2 million have been transferred to exchanges in the last day. This massive sale activity indicates a heightened sentiment in the ETH market.

Currently, Ethereum trades at $2,399 following its recent price rally. However, its daily trading volume has declined by 17.48% and is valued at $14.61 billion. If bearish sentiments persist, ETH could retrace to around $2,200 at which lies its next significant price level. However, amidst massive selling pressure, the altcoin could trade as low as $1,600.

With a market cap of $291.40 billion, Ethereum continues to rank as the second largest cryptocurrency, with a market dominance of 13.47%.

Featured image from NullTX, chart from Tradingview