On-chain data shows the Ethereum Market Value to Realized Value (MVRV) Ratio has just seen a signal that could prove to be bearish for ETH’s price.

Ethereum MVRV Momentum Has Witnessed A Bearish Crossover

As pointed out by analyst Ali Martinez in a new post on X, the Ethereum MVRV Ratio has declined under its 160-day moving average (MA) recently. The “MVRV Ratio” refers to an on-chain indicator that keeps track of the ratio between the Ethereum market cap and the realized cap.

The realized cap here is a capitalization model that calculates ETH’s total valuation by assuming that the ‘real’ value of each token in circulation is equal to the spot price at which it was last transferred on the blockchain.

Since the last transaction of any coin is likely to correspond to the last point at which it changed hands, the Realized Cap essentially measures the sum of the cost basis of the circulating supply. This model could also be looked at as a representation of the amount of capital the investors as whole have put into Ethereum. In contrast, the market cap is the value that the holders are carrying right now.

When the value of the MVRV Ratio is greater than 1, it means the market cap is greater than the realized cap. Such a trend implies the investors as a whole are sitting on unrealized gains. On the other hand, the metric being under the mark suggests the holders are carrying a lower value than they initially put in, so the average investor could be considered underwater.

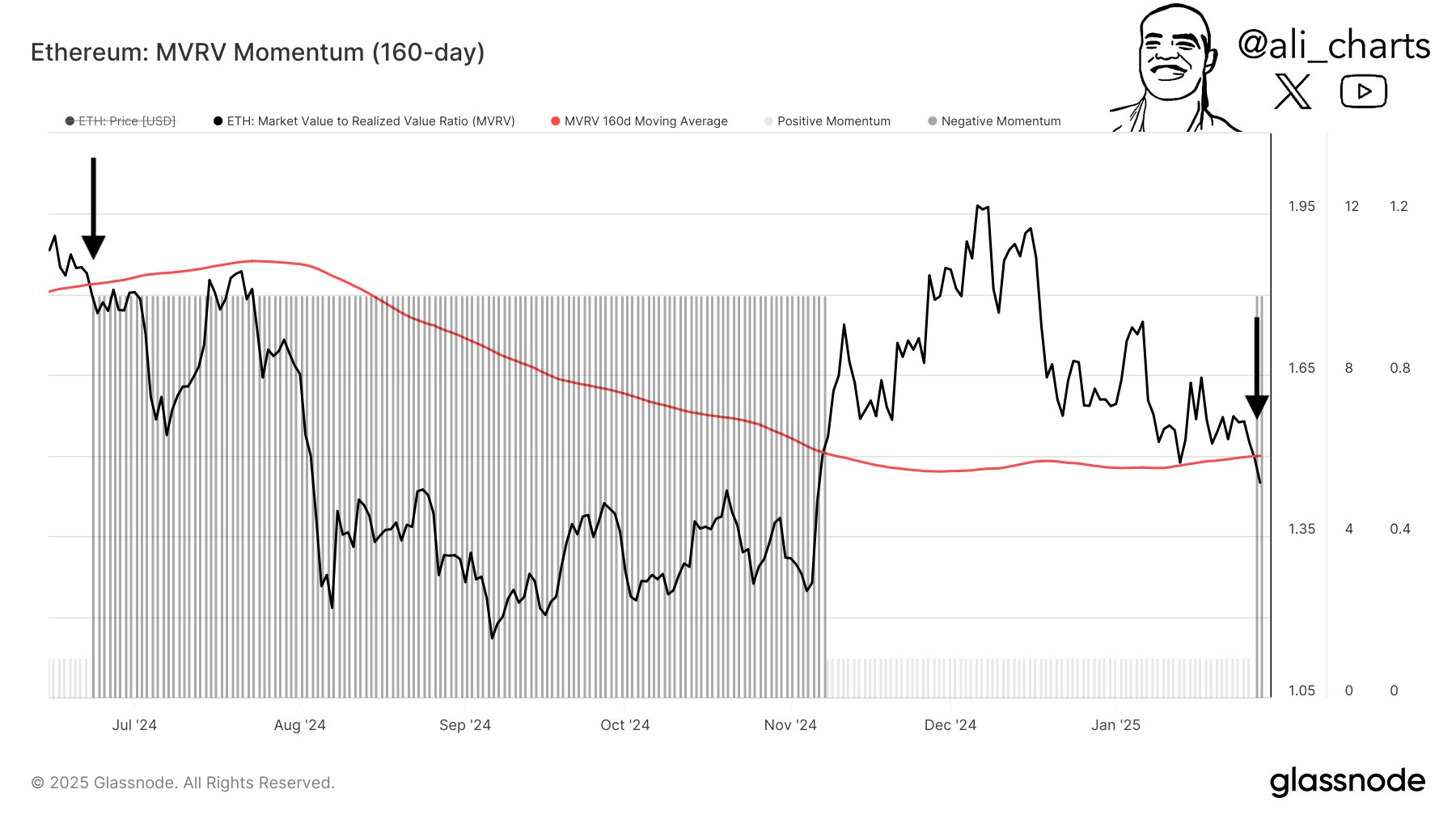

Now, here is the chart shared by the analyst that shows the trend in the Ethereum MVRV Ratio, as well as its 160-day MA, over the past year:

As is visible in the above graph, the Ethereum MVRV Ratio has registered a decline recently as ETH’s price has followed a bearish trajectory. The indicator is still above the 1 mark after this drawdown, suggesting the overall market remains in the green.

The metric’s fall, however, has meant that it has slipped under its 160-day MA. The combination of the indicator’s daily value and its 160-day is known as the MVRV Momentum. In the chart, Martinez has highlighted what happened the last time the MVRV Momentum showed a similar pattern as recently.

It would appear that the MVRV Ratio crossing under its 160-day MA led to a 40% price correction for Ethereum last year. It now remains to be seen whether the negative momentum in the indicator would also prove to be bearish for the cryptocurrency this time as well or not.

ETH Price

At the time of writing, Ethereum is floating around $3,200, up more than 2% over the last seven days.