On-chain data shows the ten largest whales on the Ethereum network are now holding 31.8 million ETH, a new all-time high.

Ethereum Holdings Of Top 10 Whales Have Now Surpassed August 2015 ATH

According to data from the on-chain analytics firm Santiment, the largest ETH whales have grown their supplies recently. The largest whales here refer to the ten largest addresses on the Ethereum network that aren’t associated with a centralized platform.

Santiment has identified such self-custodial addresses, and entities like exchanges have been excluded here because their role in the sector is different from that of the normal whales.

As the whales hold huge amounts in their wallets, they can significantly influence the market since their movements may produce noticeable effects on the price.

Thus, The ten largest whales are the most powerful investors on the network. Naturally, since their behavior may impact the market, their movements are worth watching.

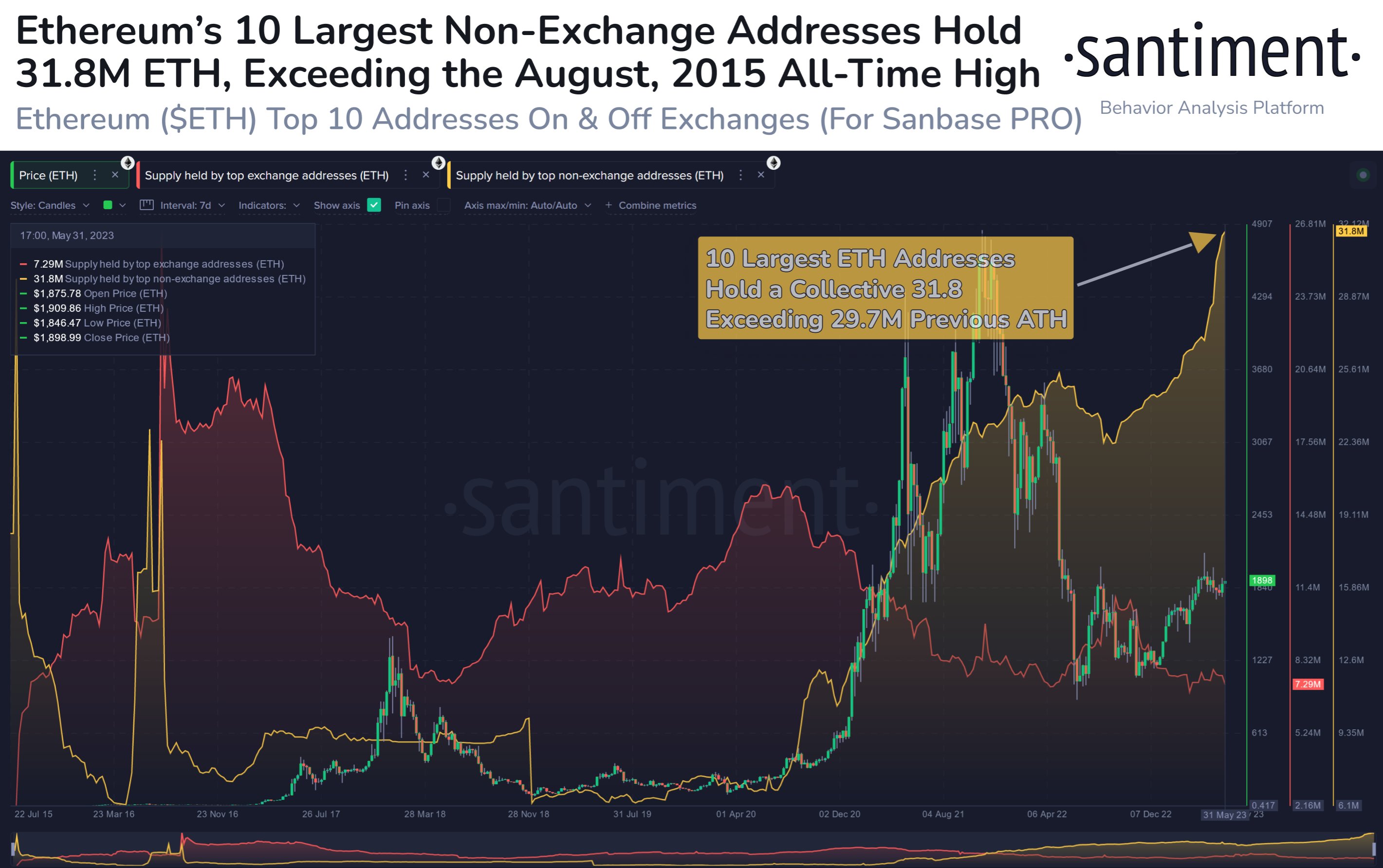

Now, here is a chart that shows how the combined balance of these large Ethereum whales has changed since the cryptocurrency first started trading back in 2015:

As you can see in the above graph, the largest players in the Ethereum ecosystem have been constantly growing their supplies in the last few years.

However, there was an exception to this trend when the bear market started in 2022 and crashes like the LUNA collapse and the 3AC bankruptcy occurred.

These investors’ holdings had shrunk during this period, implying that they may have been participating in the market selloff.

It wasn’t long, however, before these humongous holders started accumulating again. Their buying spree has also continued into the rally this year, and interestingly, the last couple of months have seen the supply of these investors observing an even sharper uptrend.

The chart also shows the data for the Ethereum exchange supply, which is the total amount of ETH currently sitting in these platforms’ wallets.

It seems like when the whales started accumulating a few years back; the exchange supply had started heading down instead. This may imply that the coins being withdrawn towards self-custody were being absorbed by this cohort.

Though, while the exchange supply has continued to decline recently, its drawdown has been much weaker. As the top ten Ethereum whales have rapidly accumulated during the same period, it would appear that the source of their fresh buying isn’t from the exchange-held tokens anymore.

After this latest sharp accumulation, the ETH whales now hold a combined 31.8 million ETH ($59.47 billion), a new all-time high.

ETH Price

At the time of writing, Ethereum is trading around $1,800, down 2% in the last week.