Ethereum staking continues to grow this year despite the emergence of spot exchange-traded funds (ETFs) and the digital asset’s price relative price weakness.

On Oct. 8, blockchain analytics firm IntoTheBlock reported that Ethereum staking rose by 5.1% this year, with 28.89% of the total ETH supply now staked, up from 23.8% in January.

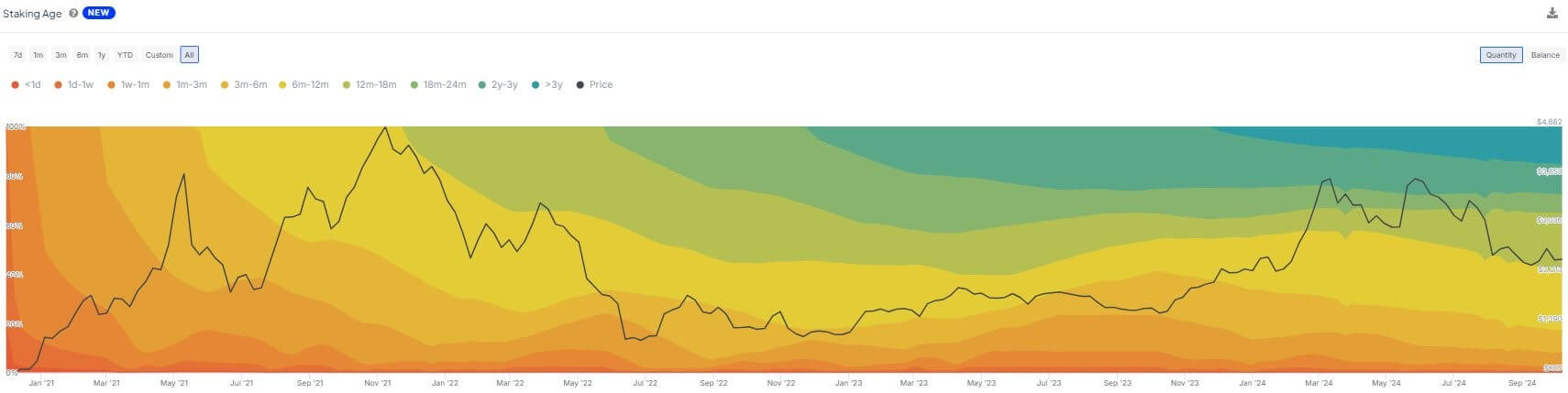

Dune Analytics data estimates that there are currently around 37.79 million ETH staked, worth approximately $84.8 billion, contributed by over one million validators. IntoTheBlock also reports that 15.3% of this staked ETH has been locked for at least three years, reflecting strong investor confidence in Ethereum’s long-term potential.

Despite the rise in staked ETH, Ethereum’s price growth has been modest compared to competitors like Solana. While Ethereum’s price is up about 6% year-to-date to $2,447, Solana has surged 41% in the same period.

Staking profitability

Staking, which involves locking up ETH to validate transactions in exchange for rewards, is central to Ethereum’s proof-of-stake (PoS) system. This process has attracted both institutional and retail investors, offering them the chance to earn yields on their staked ETH.

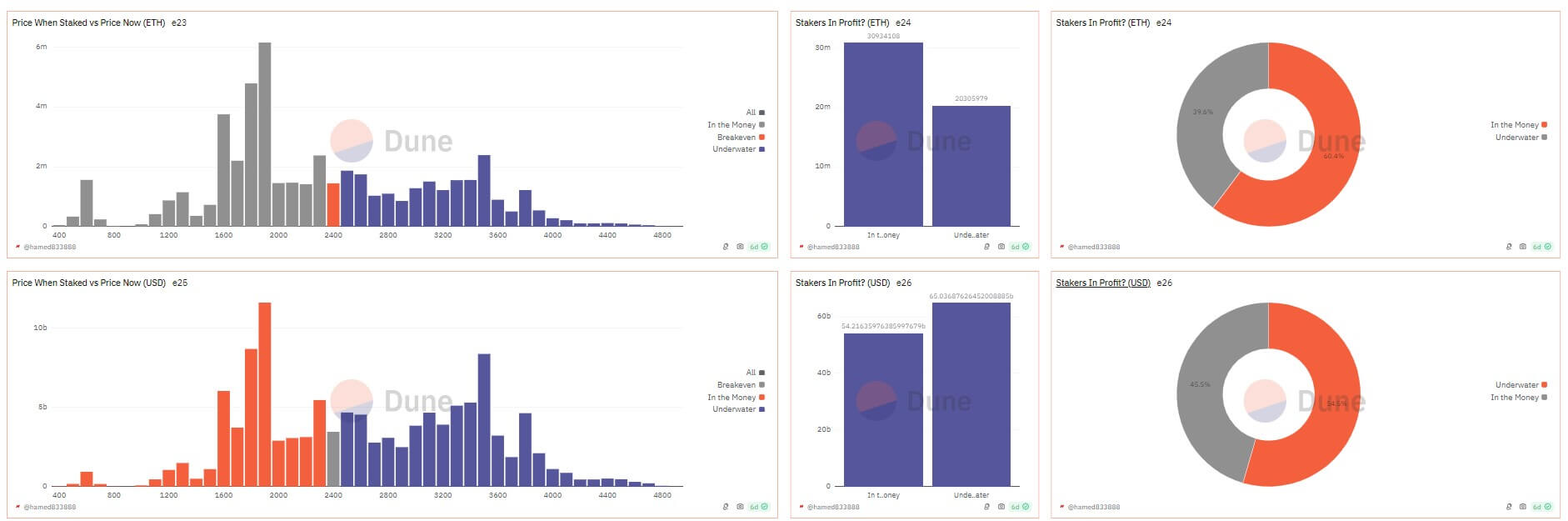

Dune Analytics data shows that about 60% of stakers are in profit, despite the asset’s price challenges. The realized price for staked ETH is around $2,265, while its current market price is $2,432, translating to a 7% profit margin for stakeholders.

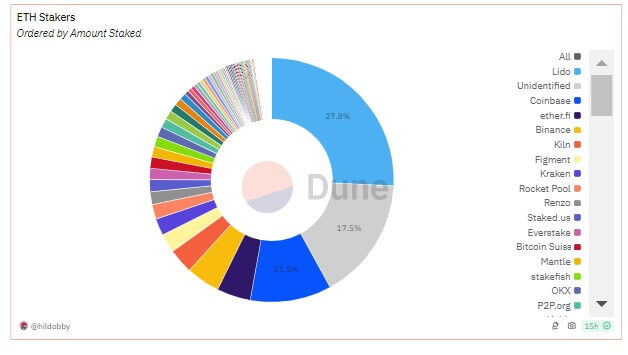

Lido, a leading liquid staking platform, holds the largest share of Ethereum staking, with 9.7 million ETH staked, valued at roughly $24 billion at current prices.

Among centralized staking providers, Coinbase leads with 11% of the total stake, holding over 4 million ETH. Binance, which offers lower commissions, controls 4.75%, or 1.6 million ETH. Other platforms, such as Ether.fi, Kiln, Figment, and Kraken also hold significant market shares. Altogether, centralized exchanges account for 18.5% of the Ethereum staking market.

Recently, Ethereum co-founder Vitalik Buterin suggested lowering the minimum ETH requirement for solo staking. If implemented, this move could attract more participants and further contributing to the growth.

The post Ethereum staking defies market trends with robust growth in 2024 appeared first on CryptoSlate.