The post Ethereum Price Could Soar to $6,000 by 2025 Amid ‘Scarcity Mode’ Predictions appeared first on Coinpedia Fintech News

Since November 5, the Ethereum market has grown steadily; it has risen by over 40.86%. Right now, the Ethereum price stands at $3,373.69. A recent post on X by Scott Melker, the host of The Wolf of All Streets Podcast, opines that the ETH market may reach the level of $6,000 by the first quarter of the next year. Why the expert anticipates massive growth in the price of ETH by Q1 2025. Here is what you should know!

Ethereum Enters ‘Scarcity Mode’: Could It Fuel a Rally to $6,000?

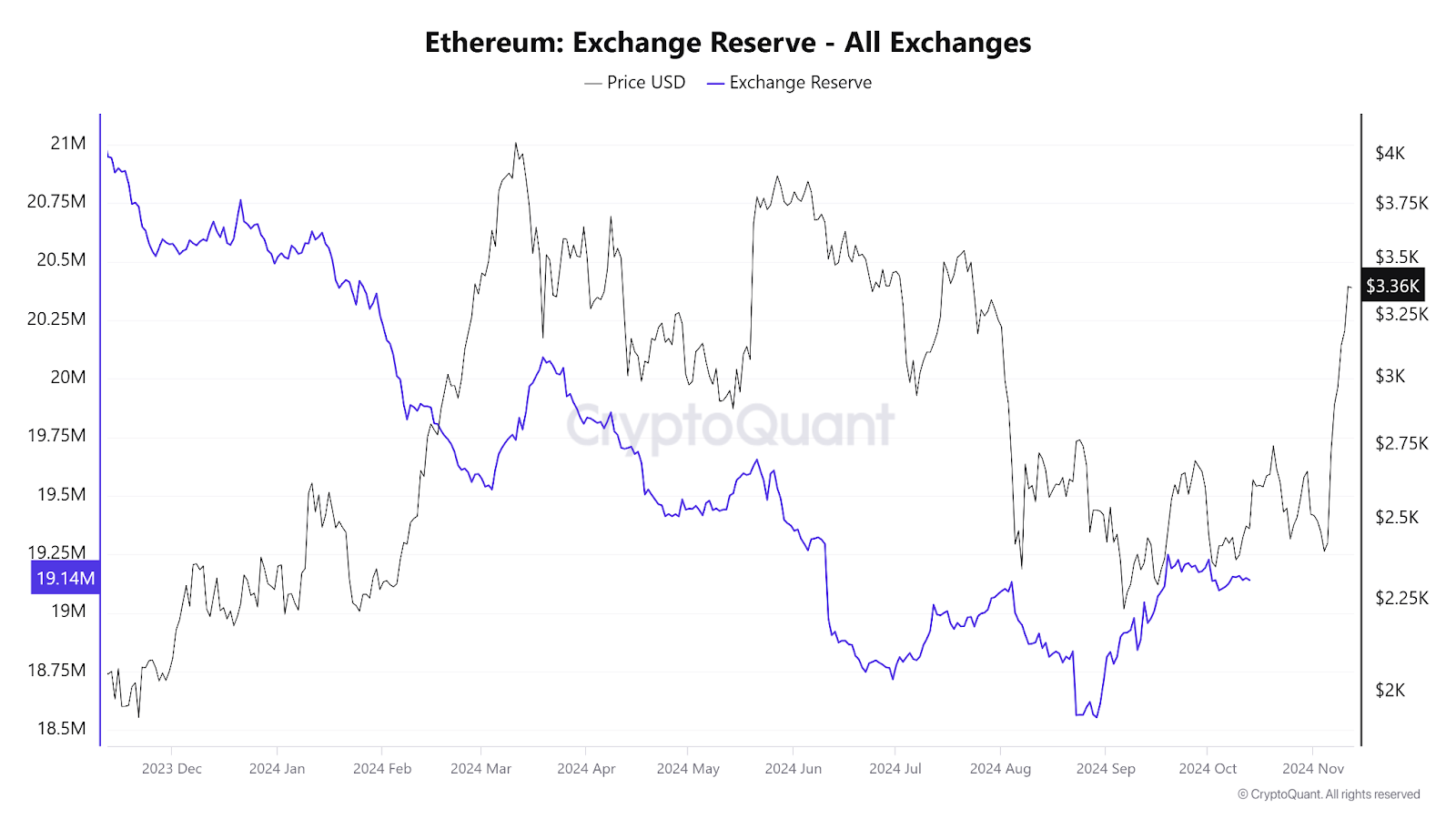

At the start of this year, the Exchange Reserve of Ethereum was around 20,521,862.99. Since then, it has dropped steadily. When the ETH price reached its market peak of $4,065.092, the reserve was around 19,738,964.89. On August 28, it touched the lowest point of 18,566,012.24. Right now, it remains around the range of 19,149,691.51.

Pointing out the sharp fall in the ETH Exchange Reserve and the recent rise in demand for Ethereum, the crypto expert notes that the market has entered a ‘Scarcity Mode’.

As per what the basic principles of the Economy preach, when something is scarce, its price often rises.

Parallels to 2023’s Bullish Pattern

At the start of 2023, the Ethereum price was around $1,198.54 – far lower than the 200-day Moving Average of $1,386.69. On January 23, it broke above the MA line. However, the price did not stay far above the line. On March 10 and June 15, the market retested the line. By August 17, the price dropped below the MA line. In early November, the market surpassed the line strongly. From then on, the market remained far above the 200-day SMA line throughout the year. On the last day of 2023, the price was around $2,223.75 – significantly higher than the 200-day SMA of $1,861.91.

Scott Melker predicts a similar upward momentum in the Ethereum market in the coming months.

This year, till late July, the market stayed above the MA line. However, since the March price peak, the gap between the price and the SMA consistently narrowed. On August 1, the price sharply slipped below the MA line. The price remained below the line, till it broke above the line on November 8. Now, the price is at $3,405.25 – significantly above the 200-day SMA of $2,958.42.

Institutional Confidence Rises With ETF Inflows

Emphasising the recent $132 million inflow into the Ethereum ETF market, the crypto expert asserts that institutional interest in the Ethereum market has significantly increased lately.

In conclusion, with Ethereum’s supply constrained and institutional interest rising, analysts see a favourable environment for the ETH price growth in the coming year.