On-chain data from Santiment shows Ethereum whales were selling during the past year while sharks were buying more of the asset.

Ethereum Sharks Added 3.61 Million ETH To Their Holdings In Past Year

According to data from the on-chain analytics firm Santiment, there has been a substantial shift in the supply held by the large holders in the ETH market recently. The relevant indicator here is the “Supply Distribution,” which tells us what percentage of the Ethereum supply is currently being held by which wallet groups.

The wallet groups here refer to cohorts divided based on the total number of coins they are holding right now. For example, the 1 to 10 coins group includes all addresses on the network that are carrying a balance amount between 1 and 10 ETH at the moment.

If the Supply Distribution metric is applied to this group, then it will measure (among other things) the combined balance held by the wallets satisfying this condition.

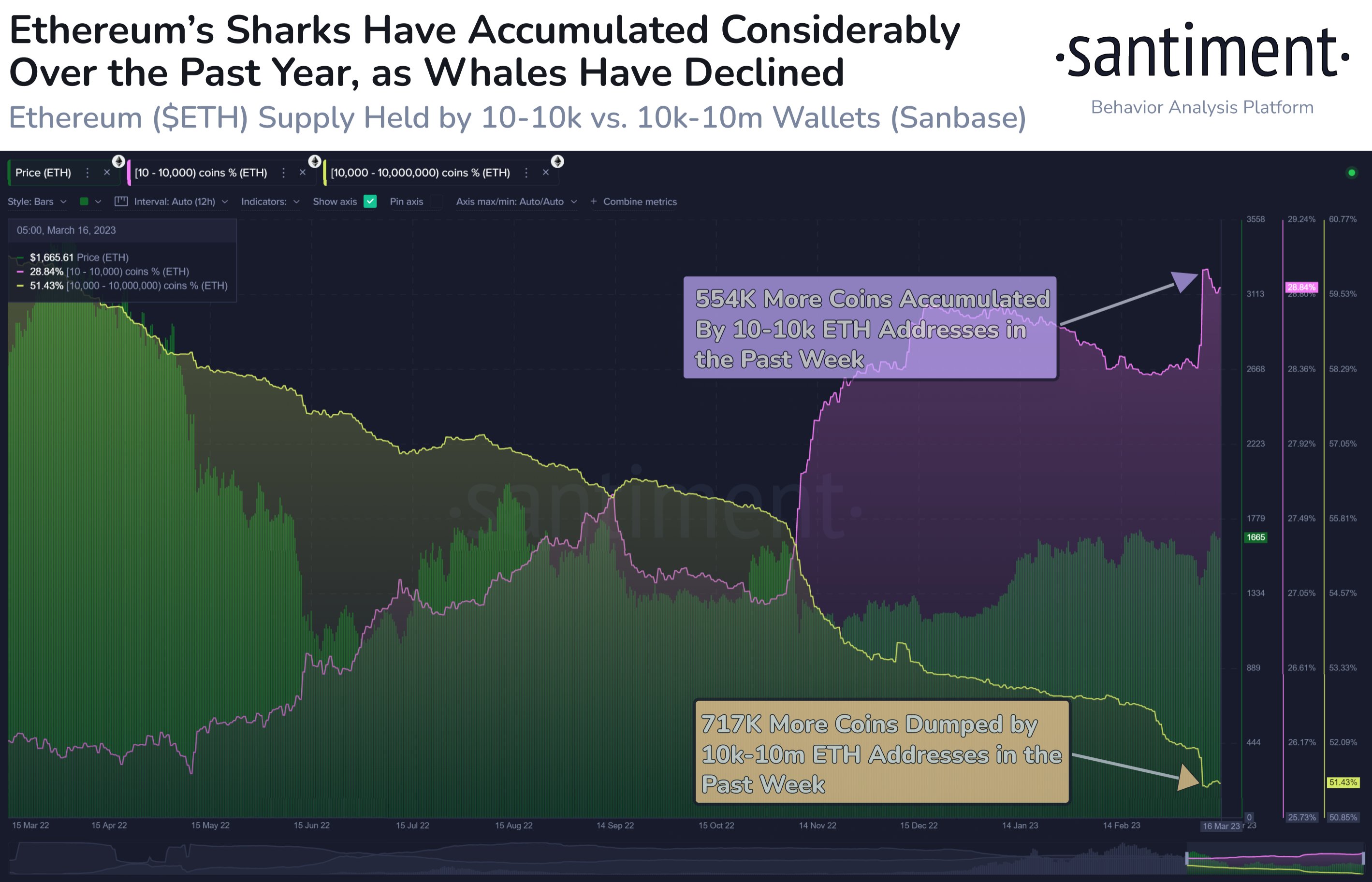

Now, in the context of the current discussion, the wallet groups of interest are the 10 to 10,000 coins and 10,000 to 10,000,000 coins cohorts. Here is a chart that shows the trend in the Supply Distribution for these Ethereum groups over the past year:

The range of the first wallet group converts to about $17,300 at the lower end and $17.3 million at the upper bound (both at the current USD price), while the second one’s is worth $17.3 million and $17.3 billion.

These groups correspond to two important cohorts in the Ethereum market called the sharks and whales. As these groups hold such large amounts of coins, their movements can sometimes have noticeable effect on the price (with whales being the more influential of the two, naturally, since they hold significantly higher balances in their wallets).

As displayed in the above graph, the holdings of the sharks have followed a net upwards trajectory during the last year, with an especially sharper uptrend seen following the FTX crash back in November 2022.

In total, this cohort has added 3.61 million ETH or $6.3 billion to their holdings during the past twelve months. There has also been some rapid accumulation from these holders in the last week, where their supply has grown by about 554,000 ETH.

As for the whales, these humongous holders appear to have dumped a net amount of the asset during the past year. In all, these investors have distributed a whopping 9.43 million ETH in this period, which is worth about $16.4 billion at the current exchange rate.

The cohort has also shown more rapid selling in the past week, possibly to take advantage of the current profit-taking opportunity, and has shed their holdings by about 717,000 tokens.

It seems like the Ethereum market has undergone a shift in how the supply is distributed among the different holder groups, with smaller holders picking up the supply being sold by the larger holders.

However, despite this significant distribution, Ethereum whales still hold about 51.4% of the total ETH supply, while sharks have around 28.8% of the supply in their wallets.

ETH Price

At the time of writing, Ethereum is trading around $1,700, up 33% in the last week.