The post Ethereum Price Climbs, but Analysts Warn of Risks Following Large Inflows appeared first on Coinpedia Fintech News

Ethereum has posted a strong recovery over the past week. On April 9 alone, the ETH market saw a growth of 8.24%. In the last 24 hours, the market has surged by over 1.5%. However, fresh on-chain data shows a disturbing trend – an unusually large influx of ETH to derivatives exchanges. Is another price drop coming?

Ethereum Regains Bullish Momentum – But Can It Hold?

At the start of this month, the Ethereum price was $1,821.51. Although at one point on the second day of the month, the price touched a peak of $1,957.94, it plummeted to $1,794.51 by the time of closing.

Between April 5 and 8, the ETH market slipped by over 18.86%. Since April 9, the market has surged by 7.82%.

Compared to the first week, the market appeared more stable in the second week. Between April 7 and 13, the market climbed slightly by 2.83%.

In the last seven days, the market has witnessed a rise of 0.1%.

77,000 ETH Inflow to Derivatives Sparks Fresh Bearish Concerns

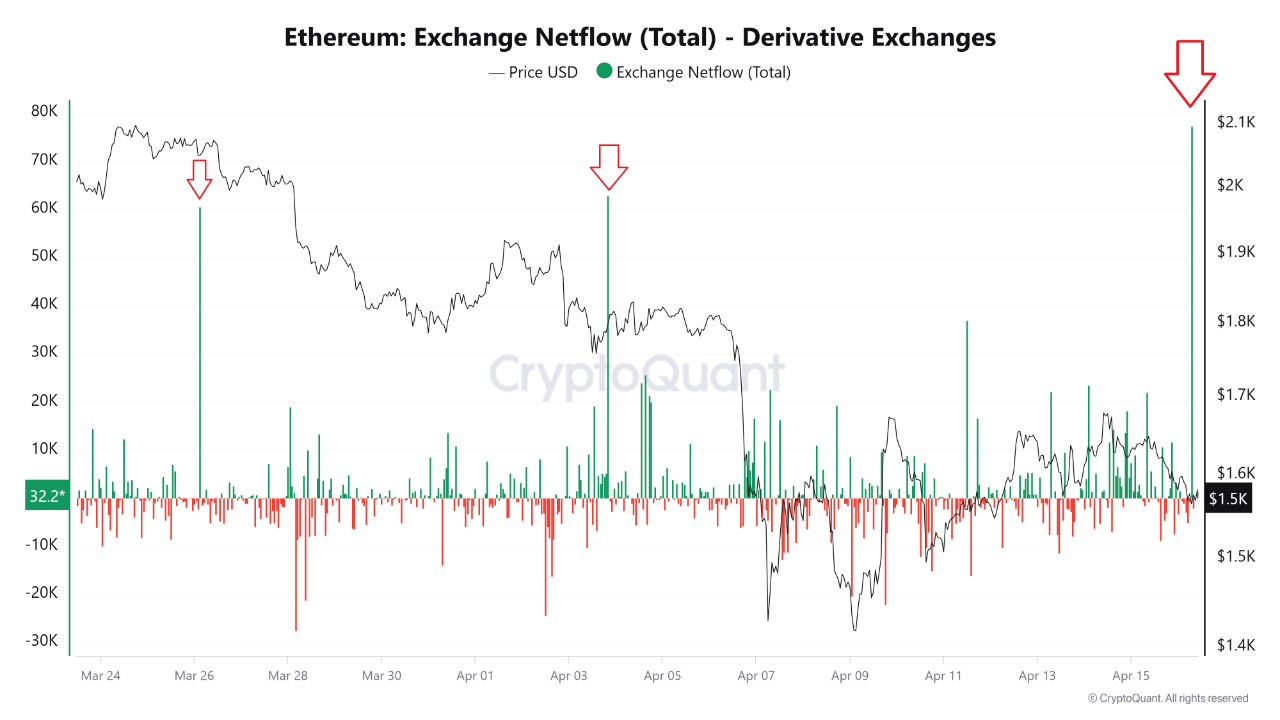

The Ethereum Exchange Netflow (Total) – Derivative Exchanges chart reveals that over 77,000 ETH were sent to derivative exchanges yesterday.

Reports indicate that the aforementioned unusual inflow was the largest daily inflow in March and April.

Yesterday, the ETH price declined from $1,588.44 to $1,577.07, marking a drop of 0.71%. At one point yesterday, the price touched as low as $1,537.28.

These types of inflows often suggest traders are hedging or opening short positions.

ETH Historical Patterns: Inflows Have Preceded Major Price Drops

A historical pattern analysis reveals that similar inflows, though not as severe as April 16’s, were observed on March 26 and April 3 as well.

On both these occasions, the market witnessed a sharp correction. Between March 25 and 30, the Ethereum market experienced a serious correction of 13.05%. Between April 4 and 8, the market saw a significant correction of 18.92%.

Macroeconomic Uncertainty and Trade Tensions Weigh on Crypto Markets

The global economic crisis, triggered by the US’ aggressive tariff policy, has affected almost all the major asset classes, including the cryptocurrency market.

Since April 1, the cryptocurrency market has slipped by around 0.38%, and the altcoin market by 4.42%. During the period, the Ethereum market has dropped by at least 12.56%.

- Also Read :

- Crypto Price Prediction 2025: Coinbase Predicts Crypto Rebound by Mid-2025 After Tariff Turmoil

- ,

Ethereum Market Outlook: What Traders Should Watch Next

In 2024 and 2023, Ethereum grew by 46.1% and 90.8%, respectively. In the first quarter of this year, the market showed an unimpressive change of -45.3%. In Q1 2024 and Q1 2023, the market rose by 59.8% and 52.4%, respectively.

April has been a volatile month for the entire crypto market, especially the Ethereum market, because of the imposition of the tariff policy by the Trump administration and the subsequent announcement of a 90-day pause for its implementation.

In conclusion, Ethereum’s price is showing some recovery, but big inflows to derivatives and global tensions make its short-term outlook uncertain.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per our Ethereum price prediction 2025, the ETH price could reach a maximum of $5,925.

The largest altcoin’s price could propel to a maximum of $6,925 in 2025. ETH is expected to cross the $15,575 mark by 2030.

As per our latest ETH price analysis, Ethereum could reach a maximum price of $123,678.

By 2050, a single Ethereum price could go as high as $255,282.