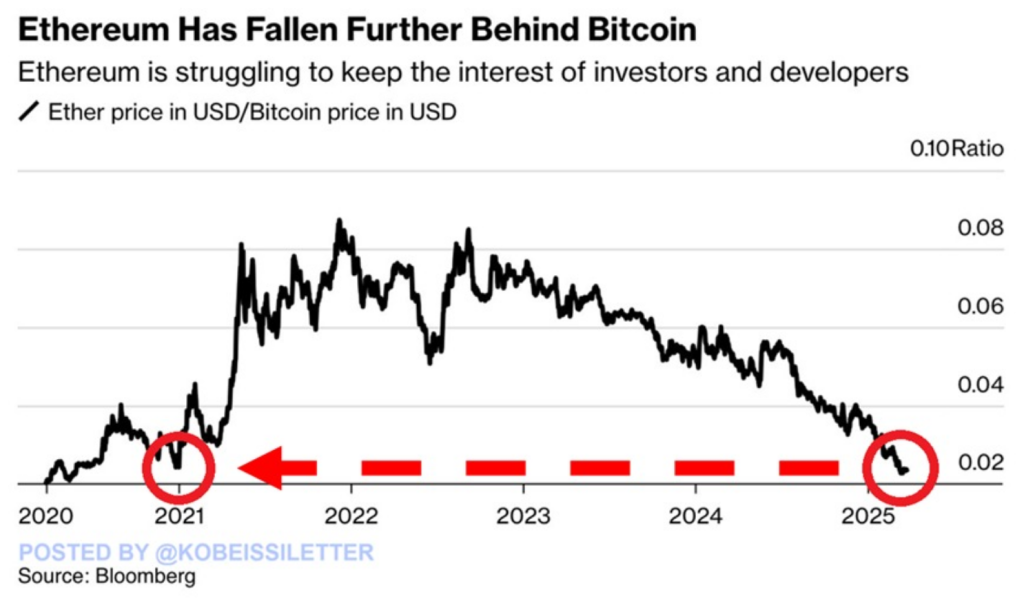

Ethereum’s value in relation to Bitcoin is at its all-time low since 2020, sparking rumors about its position in the world of cryptocurrency.

The ETH/BTC ratio now stands at only 0.02, according to the latest figures from The Kobeissi Letter. The decline is against the backdrop of Bitcoin consolidating its strength while Ethereum is having a hard time keeping up as of early 2025.

Market Statistics Reflect Widening Divide Between Cryptocurrencies

The first quarter of 2025 has been hard on the owners of Ethereum. The cryptocurrency has declined by 46% since the beginning of the year, while Bitcoin fell by only 12%.

This expanding discrepancy has attracted investors who anticipated a different outcome in the wake of recent market developments.

BREAKING: The Ethereum to Bitcoin ratio has dropped to 0.02, its lowest since December 2020.

Over the last 2.5 years, the ratio has declined a whopping 75%.

This comes as Bitcoin prices have significantly outperformed Ethereum.

During this time, Ethereum prices have risen 36%… pic.twitter.com/IUIunn9deX

— The Kobeissi Letter (@KobeissiLetter) March 31, 2025

“Bitcoin’s narrative as digital gold has strengthened,” market observers quoted in reports said. That narrative has been attractive to big money holders, but Ethereum has not experienced the same kind of interest.

Technical Issues Mar Ethereum Upgrade

Ethereum’s Pectra upgrade has encountered a number of setbacks. Reports said several test runs failed before the recent rollout of the Hoodi testnet. These technical issues have contributed to market jitters.

The transition to proof-of-stake, a significant shift in the way Ethereum operates, hasn’t provided the market uplift many had hoped for. High gas prices remain an issue for users, and other blockchain networks become more appealing.

ETF Success For Bitcoin Hasn’t Helped Ethereum

Bitcoin ETFs have attracted billions of dollars since being approved earlier this year. According to market observation, Ethereum has not been spared this trend, with institutions remaining hesitant on its long-term worth.

Bitcoin’s fixed supply makes it a more secure option for large investors seeking protection against inflation, market analysts pointed out in recent comments. This has enabled Bitcoin to remain at the top despite adverse overall market conditions.

Mixed Projections For Ethereum’s Future Value

A few market analysts think Ethereum can hit $20,000 if things improve and the Pectra upgrade is finally rolled out successfully. Others caution that investors may transfer funds to alternatives such as Solana or Avalanche if Ethereum continues to lose ground.

Based on CoinMarketCap data as of publication time, Ethereum was at $1,84, having climbed 1.35% within the last 24 hours. This minor daily increase hasn’t altered the larger context of Ethereum’s woes.

The coming weeks will be decisive, explained analysts tracking the cryptocurrency market. Their reports indicate Ethereum must demonstrate strength or face continued decline relative to the increasing dominance of Bitcoin.

Featured image from Gemini Imagen, chart from TradingView