Crypto analyst Titan of Crypto has provided a bullish outlook for the Ethereum price, assuring that ETH is not dead. The analyst highlighted a bullish pattern, which indicates that the second largest crypto by market cap could soon enjoy another leg up to the upside.

Analyst Hints Another Leg Up For Ethereum Is On The Horizon

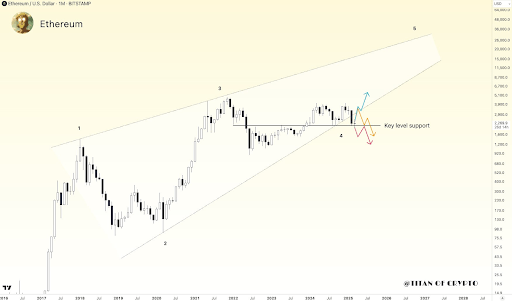

In an X post, Titan of Crypto stated that Ethereum is not dead and hinted that another leg up was on the horizon for ETH. He reaffirmed that ETH is far from being dead from a technical perspective. The analyst then noted that the Ethereum price is still progressing within a broadening wedge.

Titan of Crypto also revealed that the Ethereum price just revisited the reload zone, the prime area where professionals look to long or buy back ETH. He remarked that this is where smart money steps in, suggesting that Ethereum could rebound from that zone. The analyst’s accompanying chart showed that Ethereum could rally to between $6,129 and $6,589 as it rebounds from this reload zone.

Macro View Update On ETH

In an earlier analysis, Titan of Crypto also provided a macro view update on Ethereum. He noted that ETH had closed a monthly candle outside the 7-year rising wedge. The analyst added that a confirmed breakout requires the next monthly close to remain outside this wedge. In line with this, he outlined three possible scenarios for ETH.

For the first scenario, the analyst predicts a reintegration in which key support levels hold, leading to a bounce that pushes ETH back inside the wedge and invalidates the breakout. In the second scenario, Titan of Crypto states that there could be a triple top formation in which support holds, but ETH only retests the wedge before rolling over into a longer-term top.

Meanwhile, he remarked that for the third scenario, ETH confirms a deeper correction if support fails. However, at this stage, Titan of Crypto believes that the first or second scenario is the most likely.

The Biggest Hurdle For Ethereum

Crypto analyst Ali Martinez stated in an X post that the biggest hurdle for Ethereum is at $2,460, where 10.95 million investors acquired 64.52 million ETH. The analyst asserted that breaking through this level will reignite ETH’s bullish momentum.

Smart money already looks to be stepping in to help Ethereum break past this critical resistance level. Martinez revealed in another X post that crypto whales have bought 1.10 million ETH in the last 48 hours. These whales are known to actively accumulate before a price surge, indicating that one may be on the horizon for ETH.

At the time of writing, the Ethereum price is trading at around $2,200, down over 4% in the last 24 hours, according to data from CoinMarketCap.