Ethereum (ETH) stands as a bellwether for the industry’s ebbs and flows. As of press time, Ethereum was trading at $3,174, its price trying to reach the crucial $3,000 mark. However, beneath the surface of these seemingly stable waters lies a complex interplay of market forces and investor sentiment.

Ether’s Challenging Trajectory

Since last week, the lower timeframes have seen repeated breaches of the $3,000 psychological threshold, and the enthusiasm surrounding the altcoin king has significantly waned.

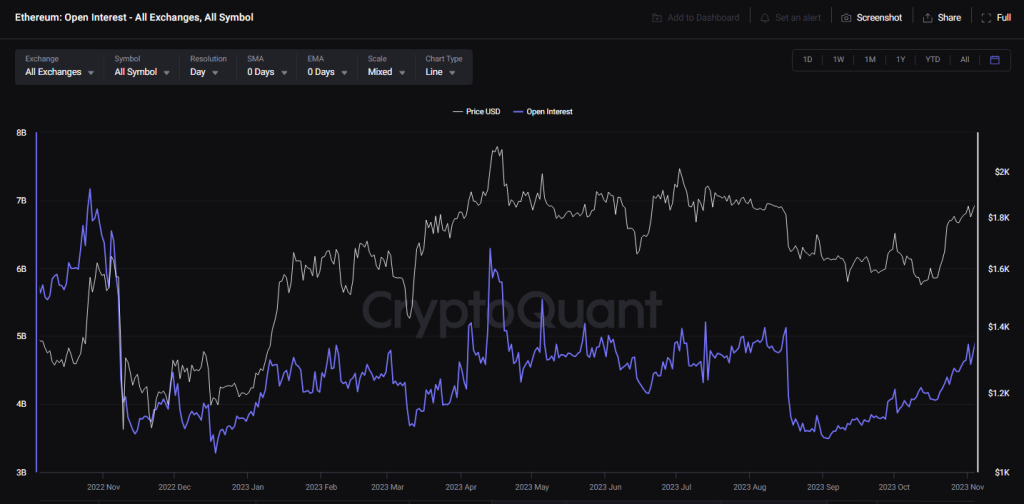

This downward pressure is further underscored by the notable drop in Open Interest (OI) behind ETH futures contracts, which plummeted from $10 billion to $7 billion in April alone.

Such a decline suggests a recalibration in the futures market, potentially signaling a cooling-off period for speculative trading activity.

Navigating Choppy Waters

However, amidst the uncertainty, there exists a glimmer of hope for ETH bulls. Historical precedents, such as the mid-February 2021 correction, offer insight into the resilience of Ethereum’s price.

Following a similar dip from an all-time high of $1,900 to $1,400, Ethereum experienced a V-shaped reversal, demonstrating the market’s propensity for swift recoveries. This historical context serves as a guiding light for investors navigating the choppy waters of cryptocurrency volatility.

On the social sentiment front, Ethereum’s trajectory has been a tale of two halves. While sentiment was strongly positive in February and briefly in mid-March, a negative sentiment has dominated as prices entered a correction phase. Factors such as high gas fees on the Ethereum network have likely contributed to this shift, highlighting the impact of practical considerations on market sentiment.

Ethereum: Fundamental Metrics

Examining Ethereum’s fundamental metrics provides further insights into its current state. Network growth has slowed in recent months, signaling a potential decline in demand. However, a closer look reveals a silver lining: the 90-day mean coin age has trended steadily higher since late March, indicating a network-wide accumulation of ETH.

As Ethereum continues to navigate these turbulent waters, all eyes are on key resistance levels. Breaking above the $3,300 barrier could instill confidence among traders and investors, potentially heralding a new wave of bullish momentum. However, uncertainties loom large, particularly in light of the broader market dynamics and the selling pressure on Bitcoin, Ethereum’s perennial counterpart.

While challenges abound and uncertainties persist, Ethereum’s historical performance and fundamental strengths offer hope for a brighter future. As investors brace for potential headwinds and opportunities alike, Ethereum stands poised to weather the storm and emerge stronger on the other side.

Featured image from Pexels, chart from TradingView