Ethereum appears to be regaining momentum, showing a notable recovery after reclaiming the $3,200 level. The asset has surged over 5% in the past day, pushing its market capitalization and daily trading volume higher.

This recent movement has narrowed the gap between Ethereum’s current price and its all-time high to just 33%, giving investors reasons to pay closer attention. Various analysts have weighed in on the potential implications of this price action, offering a mix of short- and long-term outlooks.

Analysts Discuss Key Levels and Future Targets

Elite, a well-known crypto analyst, pointed out that Ethereum’s resilience came in the face of “hawkish signals” from the Federal Reserve. The analyst wrote:

Despite the Fed’s hawkish signals yesterday, ETH broke past the $3,200 mark, showing impressive resilience. But that’s not all—on-chain activity is soaring.

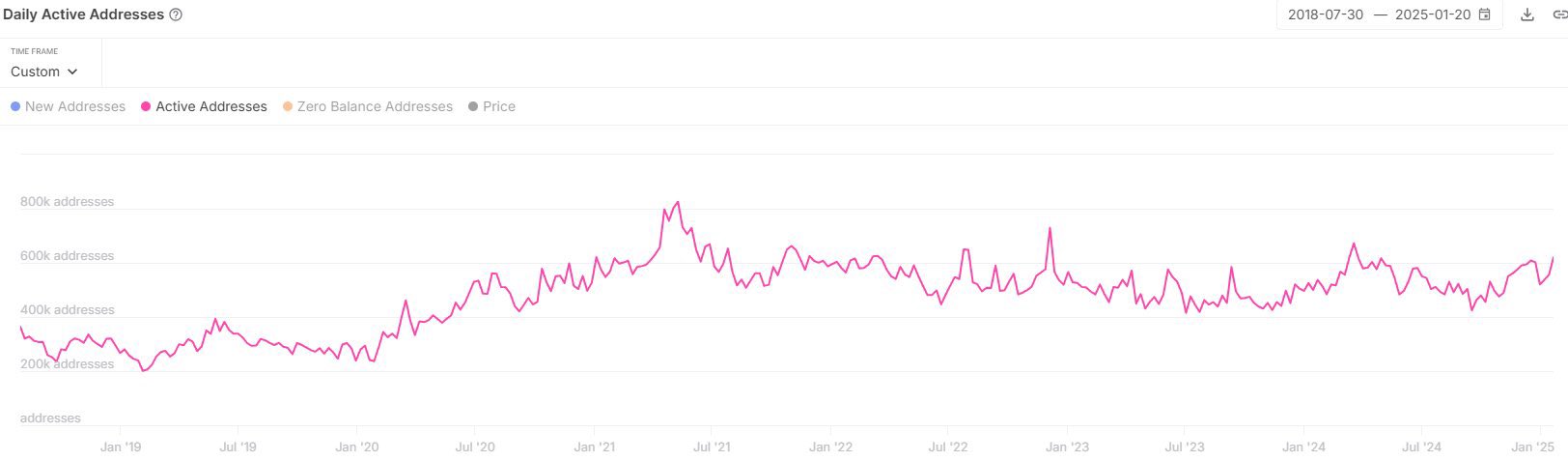

According to IntoTheBlock data, active Ethereum addresses have increased by 37% over the last few months, reaching 670,000—significantly surpassing the 400,000 level seen in early 2024.

This sharp rise in network activity is viewed by some as an indication of growing demand and renewed bullish momentum as the new year unfolds.

Several other analysts have also shared their perspectives on Ethereum’s price trajectory. WorldofCharts highlighted the cryptocurrency’s consolidation within a tight range, forming a bullish pennant.

He suggested that a successful breakout from this pattern could propel Ethereum toward the $4,000 resistance area. This ascending triangle level, previously outlined in his analysis, may serve as a critical milestone for the asset’s upward trajectory.

$Eth #Eth Consolidating Within Tight Range Of Bullish Pennant, Expecting Upside Breakout Soon, Incase Of Successful Breakout Ethereum Can Target 4000$ Area Ascending Triangle Resistance Area “Which I Shared Recently” https://t.co/Gq5sYBiKfA pic.twitter.com/B36VRnN9Qm

— World Of Charts (@WorldOfCharts1) January 30, 2025

Ethereum On The Path To A $9,000 Rally?

Another prominent analyst, Ted, emphasized that Ethereum’s higher lows on longer timeframes signal a strengthening bullish structure. He identified the $4,000 level as pivotal, predicting that its recovery could open the door to a new all-time high.

Ted went even further, forecasting that Ethereum could reach $9,000 to $10,000 within the next three to four months if these bullish conditions persist. This optimism is supported by growing on-chain activity and sustained investor interest.

Ethereum is forming higher lows on the longer timeframe.

$4K remains the most crucial level, and the reclaim of that will send $ETH to new ATH.

Once that happens, I’m expecting Ethereum to hit $9K-$10K within 3-4 months. Trump will buy more and more

pic.twitter.com/c3fFVXh8Xl

— Ted (@TedPillows) January 29, 2025

Featured image created with DALL-E, Chart from TradingView