Ethereum (ETH) has plunged 30% over the past two weeks, reflecting broader weakness across the crypto market as the global economy reels from escalating tariff wars. Crypto analyst Ali Martinez warns that ETH could fall even further in the near term, potentially testing the $1,200 level.

More Pain For Ethereum, But A Recovery Is Possible

Ethereum continues to struggle amid global economic pressures. The world’s second-largest cryptocurrency by market cap has dropped another 8.3% in the past 24 hours and is currently trading in the mid-$1,000 range.

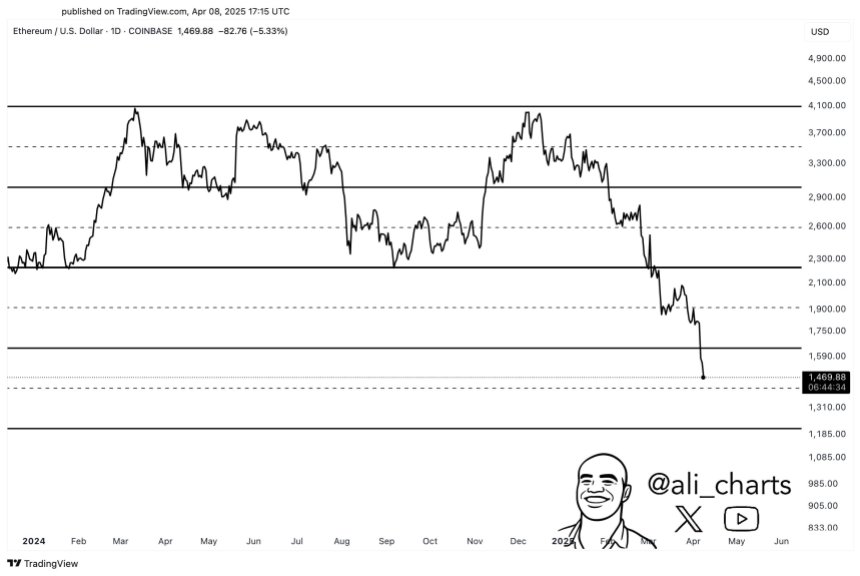

Commenting on the recent price action, seasoned analyst Martinez highlighted that ETH could find key support at the $1,200 mark. He shared the following daily chart of ETH, showing how the digital asset has broken through multiple support levels since December 2024, when it was trading near $4,000.

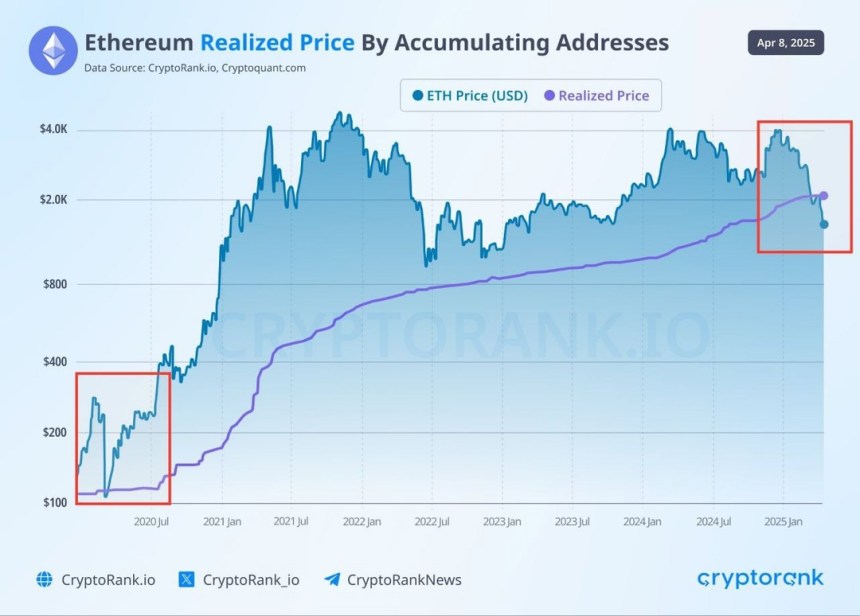

Meanwhile, renowned analyst Carl Moon noted that ETH is currently trading below its realized price of $2,000. He pointed out that the last time this occurred – back in March 2020 at the height of the COVID-19 pandemic – ETH had dropped from $289 to $109.

On a more optimistic note, Moon added that ETH recovered swiftly after that steep decline. Based on historical trends, the current price level could present a potential buying opportunity for long-term investors.

For those unfamiliar, the realized price for accumulation addresses – as shown in the above CryptoRank chart – represents the average price at which long-term holders acquired ETH. This metric has historically acted as a strong support zone.

Is ETH About To Surprise The Market?

With market sentiment approaching historical lows, confidence in ETH appears to be dwindling. The Ethereum Fear & Greed Index currently sits at 20, indicating “extreme fear” among investors.

Despite the bearish mood, some on-chain metrics and historical patterns suggest ETH could be on the verge of a strong bullish reversal – potentially catching investors off guard.

For example, crypto analyst Mister Crypto recently drew a comparison between ETH’s current price action and that from 2020, suggesting that Ethereum could embark on a price rally by Q2 2025.

Similarly, Ethereum’s Market Value to Realized Value (MVRV) Z-score hints that ETH may be undervalued at current price. The last time it was this undervalued – in October 2023 – it witnessed a sharp rally of 160%.

That said, not all indicators are bullish. Rising ETH exchange reserves continue to raise concerns about potential sell pressure from holders. At press time, ETH is trading at $1,457, down 8.3% over the past 24 hours.